As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the professional tools and equipment industry, including Kennametal (NYSE: KMT) and its peers.

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand. Some professional tools and equipment companies also provide software to accompany measurement or automated machinery, adding a stream of recurring revenues to their businesses. On the other hand, professional tools and equipment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 10 professional tools and equipment stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 1.8% while next quarter’s revenue guidance was 0.8% below.

Luckily, professional tools and equipment stocks have performed well with share prices up 12.9% on average since the latest earnings results.

Best Q3: Kennametal (NYSE: KMT)

Involved in manufacturing hard tips of anti-tank projectiles in World War II, Kennametal (NYSE: KMT) is a provider of industrial materials and tools for various sectors.

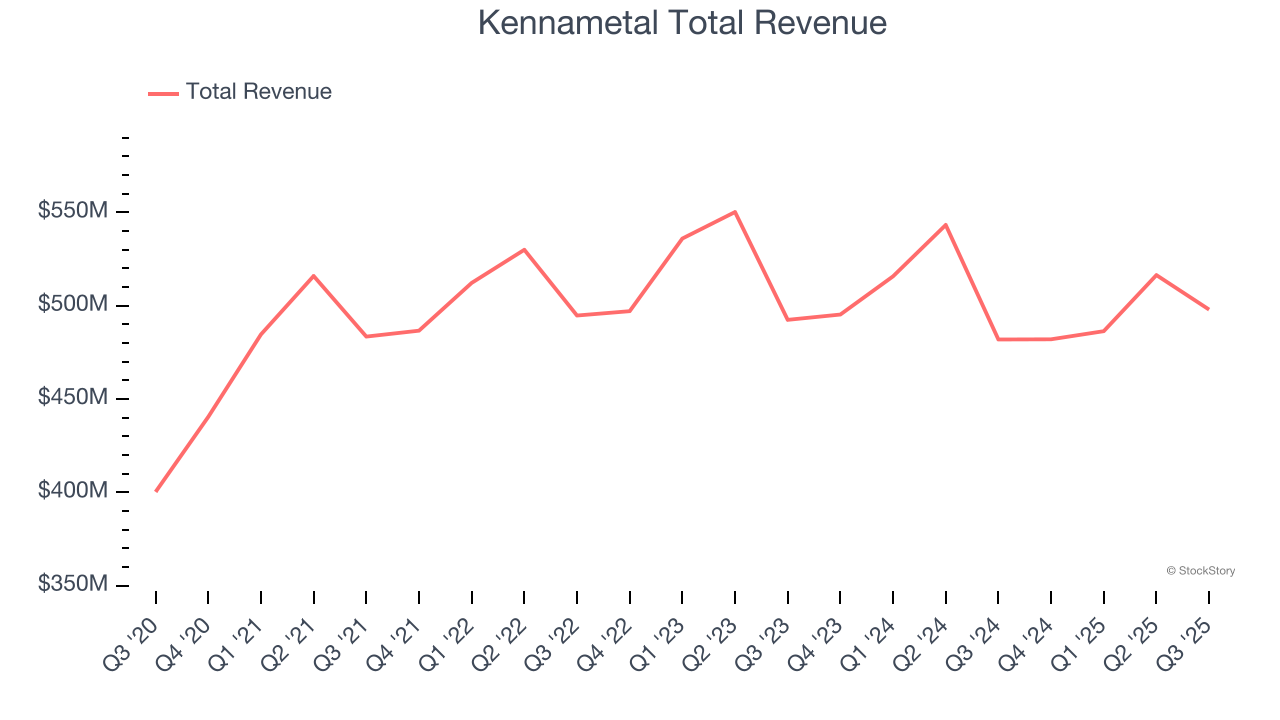

Kennametal reported revenues of $498 million, up 3.3% year on year. This print exceeded analysts’ expectations by 4.3%. Overall, it was an incredible quarter for the company with a solid beat of analysts’ organic revenue estimates and EPS guidance for next quarter exceeding analysts’ expectations.

"Our first quarter started off strong with share gains and modest end market improvements compared to our previous expectations, resulting in sales and adjusted EPS that exceeded the upper end of our outlook," said Sanjay Chowbey, President and CEO.

Kennametal scored the highest full-year guidance raise of the whole group. Unsurprisingly, the stock is up 39.1% since reporting and currently trades at $30.75.

Is now the time to buy Kennametal? Access our full analysis of the earnings results here, it’s free.

Fortive (NYSE: FTV)

Taking its name from the Latin root of "strong", Fortive (NYSE: FTV) manufactures products and develops industrial software for numerous industries.

