Student loan servicer Navient (NASDAQ: NAVI) fell short of the markets revenue expectations in Q4 CY2025, with sales falling 16% year on year to $137 million. Its GAAP loss of $0.06 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Navient? Find out by accessing our full research report, it’s free.

Navient (NAVI) Q4 CY2025 Highlights:

- Net Interest Income: $118 million vs analyst estimates of $133.3 million

- Revenue: $137 million vs analyst estimates of $155.8 million (16% year-on-year decline, 12.1% miss)

- Pre-tax Profit: -$7 million (-5.1% margin)

- EPS (GAAP): -$0.06 vs analyst estimates of $0.32 (significant miss)

- Market Capitalization: $1.17 billion

Company Overview

Spun off from Sallie Mae in 2014 to handle the company's loan servicing and collection operations, Navient (NASDAQ: NAVI) provides education loan servicing and business processing solutions that help manage federal student loans, private education loans, and government services.

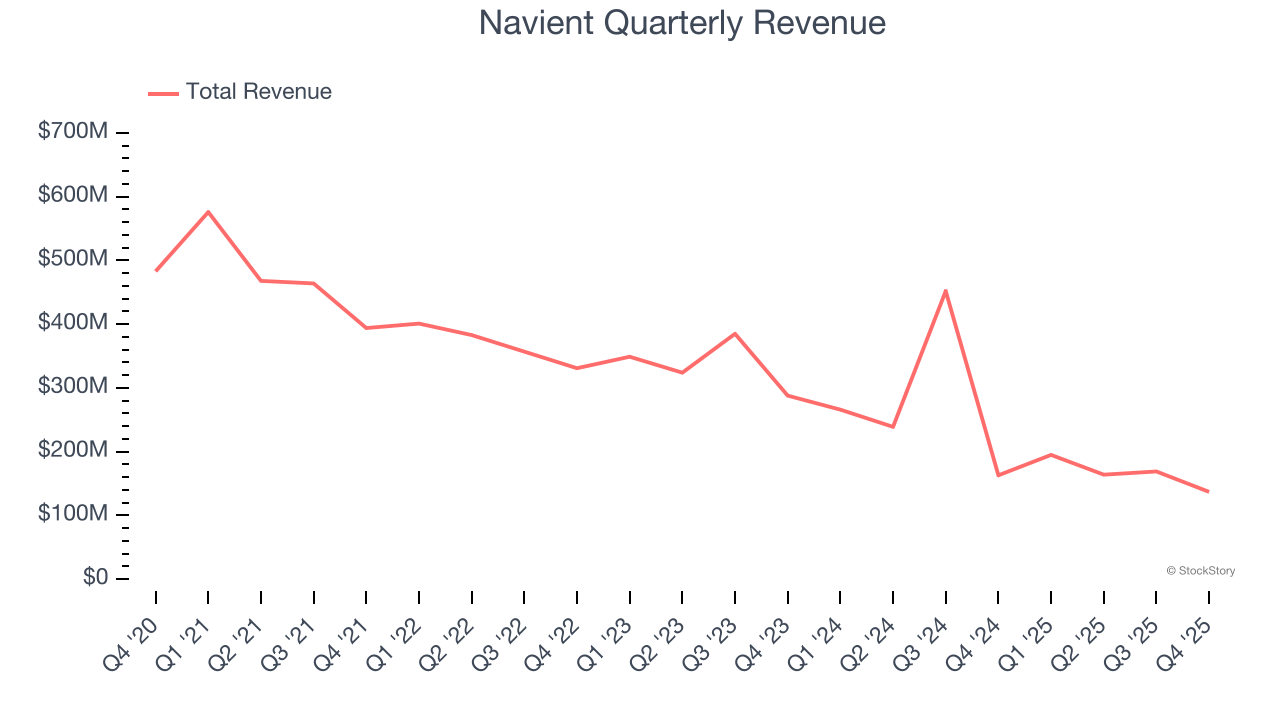

Revenue Growth

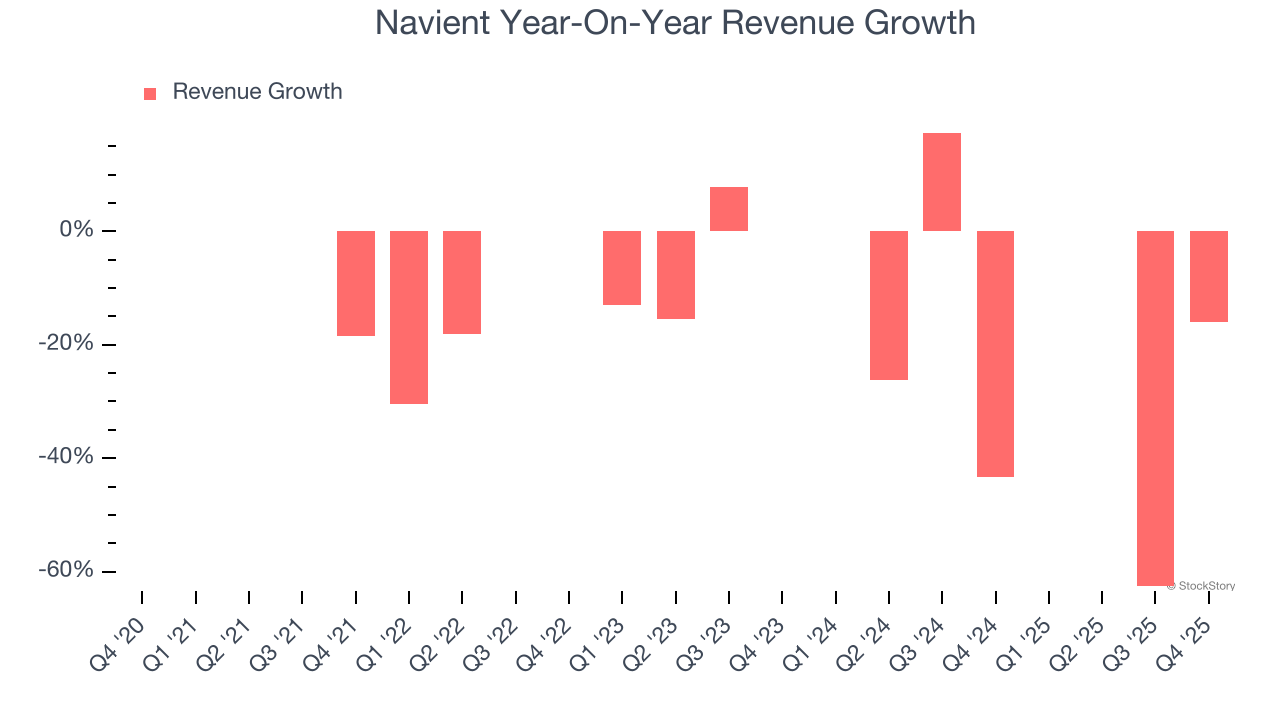

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Navient struggled to consistently generate demand over the last five years as its revenue dropped at a 19.3% annual rate. This was below our standards and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Navient’s recent performance shows its demand remained suppressed as its revenue has declined by 29.7% annually over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Navient missed Wall Street’s estimates and reported a rather uninspiring 16% year-on-year revenue decline, generating $137 million of revenue.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Key Takeaways from Navient’s Q4 Results

We struggled to find many positives in these results. Its net interest income missed and its revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $12.08 immediately after reporting.

So do we think Navient is an attractive buy at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).