Diversified bank holding company Merchants Bancorp (NASDAQCM:MBIN) beat Wall Street’s revenue expectations in Q4 CY2025, but sales fell by 4.4% year on year to $185.3 million. Its GAAP profit of $1.28 per share was 32% above analysts’ consensus estimates.

Is now the time to buy Merchants Bancorp? Find out by accessing our full research report, it’s free.

Merchants Bancorp (MBIN) Q4 CY2025 Highlights:

- Net Interest Income: $138.1 million vs analyst estimates of $129.7 million (2.6% year-on-year growth, 6.5% beat)

- Net Interest Margin: 2.9% vs analyst estimates of 2.8% (8.5 basis point beat)

- Revenue: $185.3 million vs analyst estimates of $171.9 million (4.4% year-on-year decline, 7.8% beat)

- Efficiency Ratio: 45.1% vs analyst estimates of 45.9% (71 basis point beat)

- EPS (GAAP): $1.28 vs analyst estimates of $0.97 (32% beat)

- Tangible Book Value per Share: $37.51 vs analyst estimates of $37.18 (9.8% year-on-year growth, 0.9% beat)

- Market Capitalization: $1.62 billion

"This quarter reflects a decisive shift for Merchants. Asset quality improved meaningfully, with criticized loans down 13% and nonperforming loans reduced by nearly one-third during the quarter. We also achieved a record tangible book value of $37.51 per share and the strongest quarterly gain on sale of multi-family loans in our history. While total assets increased to $19.4 billion—the highest level reported in company history—the real story is the progress we've made in strengthening credit quality and positioning the company for growth in 2026," said Michael F. Petrie, Chairman and CEO of Merchants.

Company Overview

With a strategic focus on low-risk, government-backed lending programs, Merchants Bancorp (NASDAQCM:MBIN) is an Indiana-based bank holding company specializing in multi-family mortgage banking, mortgage warehousing, and traditional banking services.

