Financial technology provider SEI Investments (NASDAQ: SEIC) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 9.1% year on year to $607.9 million. Its GAAP profit of $1.38 per share was 2.1% above analysts’ consensus estimates.

Is now the time to buy SEI Investments? Find out by accessing our full research report, it’s free.

SEI Investments (SEIC) Q4 CY2025 Highlights:

- Assets Under Management: $215.9 billion vs analyst estimates of $546.6 billion (13.7% year-on-year growth, 60.5% miss)

- Revenue: $607.9 million vs analyst estimates of $599.4 million (9.1% year-on-year growth, 1.4% beat)

- Pre-tax Profit: $217.1 million (35.7% margin)

- EPS (GAAP): $1.38 vs analyst estimates of $1.35 (2.1% beat)

- Market Capitalization: $10.43 billion

"We closed 2025 with an exceptional fourth quarter, capping one of the strongest years in SEI's history. Q4 results reflect solid revenue growth, margin expansion, and outstanding sales activity across the organization. What's most encouraging is that these results were not reliant on any single business or one-time event, but rather a result of disciplined execution against our strategy and the strength of our integrated enterprise model," said CEO Ryan Hicke.

Company Overview

Founded in 1968 as Simulated Environments Inc. to train bank loan officers using computer simulations, SEI Investments (NASDAQ: SEIC) provides technology platforms, investment management, and operational solutions for financial institutions, wealth managers, and investors.

