Residential lot developer Forestar Group (NYSE: FOR) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 9% year on year to $273 million. The company expects the full year’s revenue to be around $1.65 billion, close to analysts’ estimates. Its GAAP profit of $0.30 per share was 5.5% below analysts’ consensus estimates.

Is now the time to buy Forestar Group? Find out by accessing our full research report, it’s free.

Forestar Group (FOR) Q4 CY2025 Highlights:

- Revenue: $273 million vs analyst estimates of $267.5 million (9% year-on-year growth, 2.1% beat)

- EPS (GAAP): $0.30 vs analyst expectations of $0.32 (5.5% miss)

- Operating Margin: 6.8%, down from 8.1% in the same quarter last year

- Sales Volumes fell 16.7% year on year (-25.9% in the same quarter last year)

- Market Capitalization: $1.39 billion

Donald J. Tomnitz, Chairman of the Board, said, “The Forestar team delivered increased revenues compared to the prior year quarter and maintained strong liquidity through disciplined inventory investment amid ongoing affordability constraints and cautious consumer sentiment that continue to impact the pace of new home sales. We are focused on maximizing returns in each of our projects by aligning the pace and price of lot sales with the timing of our investments to meet demand. In fiscal 2026, we still expect to deliver between 14,000 and 15,000 lots, generating $1.6 billion to $1.7 billion of revenue.

Company Overview

As a majority-owned subsidiary of homebuilding giant D.R. Horton, Forestar Group (NYSE: FOR) develops and sells finished residential lots to homebuilders, focusing primarily on land acquisition and development for single-family homes.