Sales Growth

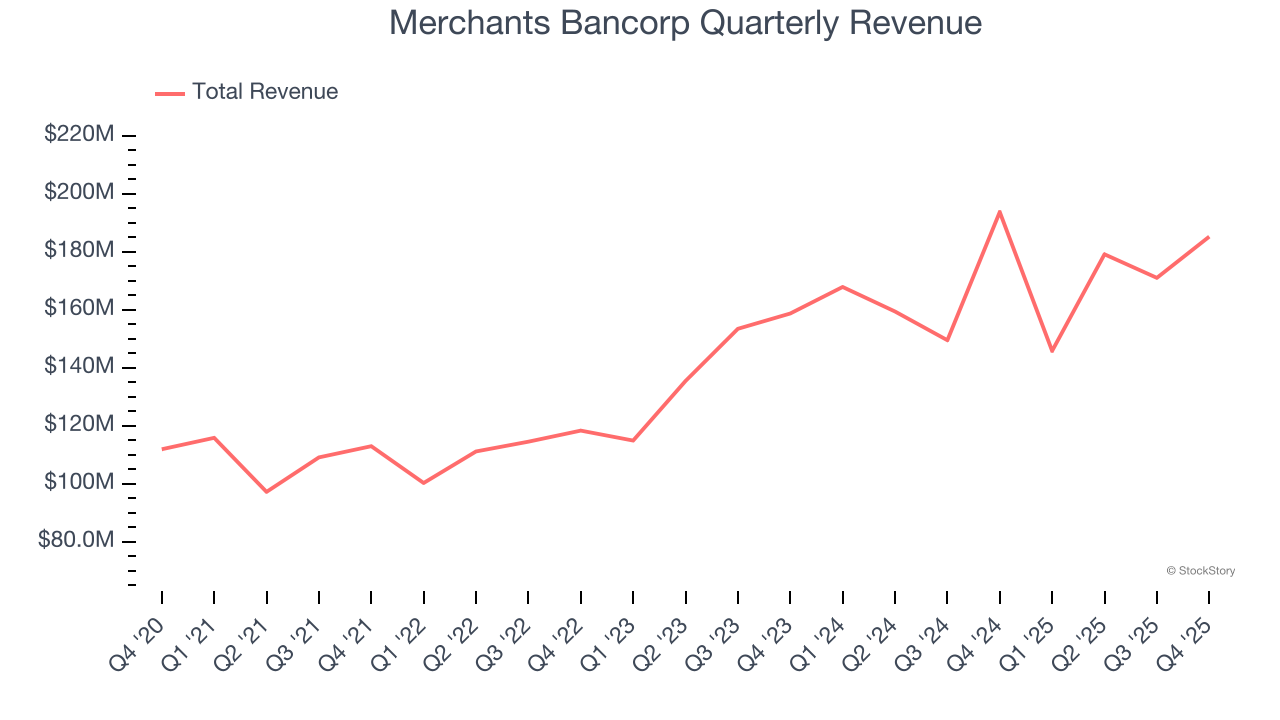

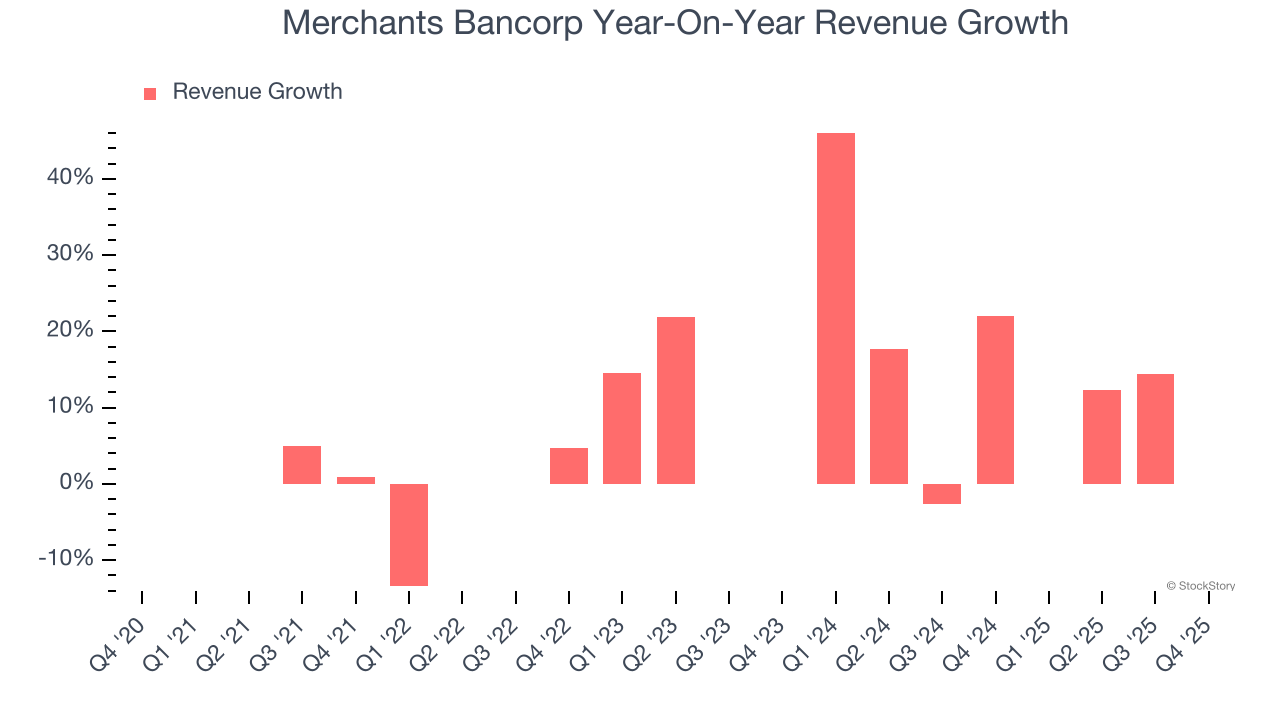

Two primary revenue streams drive bank earnings. While net interest income, which is earned by charging higher rates on loans than paid on deposits, forms the foundation, fee-based services across banking, credit, wealth management, and trading operations provide additional income. Over the last five years, Merchants Bancorp grew its revenue at an impressive 14.1% compounded annual growth rate. Its growth beat the average banking company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Merchants Bancorp’s annualized revenue growth of 10% over the last two years is below its five-year trend, but we still think the results were respectable.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Merchants Bancorp’s revenue fell by 4.4% year on year to $185.3 million but beat Wall Street’s estimates by 7.8%.

