The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how renewable energy stocks fared in Q3, starting with EnerSys (NYSE: ENS).

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

The 17 renewable energy stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 5.8% while next quarter’s revenue guidance was in line.

While some renewable energy stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.3% since the latest earnings results.

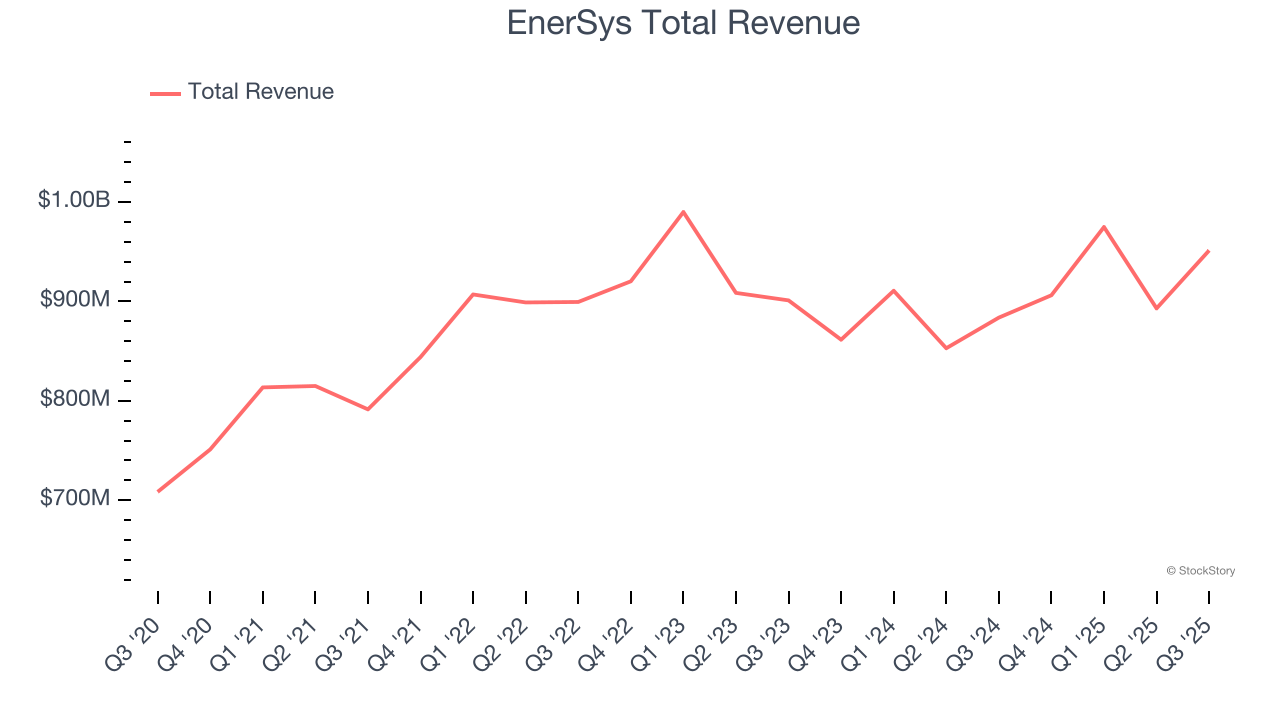

EnerSys (NYSE: ENS)

Supplying batteries that power equipment as big as mining rigs, EnerSys (NYSE: ENS) manufactures various kinds of batteries for a range of industries.

EnerSys reported revenues of $951.3 million, up 7.6% year on year. This print exceeded analysts’ expectations by 6.9%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ sales volume estimates and EPS guidance for next quarter exceeding analysts’ expectations.

“Our strong performance in the quarter reflects solid execution and our commitment to continuous improvement and collaboration across the organization,” said Shawn O’Connell, President and Chief Executive Officer of EnerSys.

Interestingly, the stock is up 27.5% since reporting and currently trades at $161.69.

Is now the time to buy EnerSys? Access our full analysis of the earnings results here, it’s free.