Revenue Growth

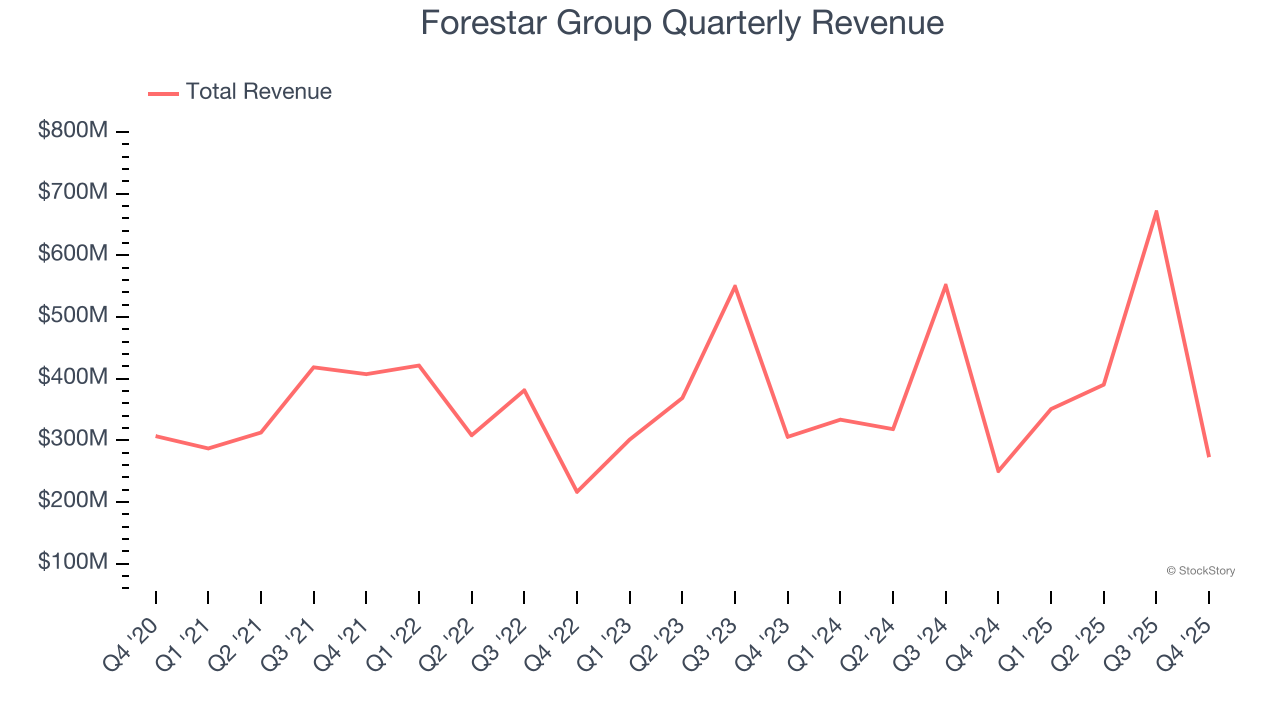

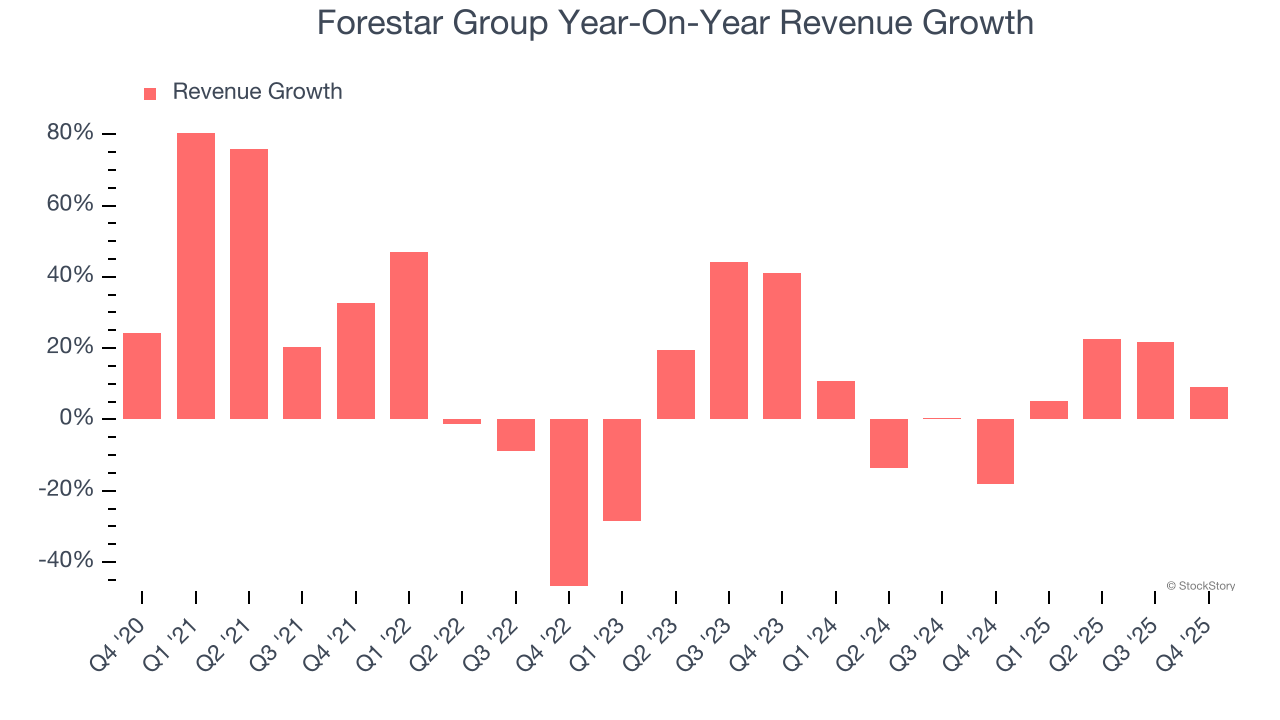

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Forestar Group grew its sales at a 11.2% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Forestar Group’s recent performance shows its demand has slowed as its annualized revenue growth of 5.1% over the last two years was below its five-year trend.

