Over the last six months, Dolby Laboratories’s shares have sunk to $62.48, producing a disappointing 16.8% loss - a stark contrast to the S&P 500’s 10.1% gain. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Dolby Laboratories, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think Dolby Laboratories Will Underperform?

Even though the stock has become cheaper, we're cautious about Dolby Laboratories. Here are three reasons there are better opportunities than DLB and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

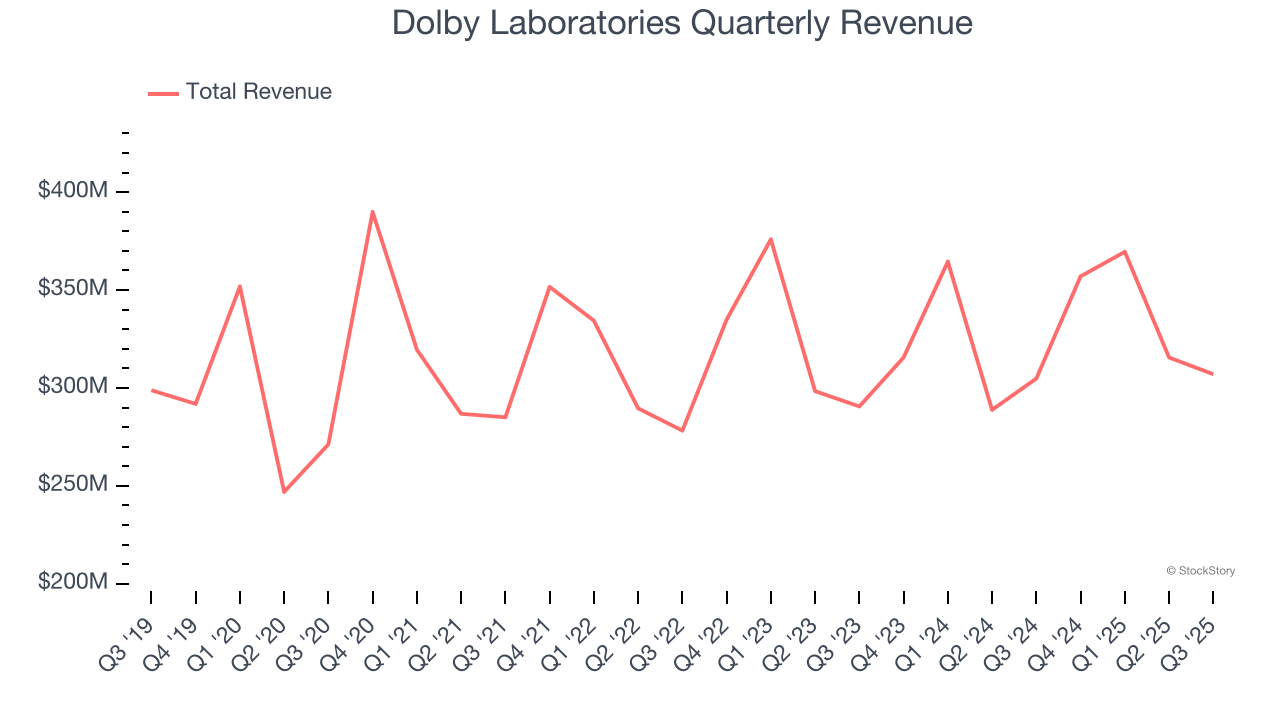

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Dolby Laboratories grew its sales at a weak 3% compounded annual growth rate. This was below our standard for the software sector.

2. Long Payback Periods Delay Returns

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Dolby Laboratories’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between Dolby Laboratories’s products and its peers.

3. Operating Margin in Limbo

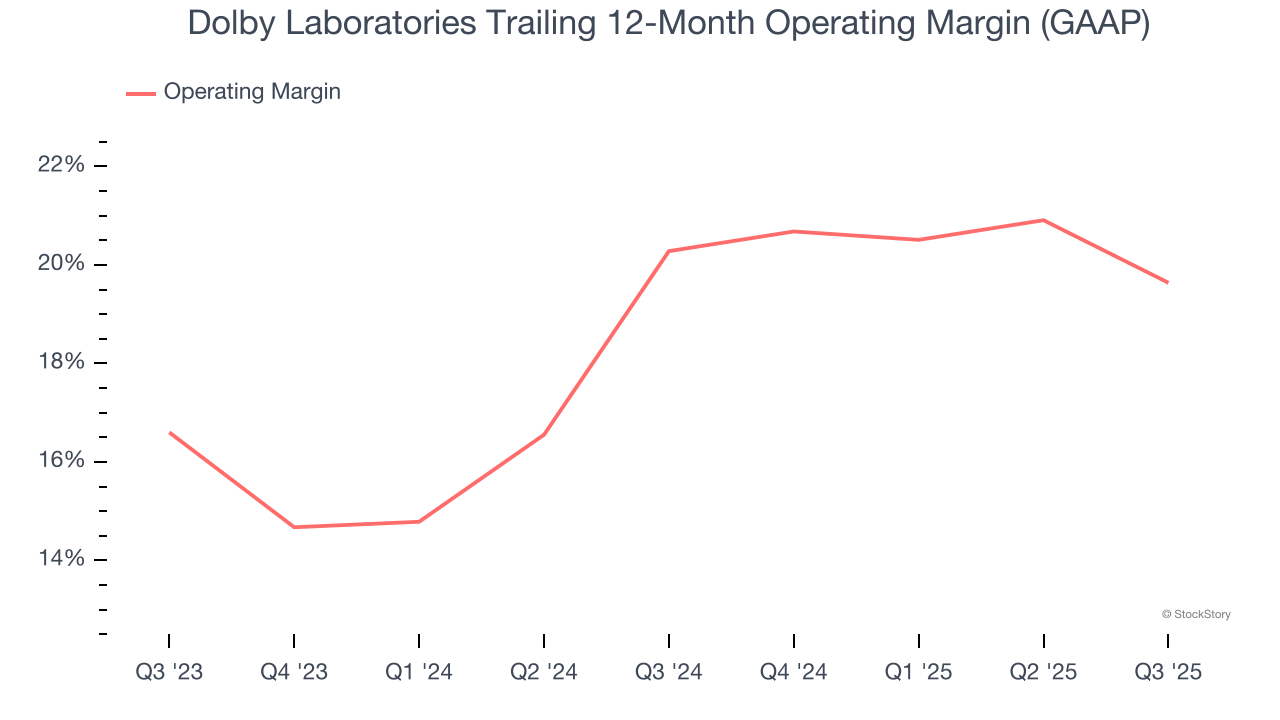

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Analyzing the trend in its profitability, Dolby Laboratories’s operating margin might fluctuated slightly but has generally stayed the same over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 19.6%.

Final Judgment

We cheer for all companies solving complex business issues, but in the case of Dolby Laboratories, we’ll be cheering from the sidelines. Following the recent decline, the stock trades at 4.4× forward price-to-sales (or $62.48 per share). This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now. Let us point you toward one of Charlie Munger’s all-time favorite businesses.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.