Homebuilder Meritage Homes (NYSE: MTH) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 12% year on year to $1.43 billion. Its non-GAAP profit of $1.67 per share was 9.6% above analysts’ consensus estimates.

Is now the time to buy Meritage Homes? Find out by accessing our full research report, it’s free.

Meritage Homes (MTH) Q4 CY2025 Highlights:

- Revenue: $1.43 billion vs analyst estimates of $1.49 billion (12% year-on-year decline, 4.4% miss)

- Adjusted EPS: $1.67 vs analyst estimates of $1.52 (9.6% beat)

- Adjusted EBITDA: $114.7 million vs analyst estimates of $151.2 million (8% margin, 24.1% miss)

- Operating Margin: 7.2%, down from 12.8% in the same quarter last year

- Free Cash Flow was $238.1 million, up from -$107 million in the same quarter last year

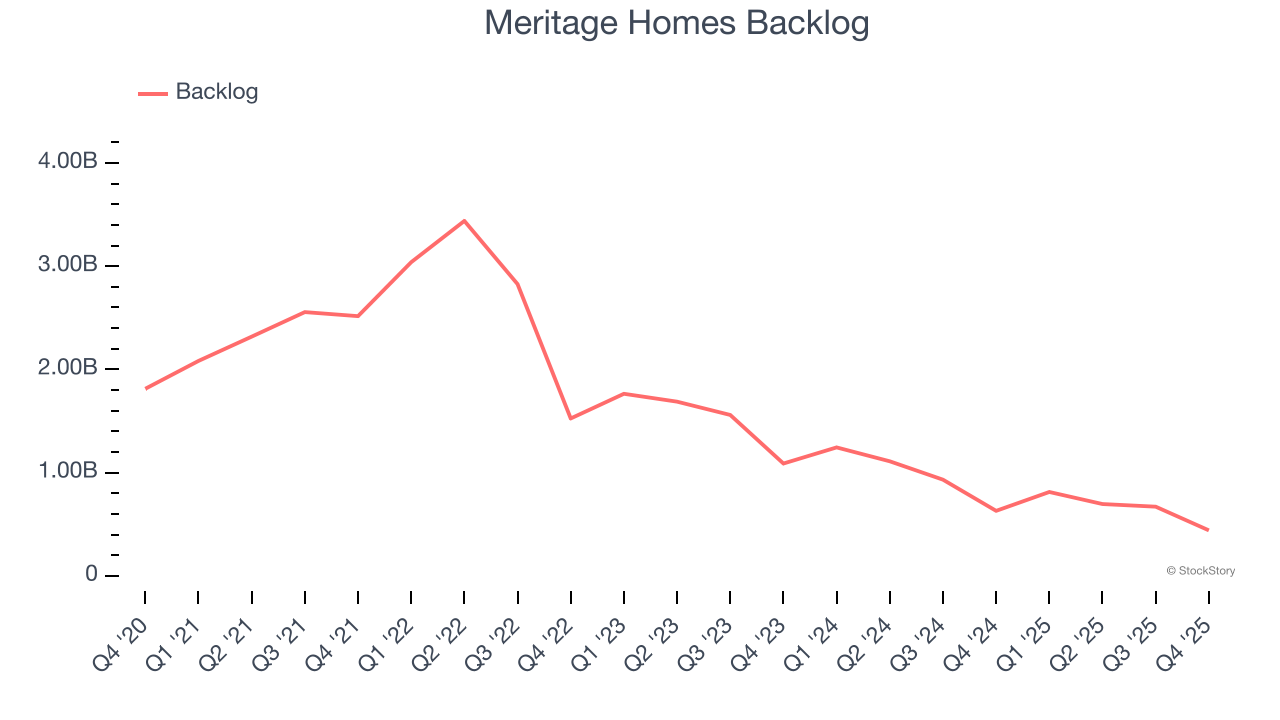

- Backlog: $440.6 million at quarter end, down 30% year on year

- Market Capitalization: $4.90 billion

Company Overview

Originally founded in 1985 in Arizona as Monterey Homes, Meritage Homes (NYSE: MTH) is a homebuilder specializing in designing and constructing energy-efficient and single-family homes in the US.