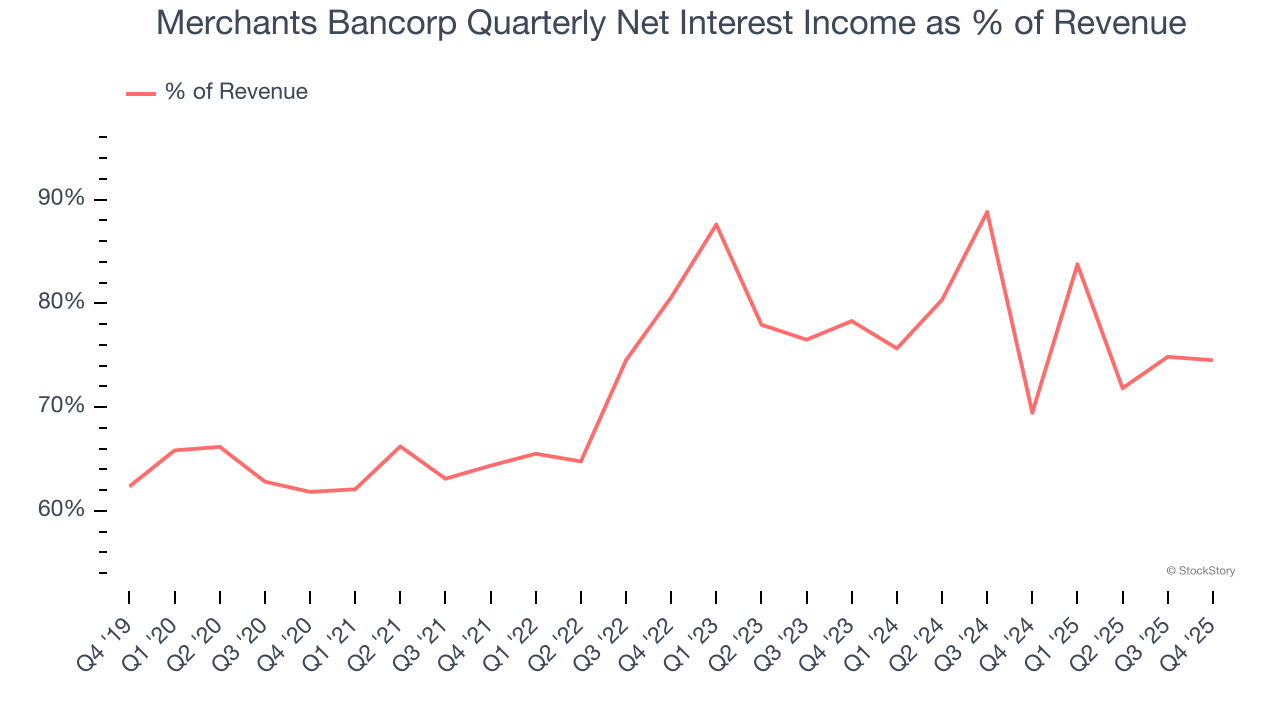

Net interest income made up 74% of the company’s total revenue during the last five years, meaning lending operations are Merchants Bancorp’s largest source of revenue.

