Over the past six months, Barrett’s stock price fell to $37.70. Shareholders have lost 15.5% of their capital, which is disappointing considering the S&P 500 has climbed by 7.7%. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Given the weaker price action, is now an opportune time to buy BBSI? Find out in our full research report, it’s free.

Why Does Barrett Spark Debate?

Operating as a professional employer organization (PEO) that serves over 8,000 companies with more than 120,000 worksite employees, Barrett Business Services (NASDAQ: BBSI) provides management solutions that help small and mid-sized businesses handle human resources, payroll, workers' compensation, and other administrative functions.

Two Things to Like:

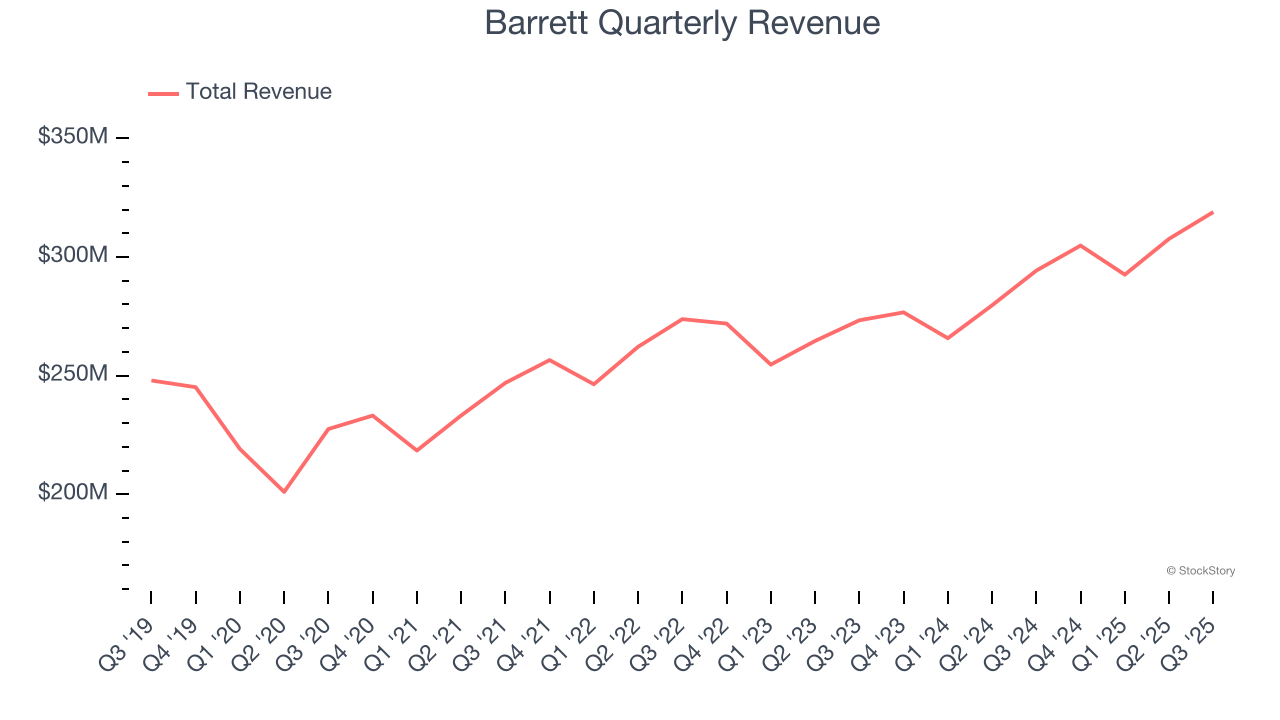

1. Long-Term Revenue Growth Shows Momentum

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Barrett grew its sales at a decent 6.5% compounded annual growth rate. Its growth was slightly above the average business services company and shows its offerings resonate with customers.