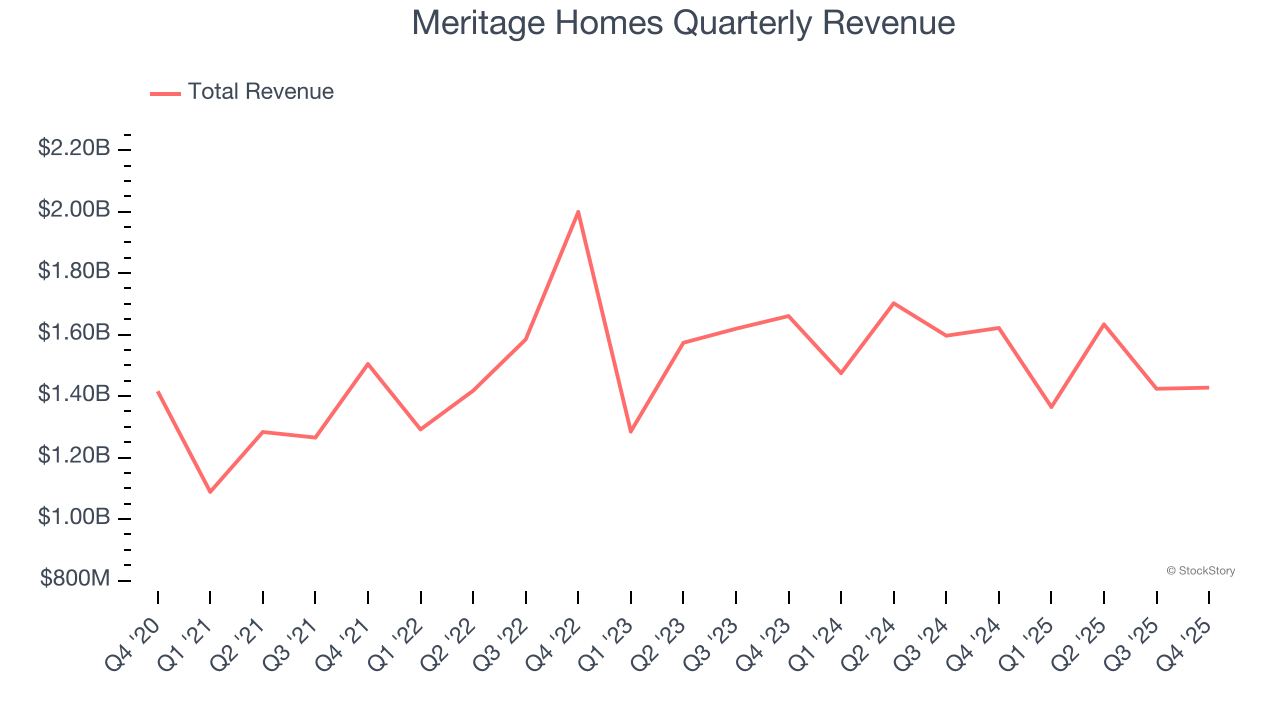

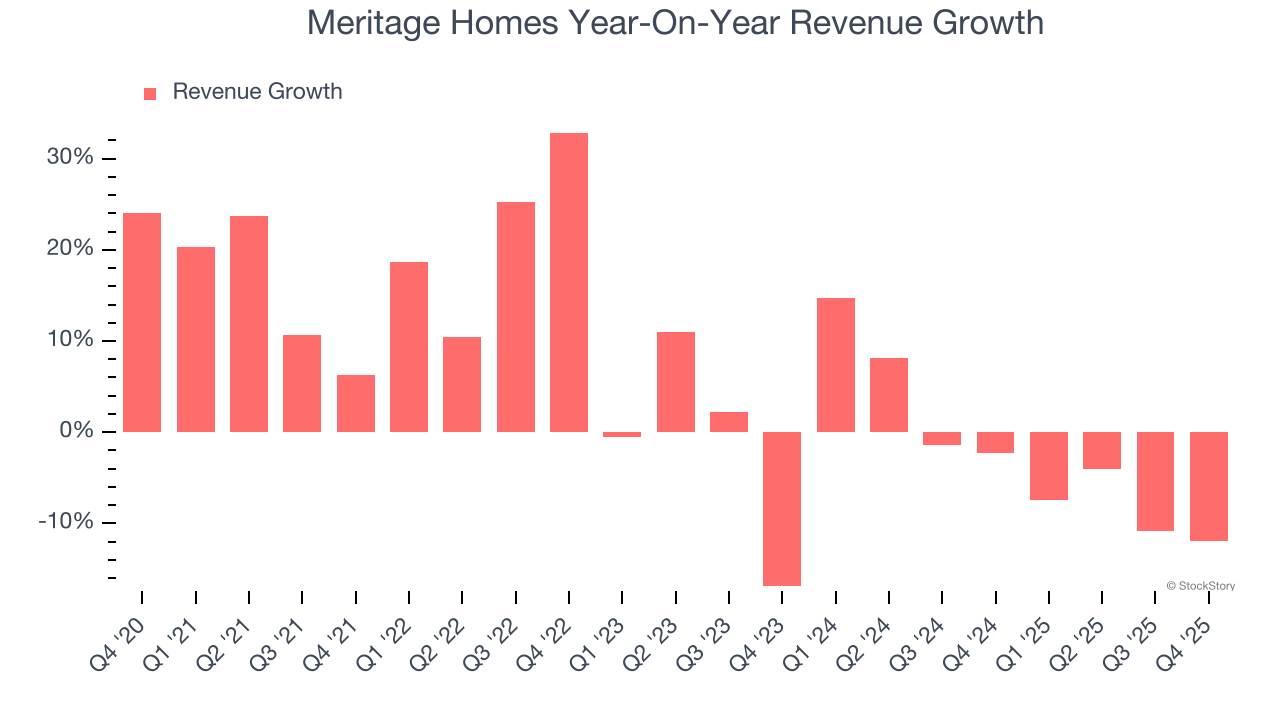

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Meritage Homes’s sales grew at a tepid 5.4% compounded annual growth rate over the last five years. This was below our standard for the industrials sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Meritage Homes’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.4% annually.

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Meritage Homes’s backlog reached $440.6 million in the latest quarter and averaged 34.5% year-on-year declines over the last two years. Because this number is lower than its revenue growth, we can see the company hasn’t secured enough new orders to maintain its growth rate in the future.

This quarter, Meritage Homes missed Wall Street’s estimates and reported a rather uninspiring 12% year-on-year revenue decline, generating $1.43 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 4.1% over the next 12 months. While this projection suggests its newer products and services will fuel better top-line performance, it is still below the sector average.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