Revenue Growth

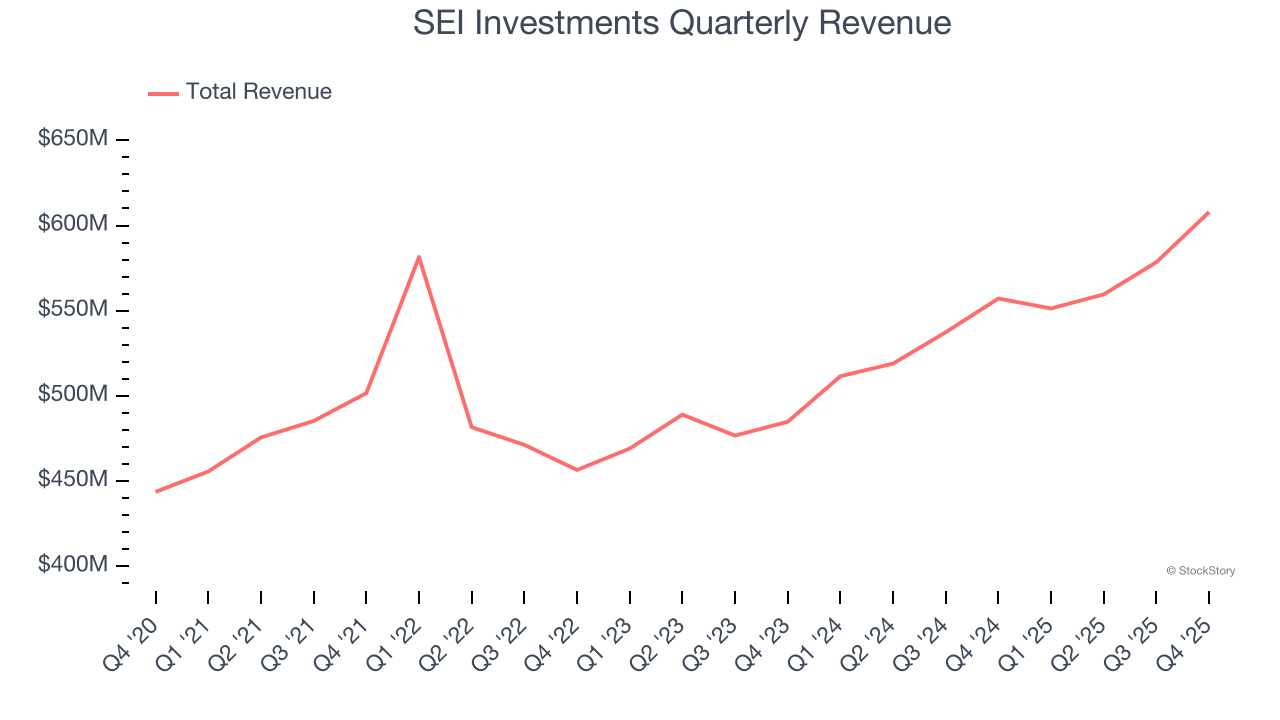

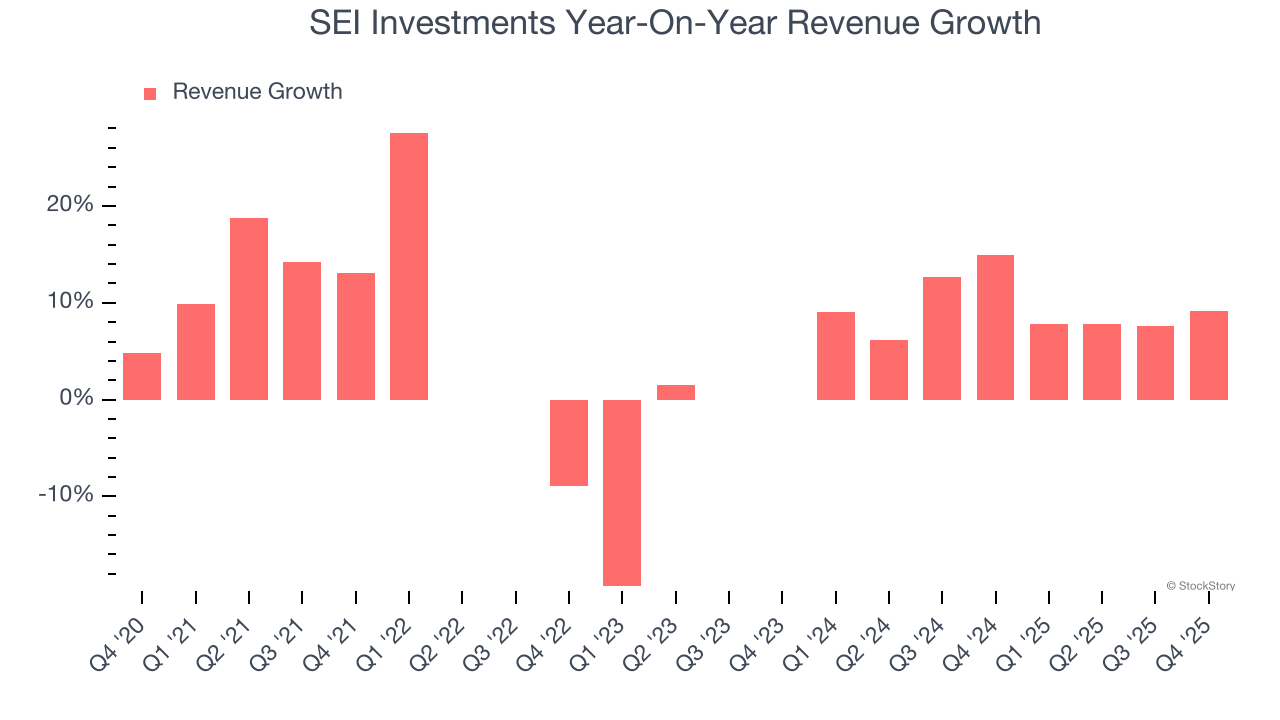

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, SEI Investments grew its revenue at a mediocre 6.4% compounded annual growth rate. This wasn’t a great result compared to the rest of the financials sector, but there are still things to like about SEI Investments.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. SEI Investments’s annualized revenue growth of 9.4% over the last two years is above its five-year trend, suggesting some bright spots.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, SEI Investments reported year-on-year revenue growth of 9.1%, and its $607.9 million of revenue exceeded Wall Street’s estimates by 1.4%.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Assets Under Management (AUM)

