Digital lending platform LendingClub (NYSE: LC) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 22.7% year on year to $266.5 million. Its GAAP profit of $0.35 per share was 3.3% above analysts’ consensus estimates.

Is now the time to buy LendingClub? Find out by accessing our full research report, it’s free.

LendingClub (LC) Q4 CY2025 Highlights:

- Revenue: $266.5 million vs analyst estimates of $261.9 million (22.7% year-on-year growth, 1.8% beat)

- Pre-tax Profit: $50.03 million (18.8% margin)

- EPS (GAAP): $0.35 vs analyst estimates of $0.34 (3.3% beat)

- EPS (GAAP) guidance for the upcoming financial year 2026 is $1.73 at the midpoint, beating analyst estimates by 3.7%

- Market Capitalization: $2.40 billion

"We closed out a fantastic year with another strong quarter, delivering 40% originations growth and ROTCE approaching 12%," said Scott Sanborn, LendingClub CEO.

Company Overview

Pioneering peer-to-peer lending in the US before evolving into a digital bank, LendingClub (NYSE: LC) operates a marketplace that connects borrowers with lenders, offering personal loans, auto refinancing, and banking services.

Revenue Growth

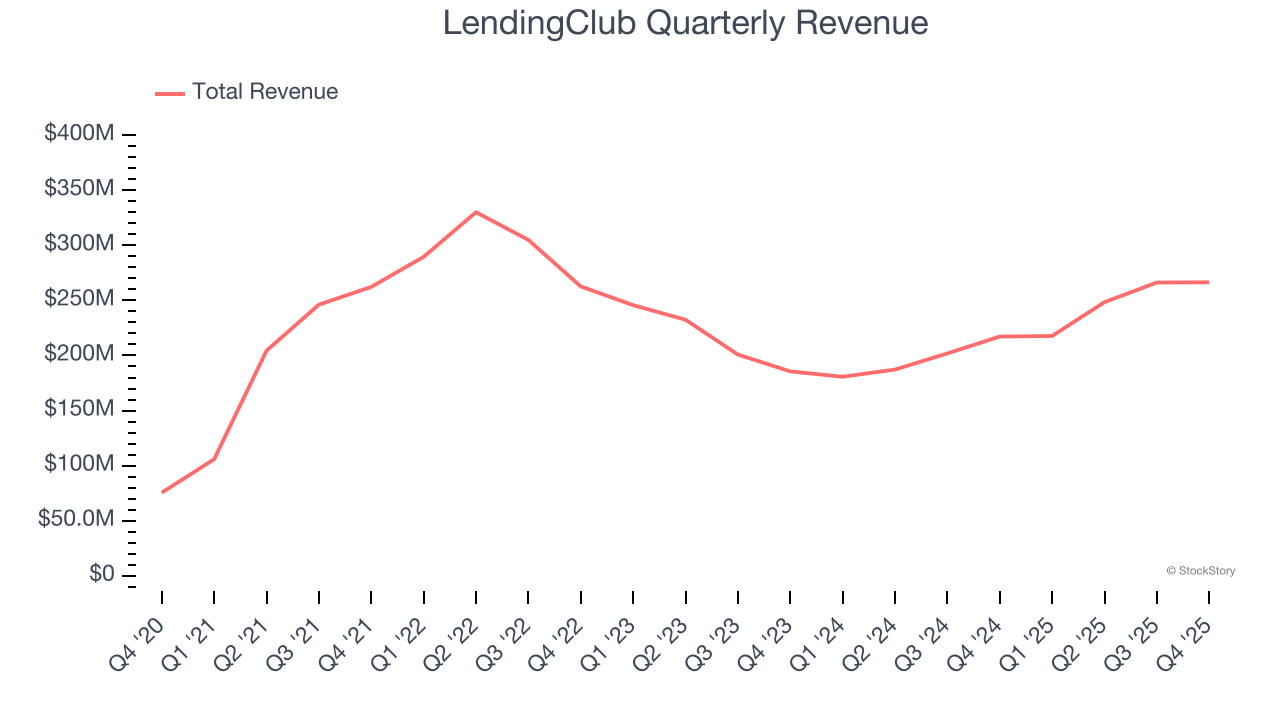

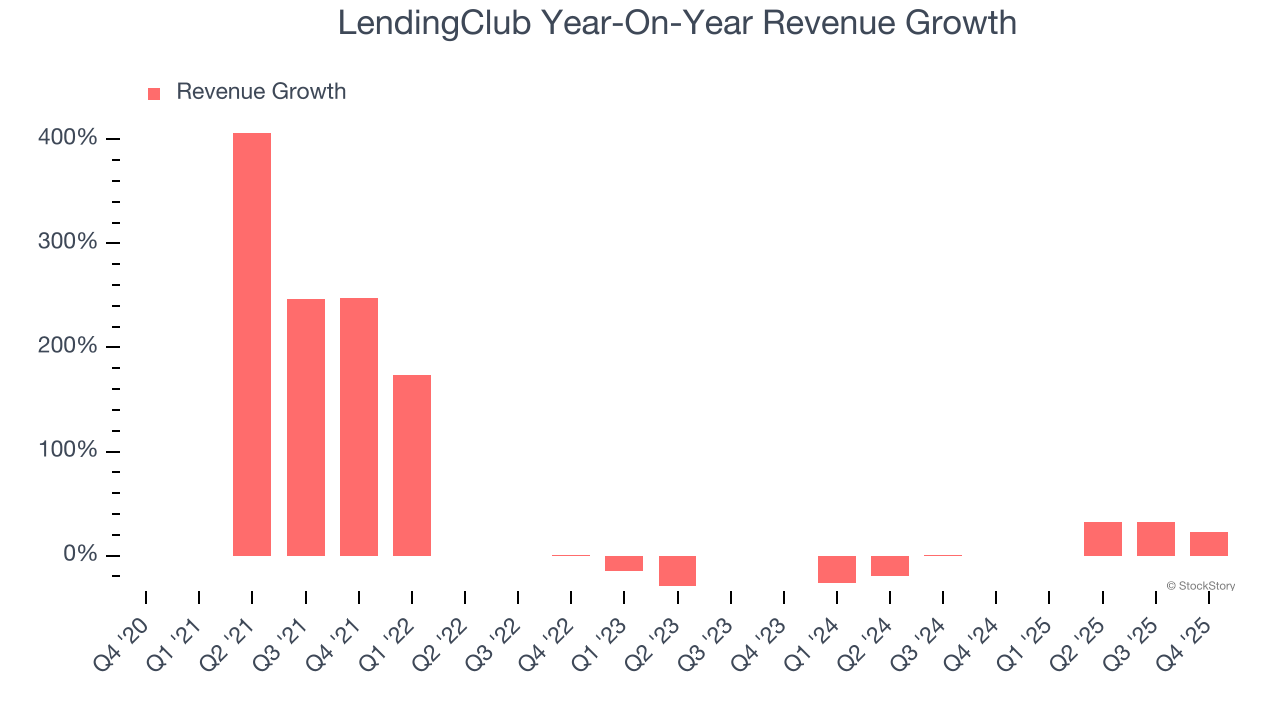

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, LendingClub’s revenue grew at an incredible 25.7% compounded annual growth rate over the last five years. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. LendingClub’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 7.5% over the last two years was well below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, LendingClub reported robust year-on-year revenue growth of 22.7%, and its $266.5 million of revenue topped Wall Street estimates by 1.8%.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Key Takeaways from LendingClub’s Q4 Results

It was great to see LendingClub’s full-year EPS guidance top analysts’ expectations. We were also happy its revenue outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. Investors were likely hoping for more, and shares traded down 5.1% to $18.55 immediately after reporting.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).