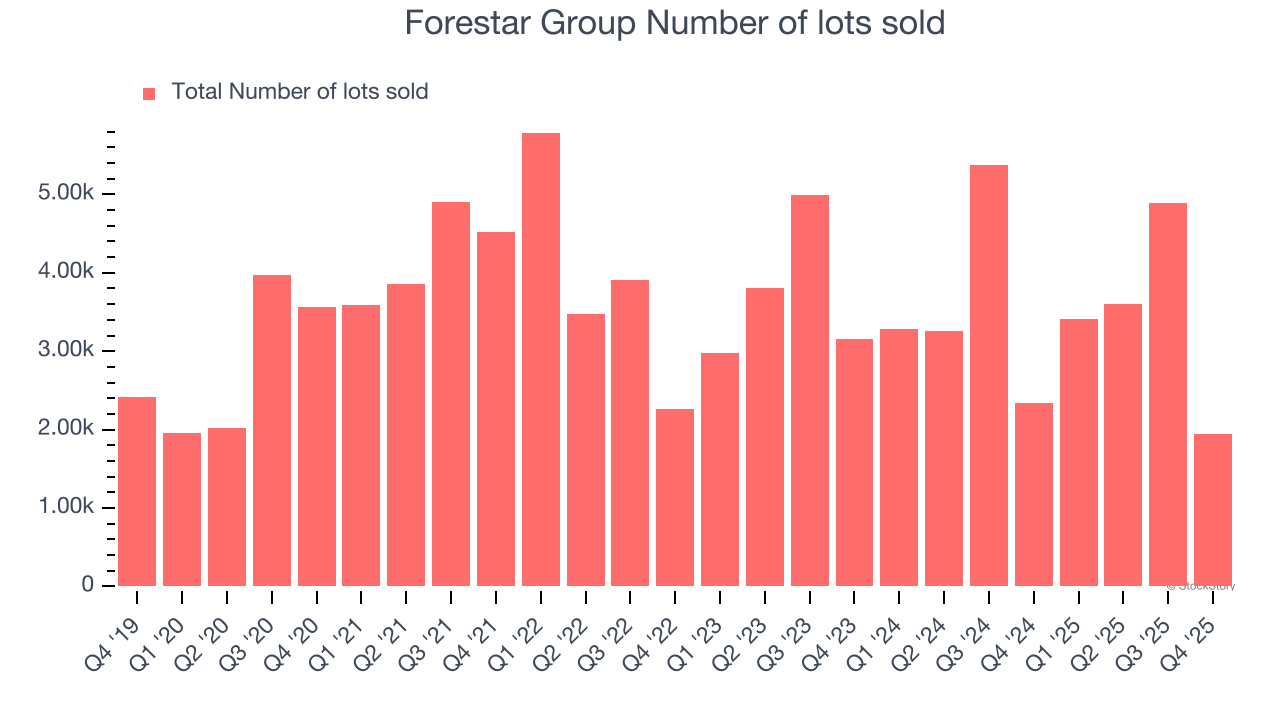

Forestar Group also reports its number of number of lots sold, which reached 1,944 in the latest quarter. Over the last two years, Forestar Group’s number of lots sold averaged 4.2% year-on-year declines. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Forestar Group reported year-on-year revenue growth of 9%, and its $273 million of revenue exceeded Wall Street’s estimates by 2.1%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