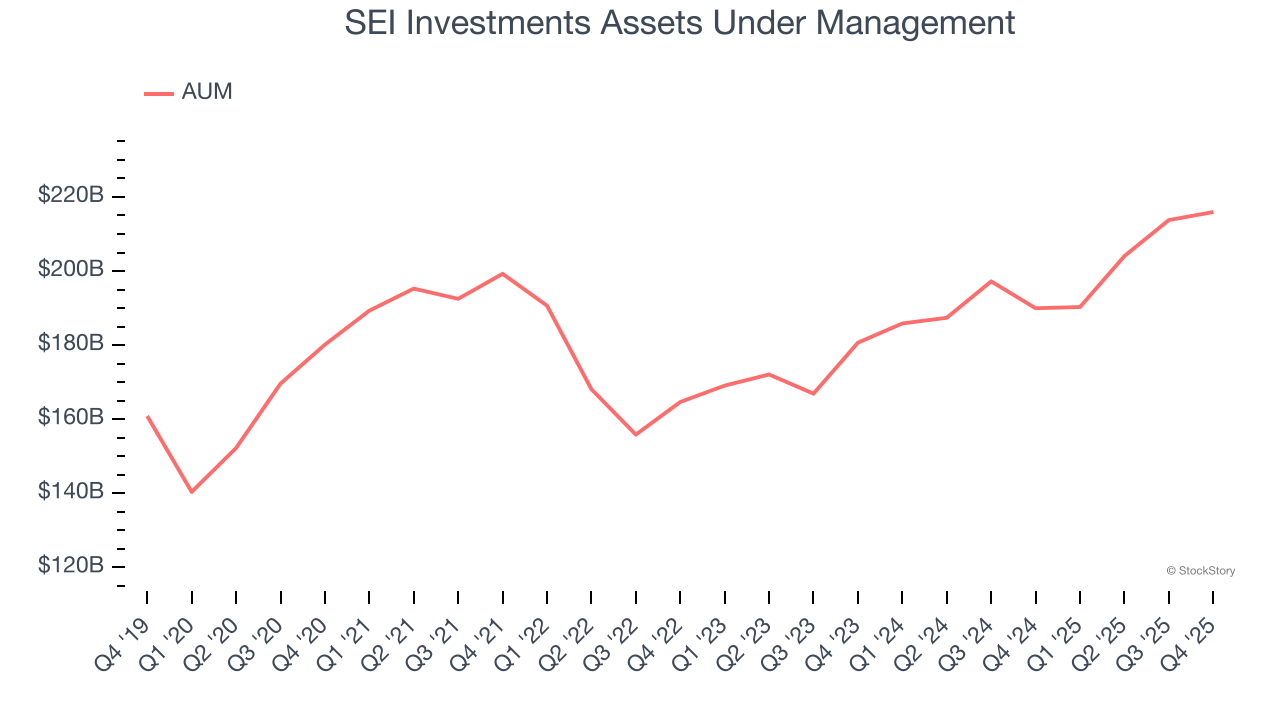

Assets Under Management (AUM) is the cornerstone of a financial firm's investment division, representing all client capital under its stewardship. Management fees on this AUM create reliable, recurring revenue that maintains stability even when investment performance struggles, though prolonged poor returns can eventually affect asset retention and growth.

SEI Investments’s AUM has grown at an annual rate of 5.1% over the last five years, worse than the broader financials industry and slower than its total revenue. When analyzing SEI Investments’s AUM over the last two years, we can see that growth accelerated to 9.4% annually. This performance aligned with its total revenue.

In Q4, SEI Investments’s AUM was $215.9 billion, falling 60.5% short of analysts’ expectations. This print was 13.7% higher than the same quarter last year.

Key Takeaways from SEI Investments’s Q4 Results

It was good to see SEI Investments narrowly top analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its AUM missed. Overall, this print had some key positives. The stock remained flat at $85.97 immediately after reporting.

Is SEI Investments an attractive investment opportunity right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).