Fair Isaac Corporation trades at $1,656 per share and has stayed right on track with the overall market, gaining 7% over the last six months. At the same time, the S&P 500 has returned 10.4%.

Is FICO a buy right now? Find out in our full research report, it’s free.

Why Are We Positive On FICO?

Creator of the three-digit number that can determine whether you get a mortgage or credit card, Fair Isaac Corporation (NYSE: FICO) develops analytics software and the widely used FICO Score, which is the standard measure of consumer credit risk in the United States.

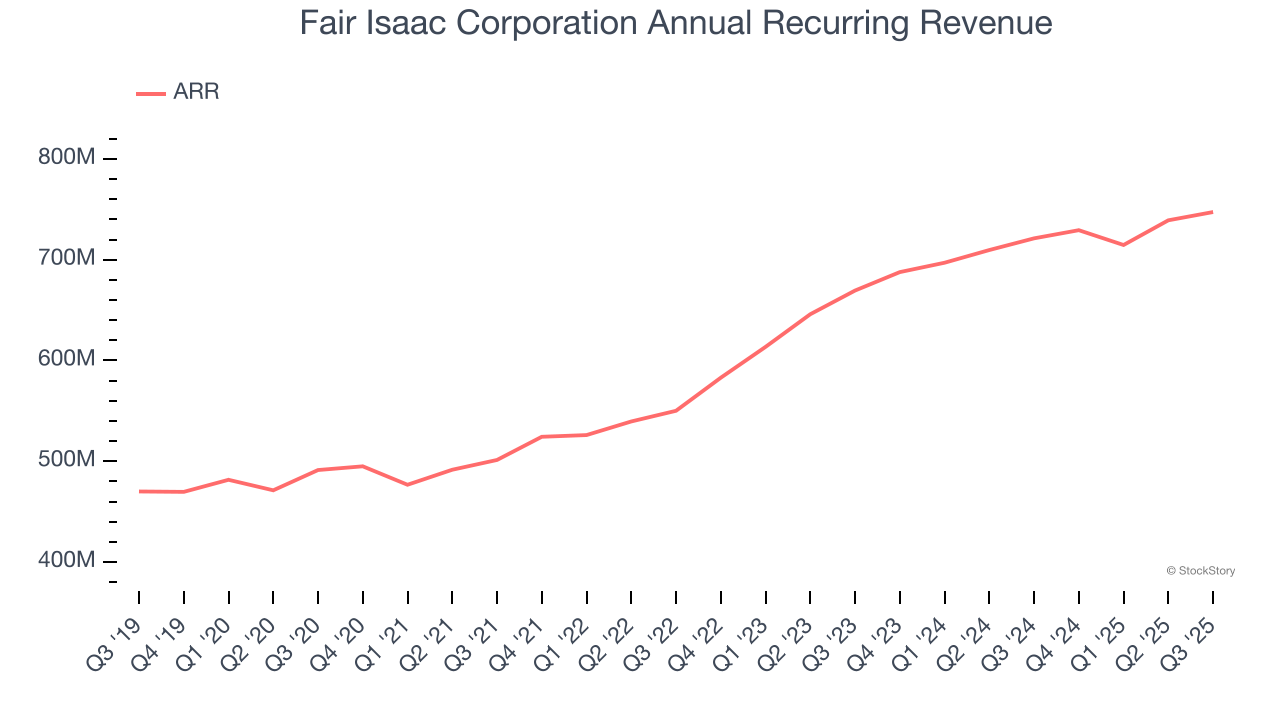

1. ARR Growth Powers Predictable Revenue Streams

In addition to reported revenue, ARR (annual recurring revenue) is a useful data point for analyzing Data & Business Process Services companies. This metric shows how much Fair Isaac Corporation expects to collect from its existing customer base in the next 12 months, giving visibility into its future revenue streams.

Fair Isaac Corporation’s ARR punched in at $747.3 million in the latest quarter, and over the last two years, its year-on-year growth averaged 8.2%. This performance was solid, reflecting the company’s ability to maintain strong customer relationships and secure longer-term commitments. Its growth also contributes positively to Fair Isaac Corporation’s predictability and valuation, as investors typically prefer businesses with recurring revenue.