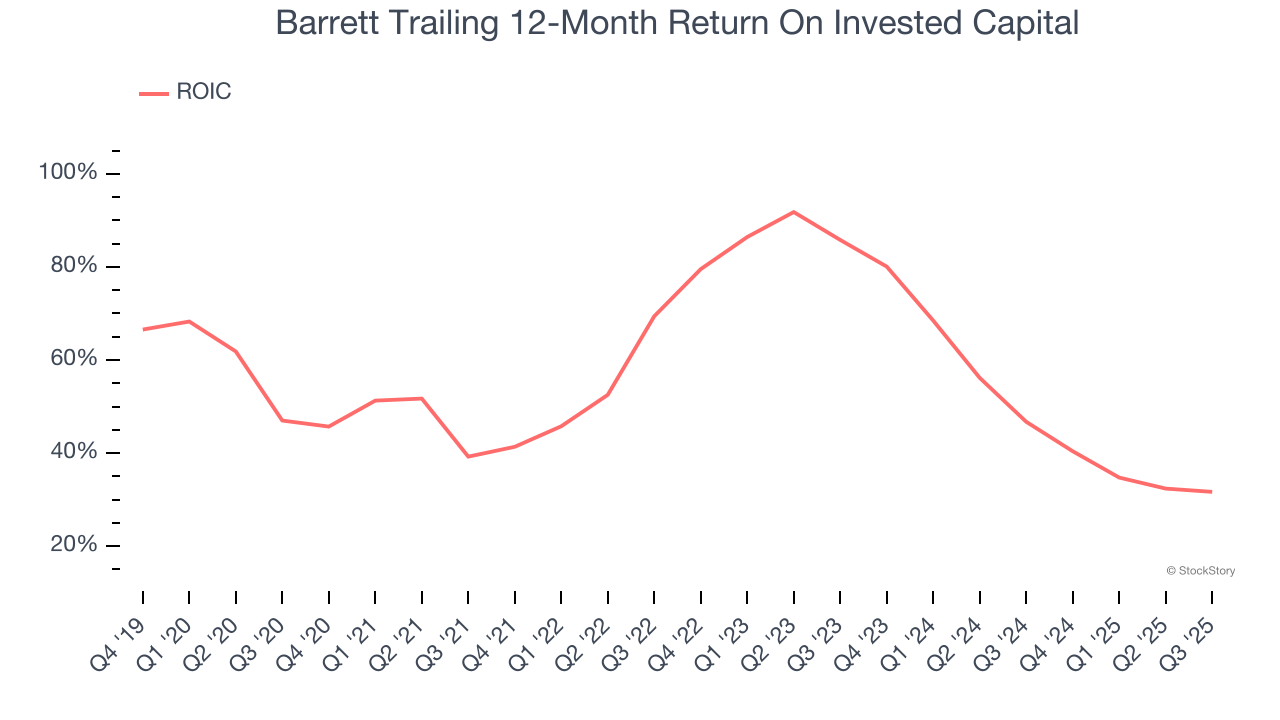

2. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Barrett’s five-year average ROIC was 54.6%, placing it among the best business services companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

One Reason to be Careful:

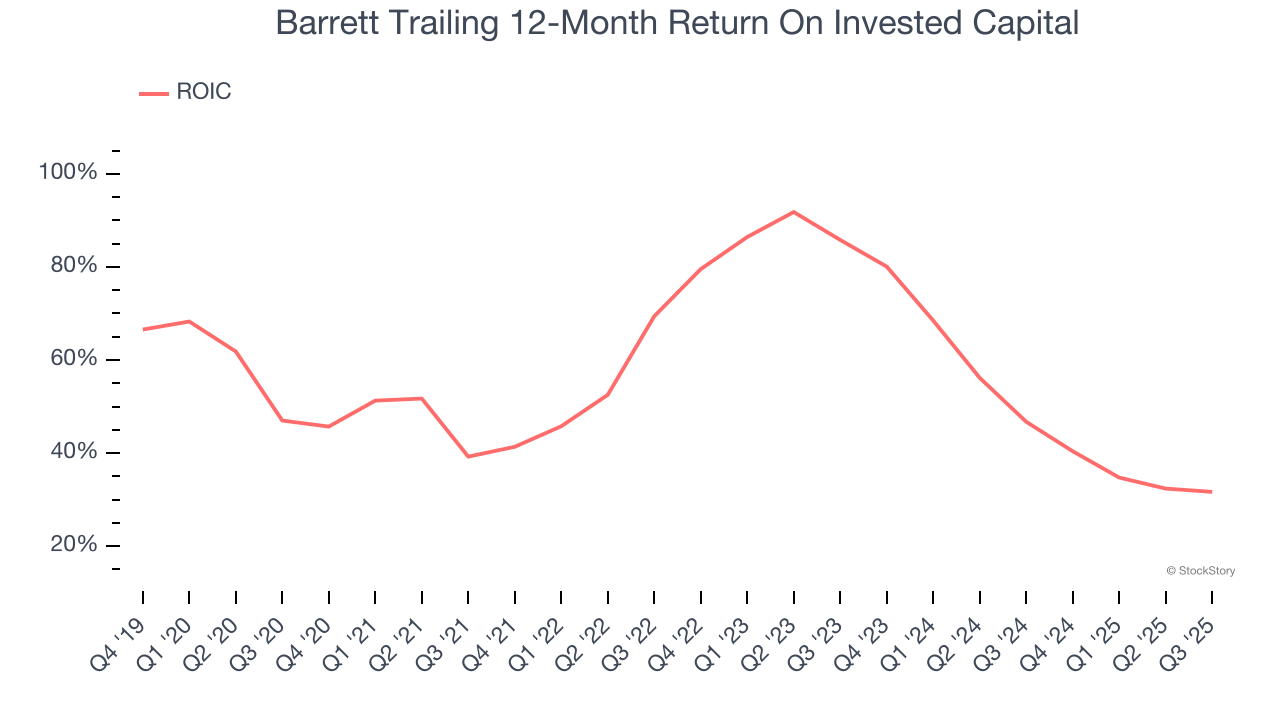

New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Barrett’s ROIC has unfortunately decreased significantly. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

Final Judgment

Barrett’s positive characteristics outweigh the negatives. With the recent decline, the stock trades at 16.5× forward P/E (or $37.70 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Barrett

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.