Tetra Tech has been treading water for the past six months, recording a small loss of 1.5% while holding steady at $37.33. The stock also fell short of the S&P 500’s 10.1% gain during that period.

Given the weaker price action, is now a good time to buy TTEK? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free.

Why Does Tetra Tech Spark Debate?

With a 50-year legacy of "Leading with Science" and operations on all seven continents, Tetra Tech (NASDAQ: TTEK) provides high-end consulting and engineering services focused on water management, environmental solutions, and sustainable infrastructure for government and commercial clients worldwide.

Two Positive Attributes:

1. Skyrocketing Revenue Shows Strong Momentum

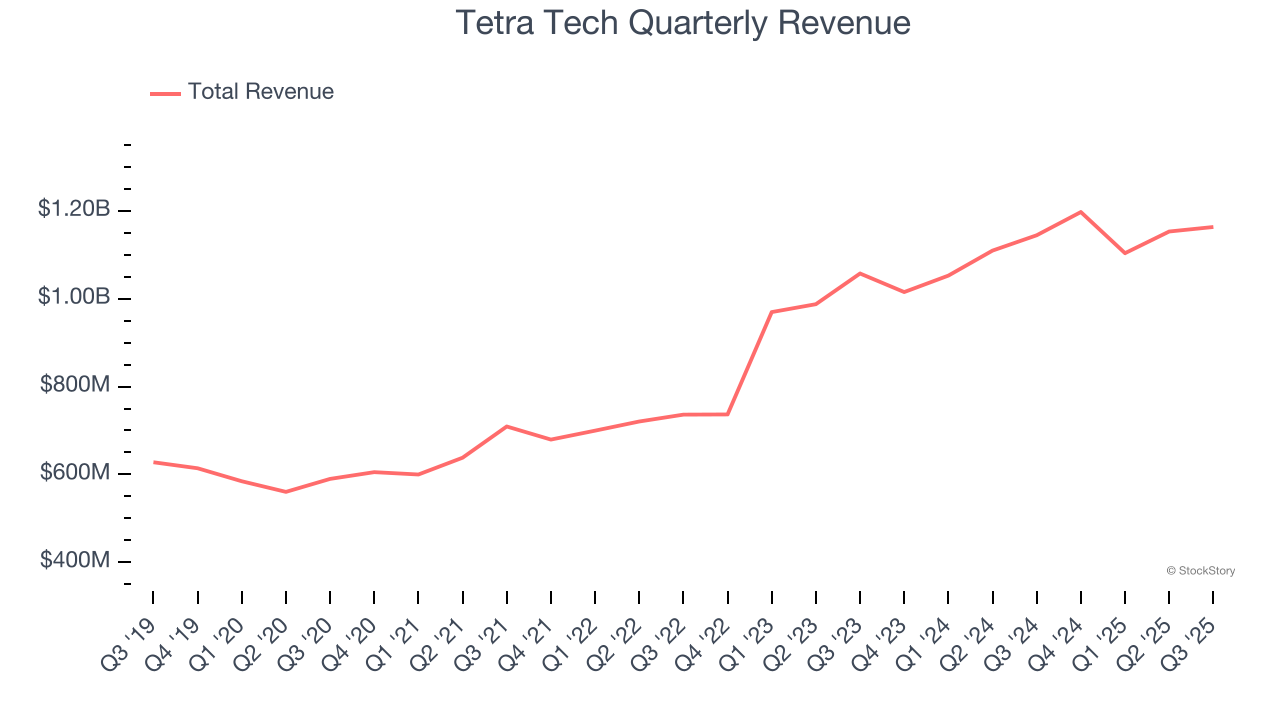

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Tetra Tech grew its sales at an exceptional 14.5% compounded annual growth rate. Its growth beat the average business services company and shows its offerings resonate with customers.

