Flutter Entertainment has gotten torched over the last six months - since August 2025, its stock price has dropped 57.7% to $124.31 per share. This might have investors contemplating their next move.

Is now the time to buy Flutter Entertainment, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think Flutter Entertainment Will Underperform?

Even though the stock has become cheaper, we don't have much confidence in Flutter Entertainment. Here are three reasons there are better opportunities than FLUT and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

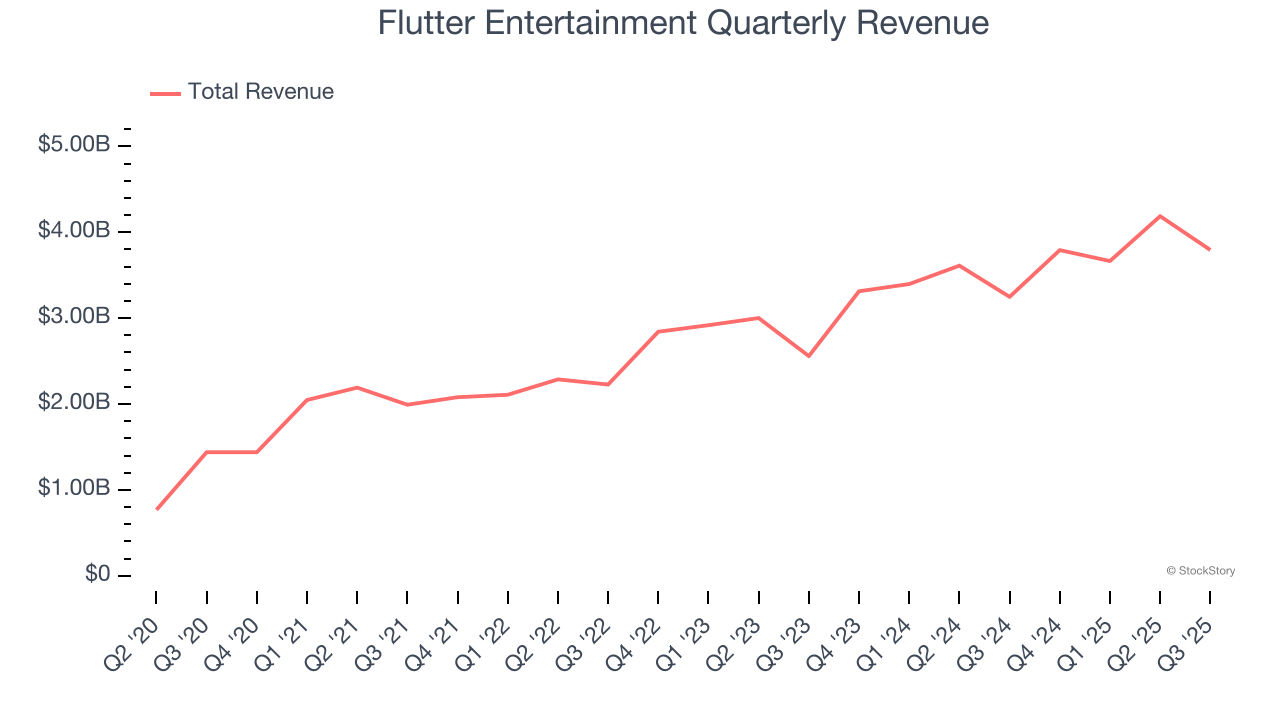

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Flutter Entertainment grew its sales at a 29.3% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

2. Projected Free Cash Flow Gains to Pump Profits

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Over the next year, analysts predict Flutter Entertainment’s cash conversion will slightly improve. Their consensus estimates imply its free cash flow margin of 5.4% for the last 12 months will increase to 7.5%, it options for capital deployment (investments, share buybacks, etc.).

3. New Investments Bear Fruit as ROIC Jumps

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Flutter Entertainment’s ROIC increased by 2 percentage points annually each year over the last few years. This is a good sign, and we hope the company can continue improving.

Final Judgment

We see the value of companies helping consumers, but in the case of Flutter Entertainment, we’re out. Following the recent decline, the stock trades at 16.2× forward P/E (or $124.31 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are more exciting stocks to buy at the moment. We’d recommend looking at one of our top software and edge computing picks.

Stocks We Like More Than Flutter Entertainment

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.