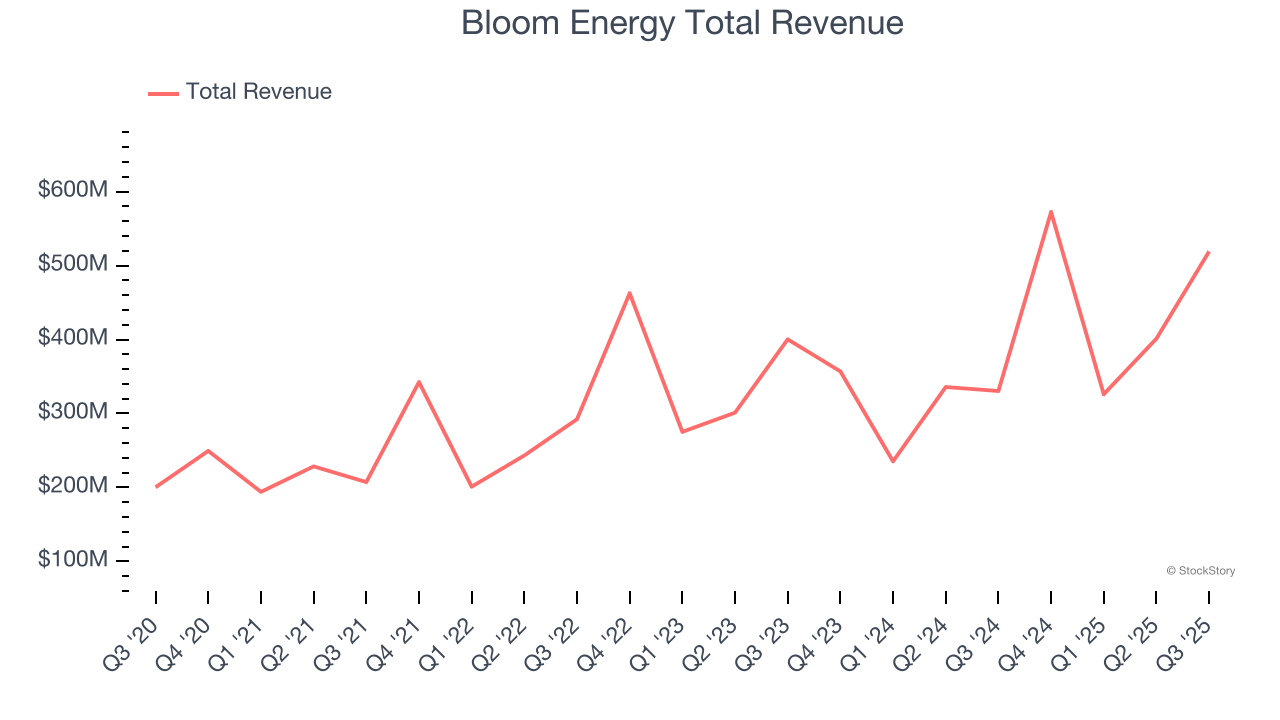

Best Q3: Bloom Energy (NYSE: BE)

Working in stealth mode for eight years, Bloom Energy (NYSE: BE) designs, manufactures, and markets solid oxide fuel cell systems for on-site power generation.

Bloom Energy reported revenues of $519 million, up 57.1% year on year, outperforming analysts’ expectations by 22.8%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 21% since reporting. It currently trades at $137.10.

Is now the time to buy Bloom Energy? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Generac (NYSE: GNRC)

With its name deriving from a combination of “generating” and “AC”, Generac (NYSE: GNRC) offers generators and other power products for residential, industrial, and commercial use.

Generac reported revenues of $1.11 billion, down 5% year on year, falling short of analysts’ expectations by 6.6%. It was a disappointing quarter as it posted a miss of analysts’ Residential revenue estimates and a significant miss of analysts’ revenue estimates.

As expected, the stock is down 17.6% since the results and currently trades at $156.62.

Read our full analysis of Generac’s results here.

First Solar (NASDAQ: FSLR)

Headquartered in Arizona, First Solar (NASDAQ: FSLR) specializes in manufacturing solar panels and providing photovoltaic solar energy solutions.

First Solar reported revenues of $1.59 billion, up 79.7% year on year. This result was in line with analysts’ expectations. Taking a step back, it was a disappointing quarter as it produced full-year revenue guidance missing analysts’ expectations significantly and full-year EPS guidance missing analysts’ expectations significantly.

First Solar scored the fastest revenue growth among its peers. The stock is up 1.9% since reporting and currently trades at $238.04.

Read our full, actionable report on First Solar here, it’s free.

EVgo (NASDAQ: EVGO)

Created through a settlement between NRG Energy and the California Public Utilities Commission, EVgo (NASDAQ: EVGO) is a provider of electric vehicle charging solutions, operating fast charging stations across the United States.

EVgo reported revenues of $92.3 million, up 36.7% year on year. This number topped analysts’ expectations by 0.7%. It was a strong quarter as it also put up a beat of analysts’ EPS estimates and full-year EBITDA guidance exceeding analysts’ expectations.

EVgo delivered the highest full-year guidance raise among its peers. The stock is down 8.4% since reporting and currently trades at $3.13.

Read our full, actionable report on EVgo here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.