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

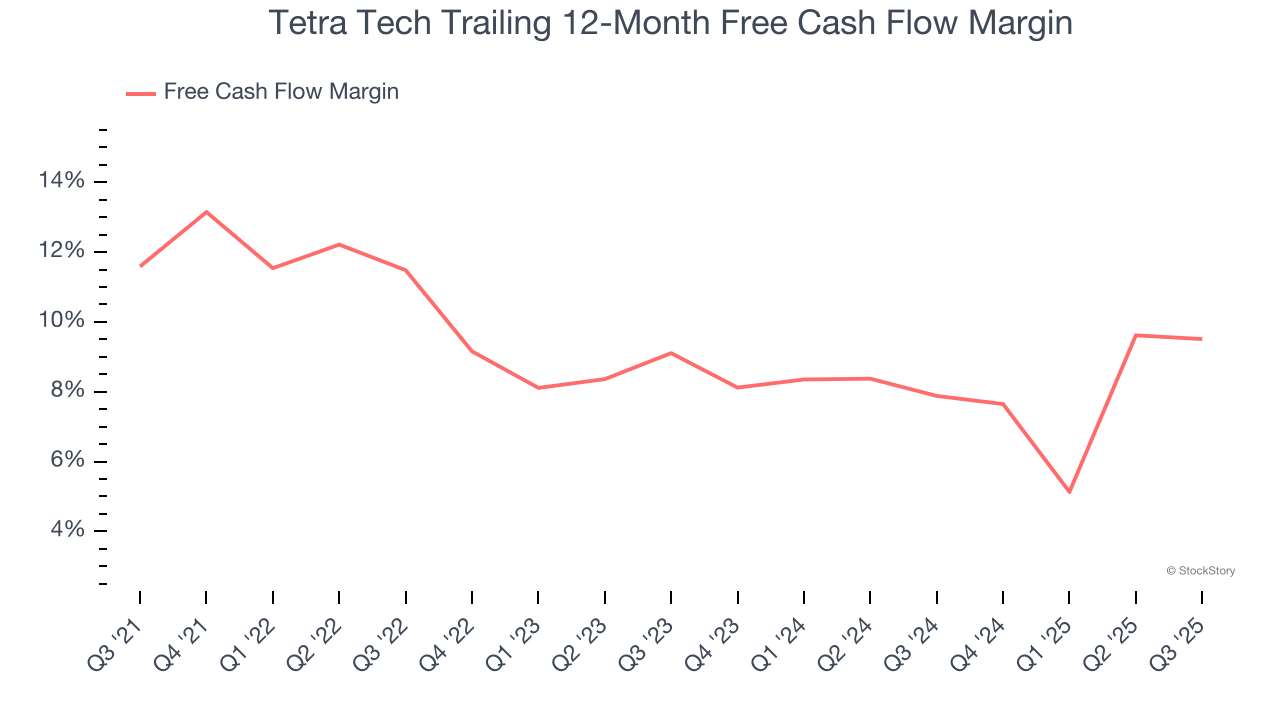

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Tetra Tech has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 9.6% over the last five years, quite impressive for a business services business.

One Reason to be Careful:

Weak Backlog Growth Points to Soft Demand

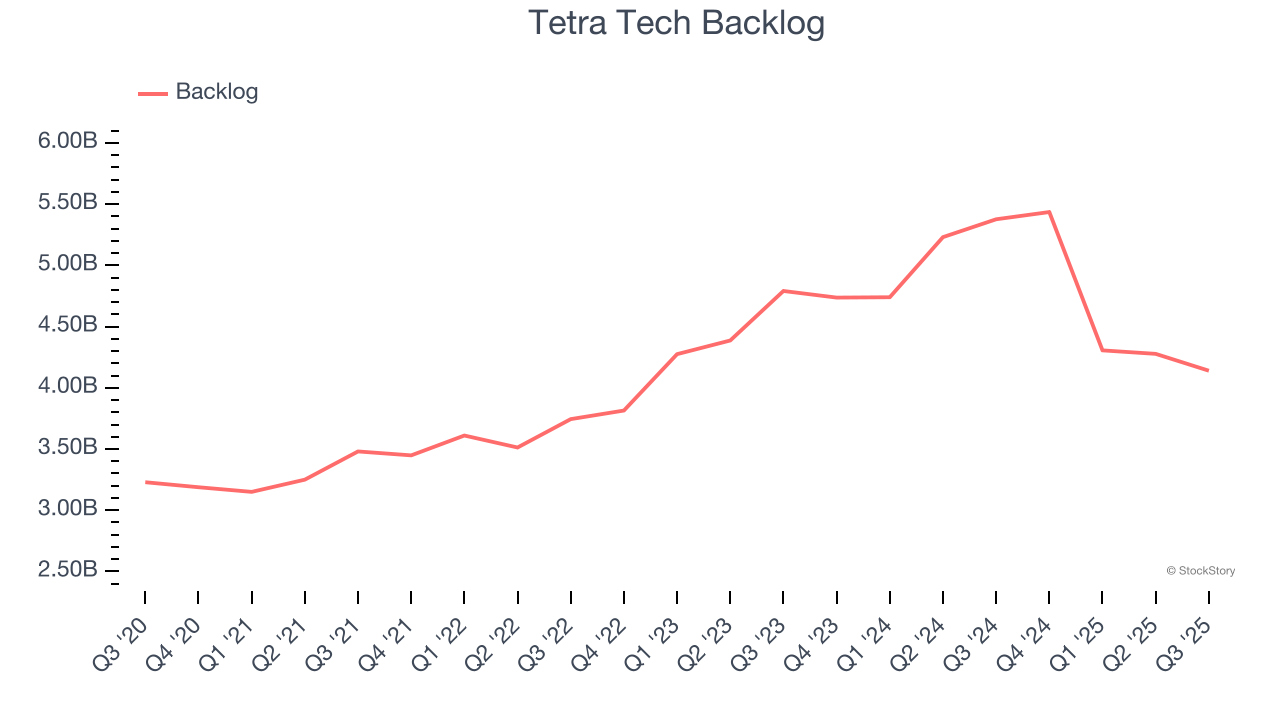

Investors interested in Industrial & Environmental Services companies should track backlog in addition to reported revenue. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Tetra Tech’s future revenue streams.

Tetra Tech’s backlog came in at $4.14 billion in the latest quarter, and over the last two years, its year-on-year growth averaged 3.9%. This performance was underwhelming and suggests that increasing competition is causing challenges in winning new orders.

Final Judgment

Tetra Tech’s positive characteristics outweigh the negatives. With its shares lagging the market recently, the stock trades at 25× forward P/E (or $37.33 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.