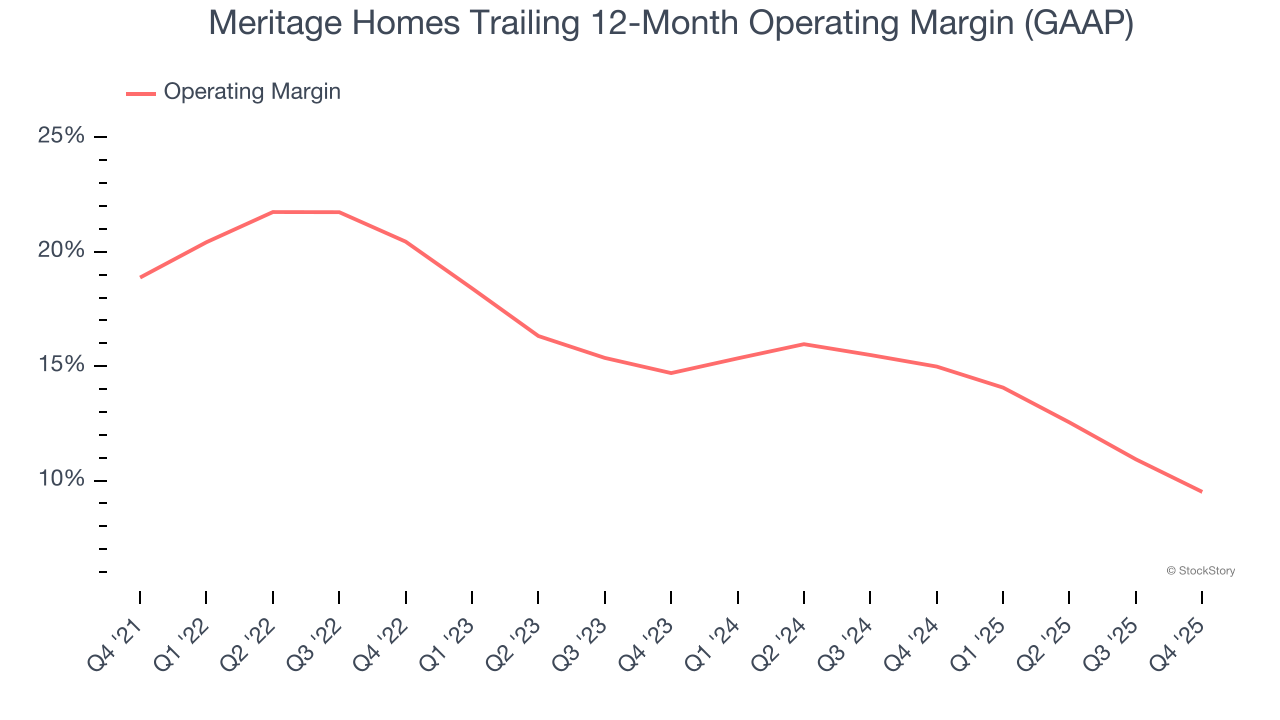

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Meritage Homes has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 15.7%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Meritage Homes’s operating margin decreased by 9.4 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Meritage Homes generated an operating margin profit margin of 7.2%, down 5.6 percentage points year on year. Since Meritage Homes’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

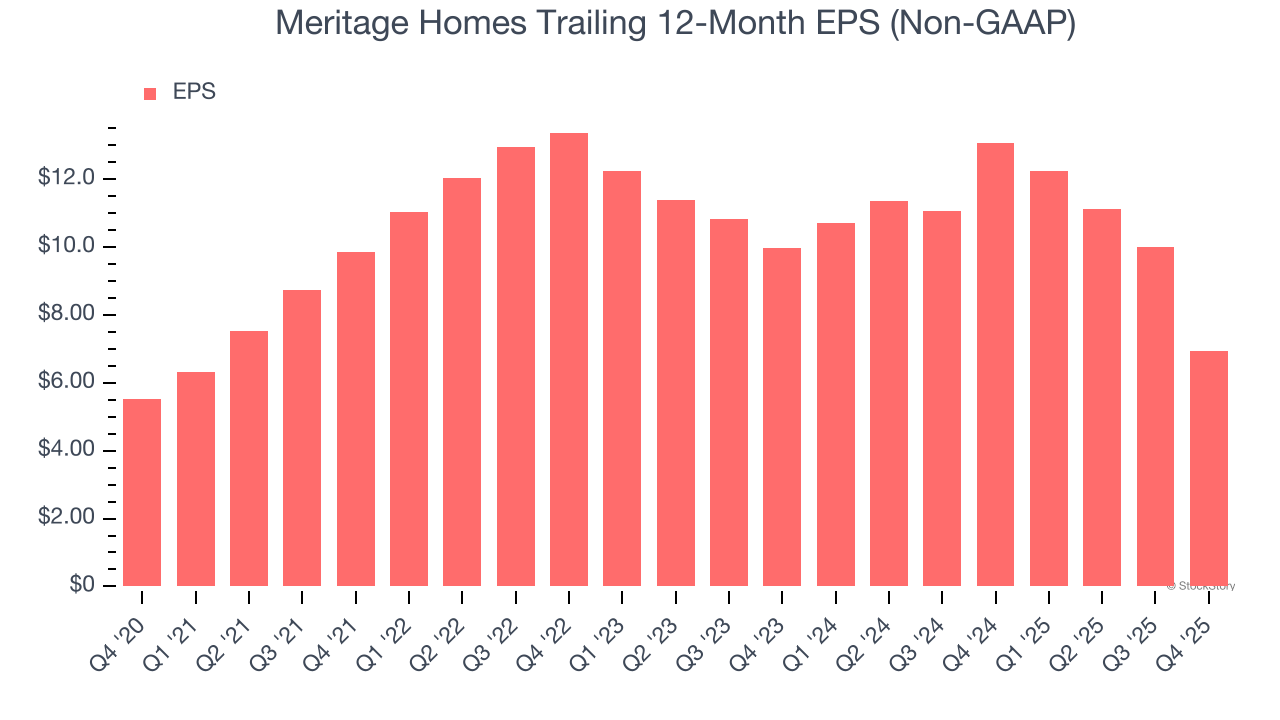

Meritage Homes’s unimpressive 4.8% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Meritage Homes’s two-year annual EPS declines of 16.5% were bad and lower than its two-year revenue losses.

Diving into the nuances of Meritage Homes’s earnings can give us a better understanding of its performance. Meritage Homes’s operating margin has declined over the last two years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Meritage Homes reported adjusted EPS of $1.67, down from $4.72 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 9.6%. Over the next 12 months, Wall Street expects Meritage Homes’s full-year EPS of $6.95 to shrink by 2.2%.

Key Takeaways from Meritage Homes’s Q4 Results

It was good to see Meritage Homes beat analysts’ EPS expectations this quarter. On the other hand, its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $69.19 immediately after reporting.

So should you invest in Meritage Homes right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).