Investment banking firm Houlihan Lokey (NYSE: HLI) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 13% year on year to $717.1 million. Its non-GAAP profit of $1.94 per share was 3.6% above analysts’ consensus estimates.

Is now the time to buy Houlihan Lokey? Find out by accessing our full research report, it’s free.

Houlihan Lokey (HLI) Q4 CY2025 Highlights:

- Revenue: $717.1 million vs analyst estimates of $698.3 million (13% year-on-year growth, 2.7% beat)

- Pre-tax Profit: $169.6 million (23.7% margin)

- Adjusted EPS: $1.94 vs analyst estimates of $1.87 (3.6% beat)

- Market Capitalization: $12.59 billion

“We are pleased with our results for the quarter and our performance year-to-date. We continue to benefit from improving investor sentiment and acceleration in the private equity markets. Most importantly, we continue to broaden and deepen our bench of exceptional talent around the world, most recently with our two transactions in Europe,” stated Scott Adelson, Chief Executive Officer of Houlihan Lokey.

Company Overview

Founded in 1972 and known for its expertise in complex financial situations, Houlihan Lokey (NYSE: HLI) is a global investment bank specializing in mergers and acquisitions, capital markets, financial restructurings, and valuation advisory services.

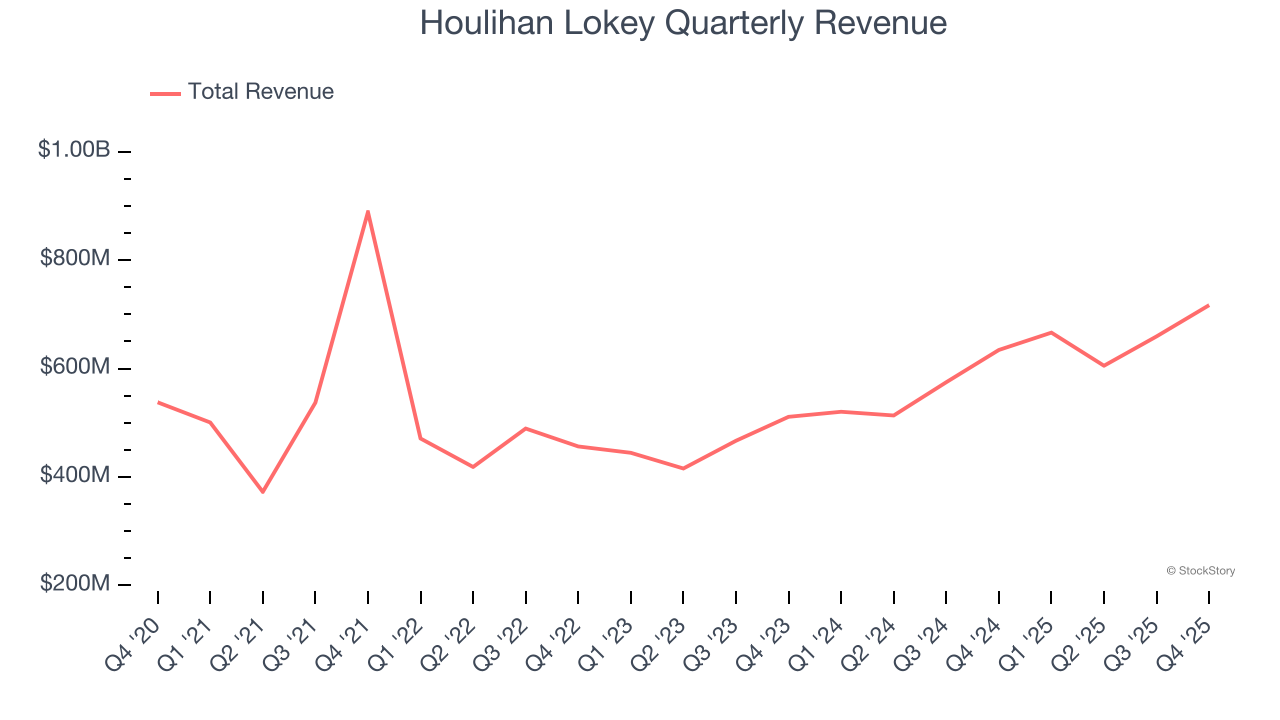

Revenue Growth

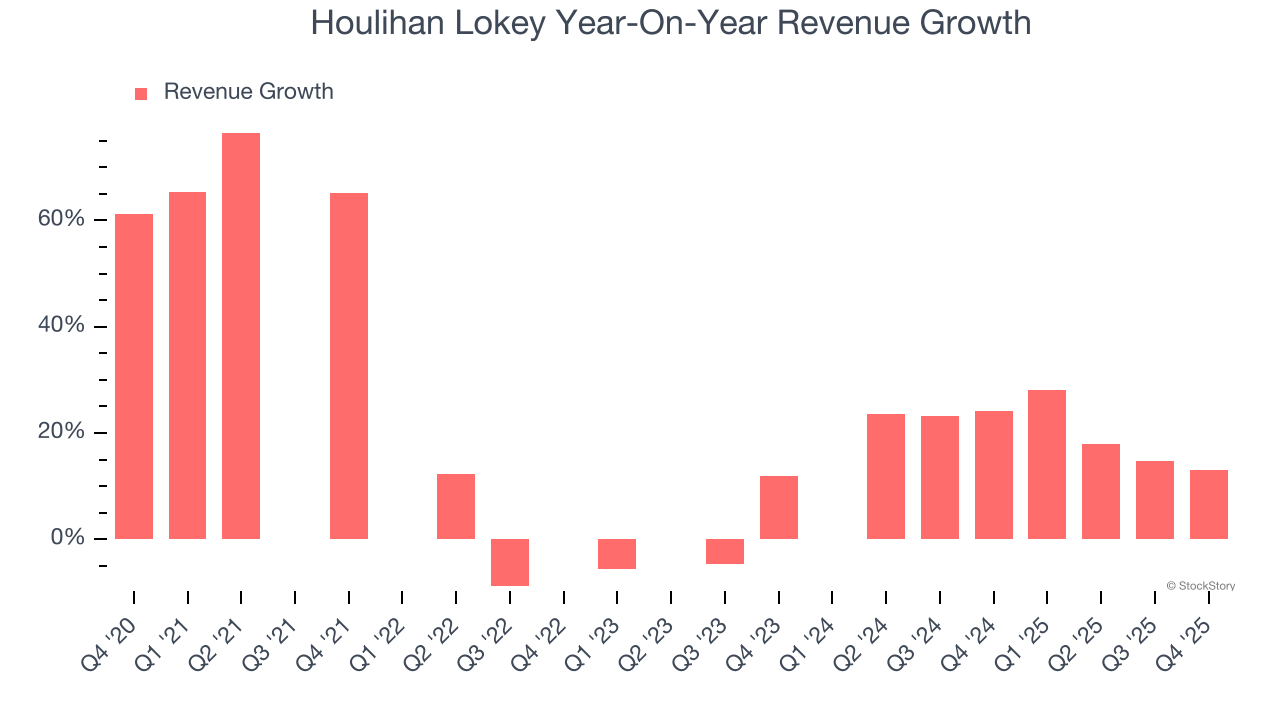

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Houlihan Lokey grew its revenue at an impressive 14.8% compounded annual growth rate. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Houlihan Lokey’s annualized revenue growth of 20% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Houlihan Lokey reported year-on-year revenue growth of 13%, and its $717.1 million of revenue exceeded Wall Street’s estimates by 2.7%.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Key Takeaways from Houlihan Lokey’s Q4 Results

It was encouraging to see Houlihan Lokey beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $180.54 immediately after reporting.

Big picture, is Houlihan Lokey a buy here and now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).