The Real Brokerage currently trades at $4.20 per share and has shown little upside over the past six months, posting a middling return of 3.4%. The stock also fell short of the S&P 500’s 10.4% gain during that period.

Is there a buying opportunity in The Real Brokerage, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Do We Think The Real Brokerage Will Underperform?

We're swiping left on The Real Brokerage for now. Here are three reasons you should be careful with REAX and a stock we'd rather own.

1. Operating Losses Sound the Alarms

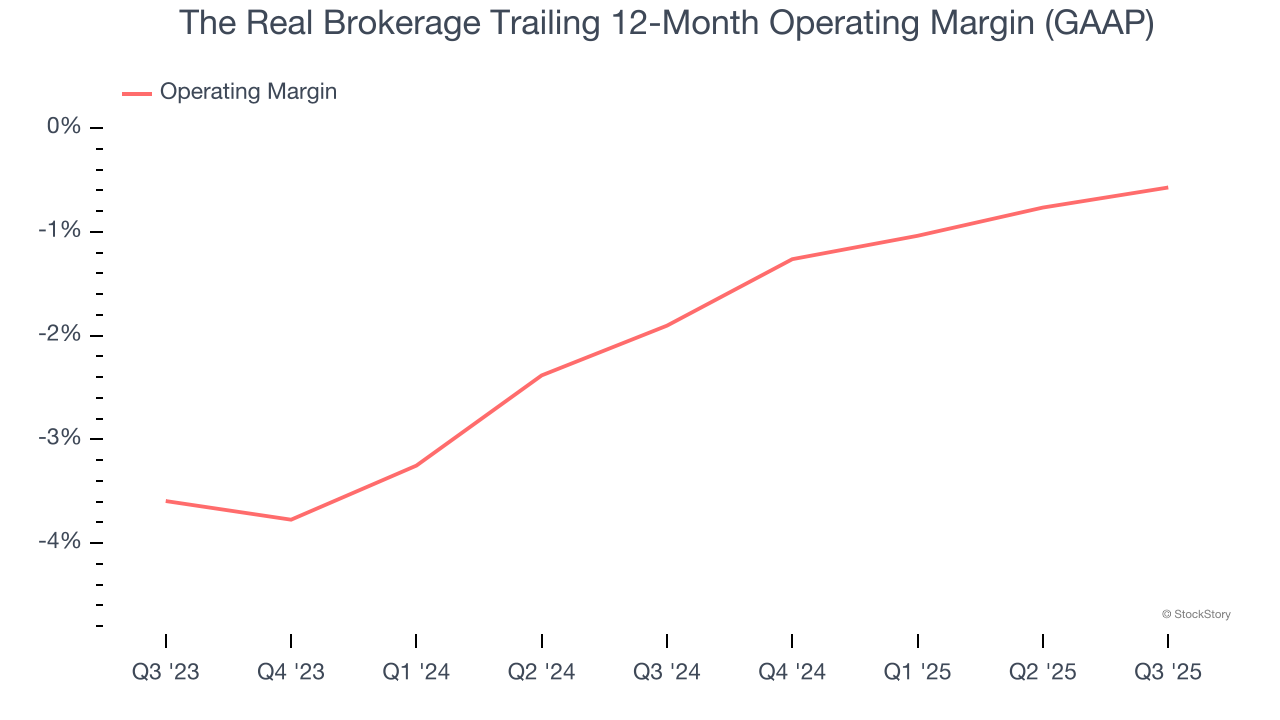

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

The Real Brokerage’s operating margin has been trending up over the last 12 months, but it still averaged negative 1.1% over the last two years. This is due to its large expense base and inefficient cost structure.

2. EPS Trending Down

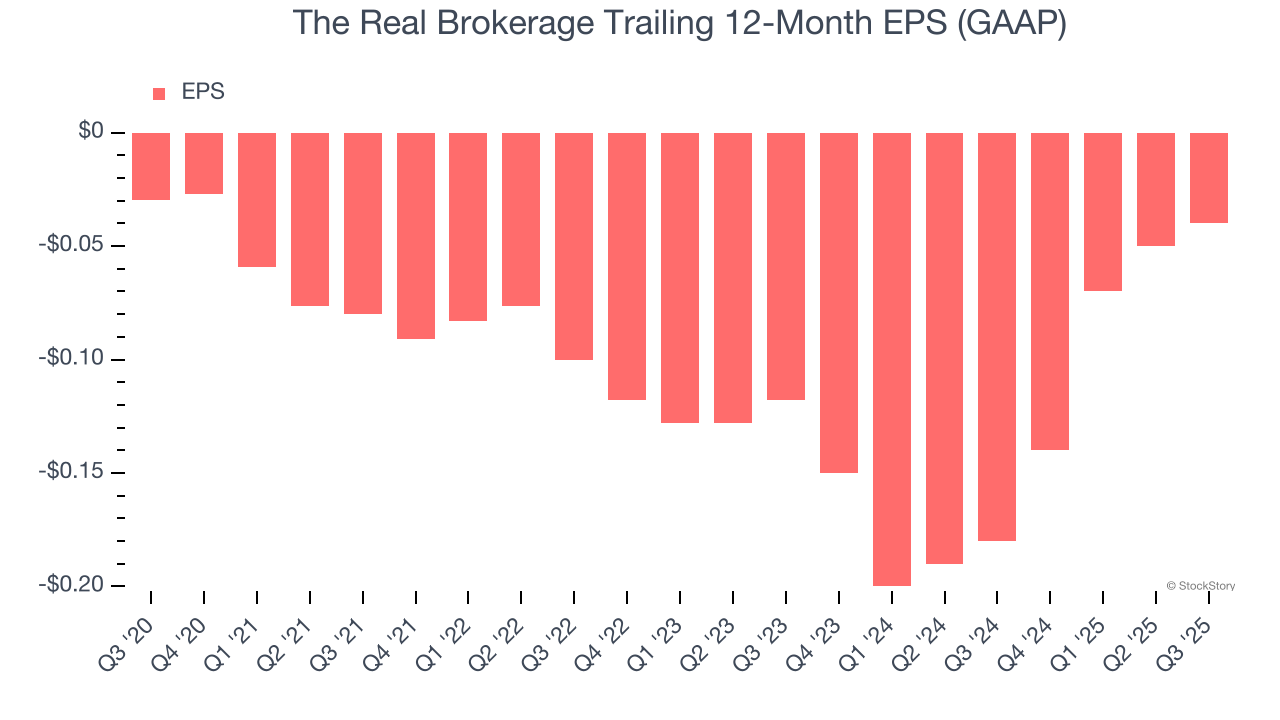

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

The Real Brokerage’s earnings losses deepened over the last five years as its EPS dropped 6.2% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. Consumer Discretionary companies are particularly exposed to this, and if the tide turns unexpectedly, The Real Brokerage’s low margin of safety could leave its stock price susceptible to large downswings.

3. Free Cash Flow Projections Disappoint

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Over the next year, analysts’ consensus estimates show they’re expecting The Real Brokerage’s free cash flow margin of 3.8% for the last 12 months to remain the same.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of The Real Brokerage, we’ll be cheering from the sidelines. With its shares trailing the market in recent months, the stock trades at 10.2× forward EV-to-EBITDA (or $4.20 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are more exciting stocks to buy at the moment. We’d suggest looking at the most entrenched endpoint security platform on the market.

Stocks We Like More Than The Real Brokerage

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.