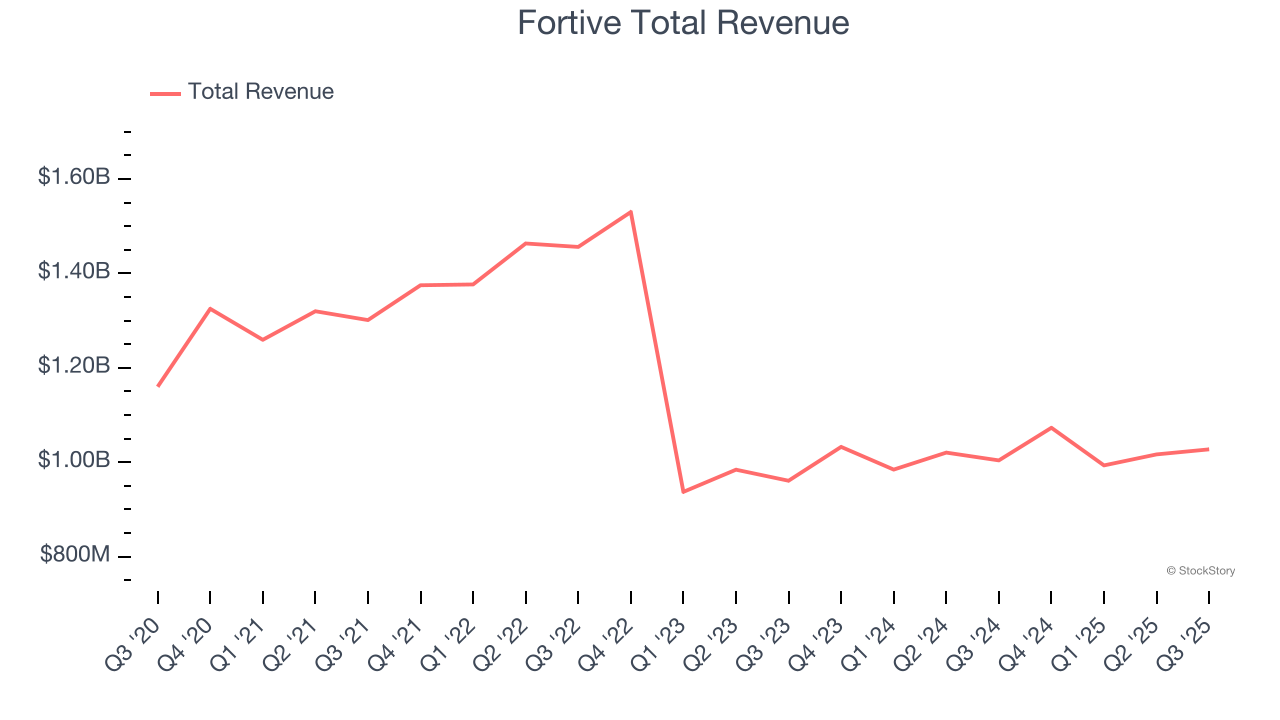

Fortive reported revenues of $1.03 billion, up 2.3% year on year, outperforming analysts’ expectations by 1.8%. The business had a stunning quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ adjusted operating income estimates.

The market seems happy with the results as the stock is up 11.8% since reporting. It currently trades at $54.97.

Is now the time to buy Fortive? Access our full analysis of the earnings results here, it’s free.

Slowest Q3: Stanley Black & Decker (NYSE: SWK)

With an iconic “STANLEY” logo which has remained virtually unchanged for over a century, Stanley Black & Decker (NYSE: SWK) is a manufacturer primarily catering to the tool and outdoor equipment industry.

Stanley Black & Decker reported revenues of $3.76 billion, flat year on year, in line with analysts’ expectations. It was a mixed quarter as it posted a beat of analysts’ EPS estimates but full-year EPS guidance slightly missing analysts’ expectations.

Interestingly, the stock is up 24.4% since the results and currently trades at $82.57.

Read our full analysis of Stanley Black & Decker’s results here.

Middleby (NASDAQ: MIDD)

Holding a Guinness World Record for creating the world’s fastest conveyor pizza oven, Middleby (NYSE: MIDD) is a food service and equipment manufacturer.

Middleby reported revenues of $982.1 million, up 4.2% year on year. This number topped analysts’ expectations by 2.2%. Overall, it was a strong quarter as it also produced an impressive beat of analysts’ revenue estimates and a beat of analysts’ EPS estimates.

The stock is up 27.8% since reporting and currently trades at $157.76.

Read our full, actionable report on Middleby here, it’s free.

Nordson (NASDAQ: NDSN)

Founded in 1954, Nordson Corporation (NASDAQ: NDSN) manufactures dispensing equipment and industrial adhesives, sealants and coatings.

Nordson reported revenues of $751.8 million, flat year on year. This result missed analysts’ expectations by 1.3%. More broadly, it was a mixed quarter as it also recorded an impressive beat of analysts’ adjusted operating income estimates but a slight miss of analysts’ revenue estimates.

Nordson had the weakest performance against analyst estimates and weakest full-year guidance update among its peers. The stock is up 10.5% since reporting and currently trades at $261.21.

Read our full, actionable report on Nordson here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.