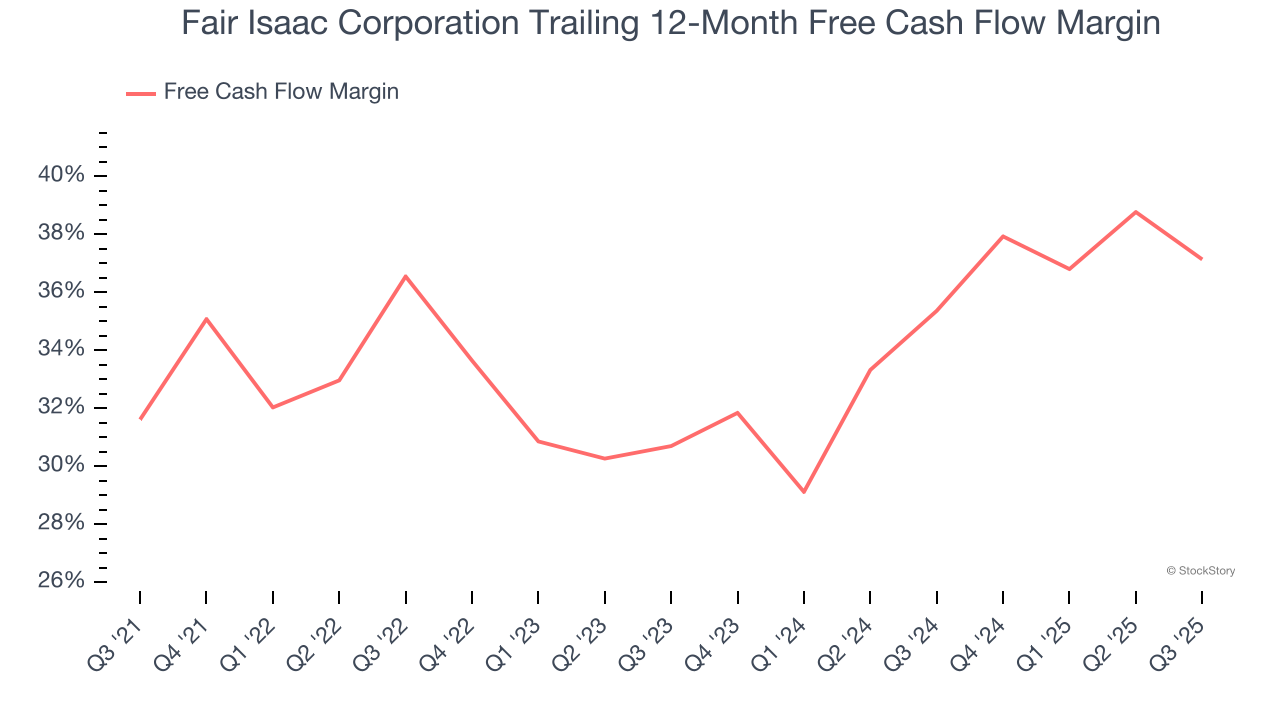

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Fair Isaac Corporation has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging an eye-popping 34.5% over the last five years.

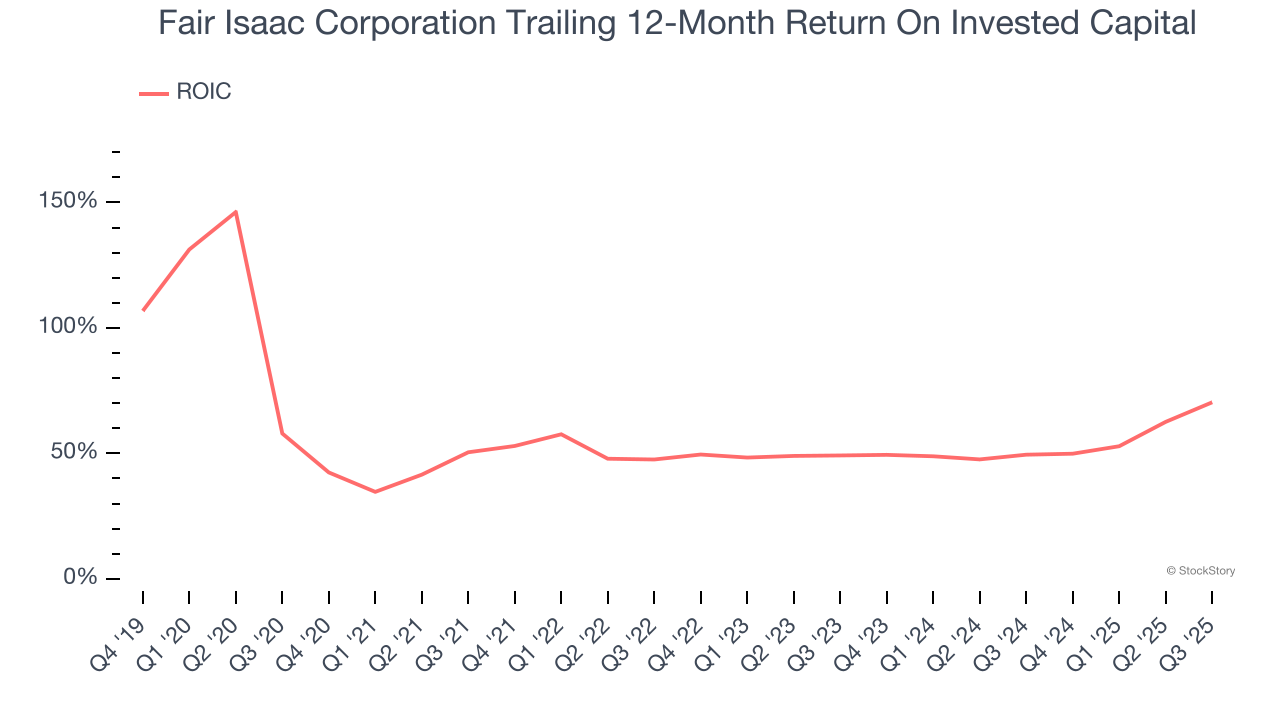

3. New Investments Bear Fruit as ROIC Jumps

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Fair Isaac Corporation’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

Final Judgment

These are just a few reasons why we think Fair Isaac Corporation is one of the best business services companies out there, but at $1,656 per share (or 38.9× forward P/E), is now the time to initiate a position? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.