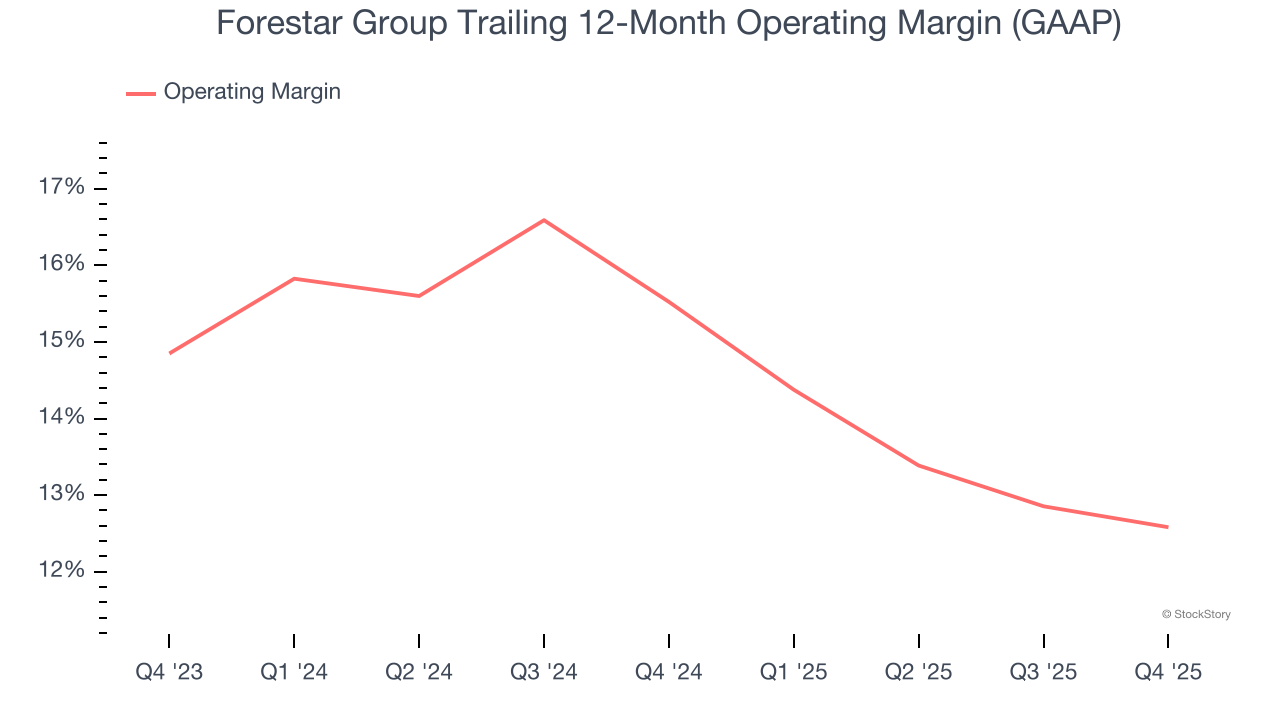

Forestar Group’s operating margin has shrunk over the last 12 months and averaged 13.9% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, Forestar Group generated an operating margin profit margin of 6.8%, down 1.3 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

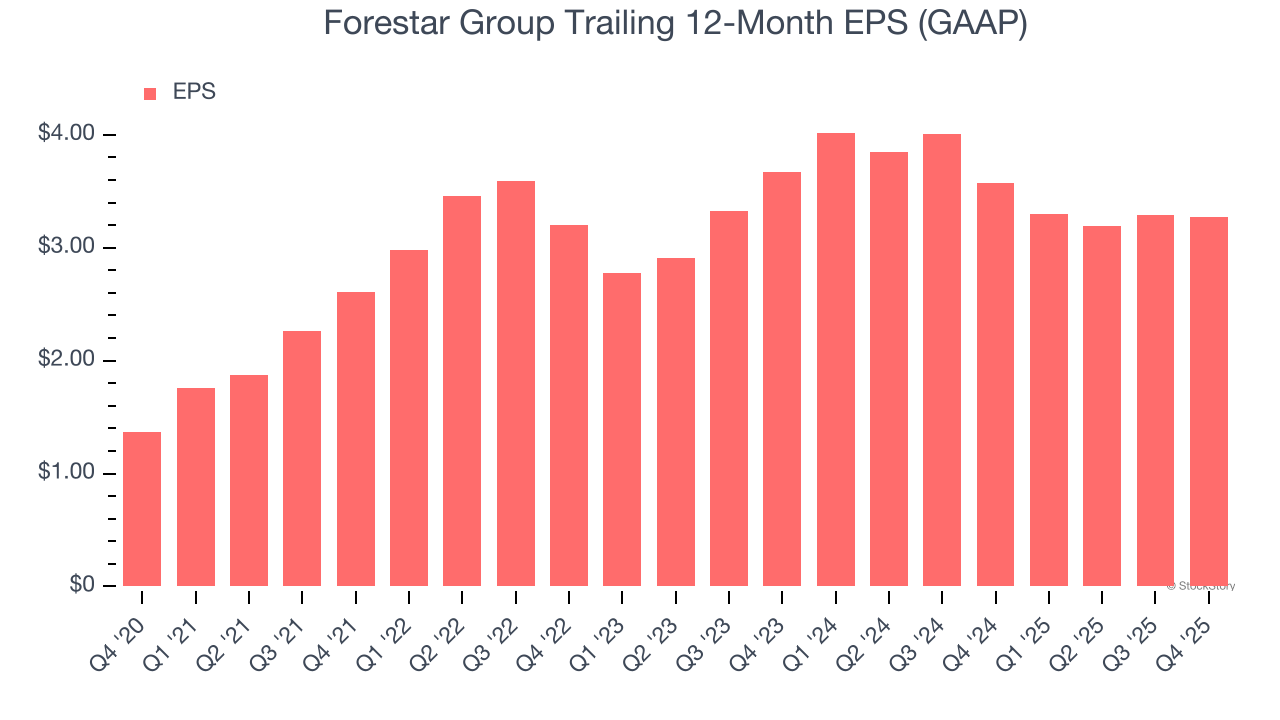

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Forestar Group’s EPS grew at a weak 19% compounded annual growth rate over the last five years. This performance was better than its flat revenue, but we take it with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

In Q4, Forestar Group reported EPS of $0.30, down from $0.32 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Forestar Group’s full-year EPS of $3.27 to shrink by 1.8%.

Key Takeaways from Forestar Group’s Q4 Results

It was encouraging to see Forestar Group beat analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Overall, this was a mixed quarter. The stock remained flat at $27.50 immediately following the results.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).