Net interest income commands greater market attention due to its reliability and consistency, whereas non-interest income is often seen as lower-quality revenue that lacks the same dependable characteristics.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Tangible Book Value Per Share (TBVPS)

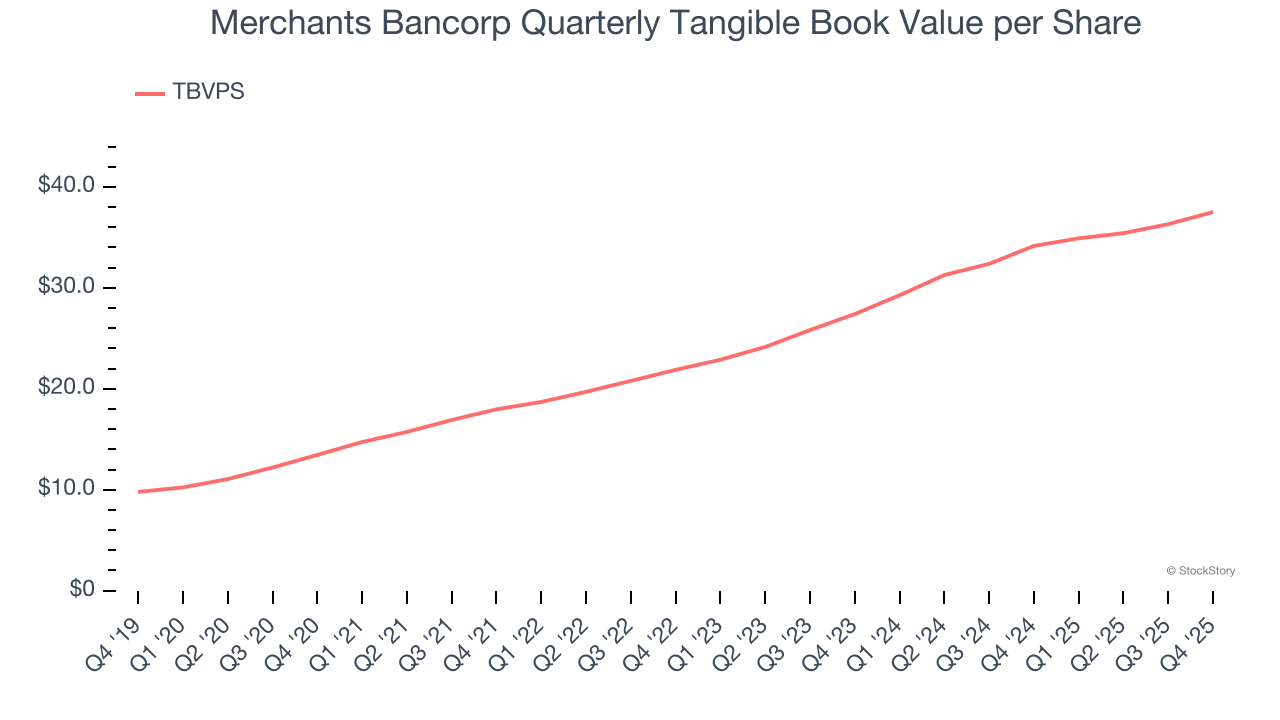

Banks profit by intermediating between depositors and borrowers, making them fundamentally balance sheet-driven enterprises. Market participants emphasize balance sheet quality and sustained book value growth when evaluating these institutions.

Because of this, tangible book value per share (TBVPS) emerges as the critical performance benchmark. By excluding intangible assets with uncertain liquidation values, this metric captures real, liquid net worth per share. EPS can become murky due to acquisition impacts or accounting flexibility around loan provisions, and TBVPS resists financial engineering manipulation.

Merchants Bancorp’s TBVPS grew at an incredible 22.8% annual clip over the last five years. TBVPS growth has recently decelerated to 17% annual growth over the last two years (from $27.40 to $37.51 per share).

Over the next 12 months, Consensus estimates call for Merchants Bancorp’s TBVPS to grow by 11.2% to $41.71, mediocre growth rate.

Key Takeaways from Merchants Bancorp’s Q4 Results

It was good to see Merchants Bancorp beat analysts’ EPS expectations this quarter. We were also excited its net interest income outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $34.98 immediately after reporting.

Is Merchants Bancorp an attractive investment opportunity at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).