Lab services company Charles River Laboratories (NYSE: CRL) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, but sales were flat year on year at $994.2 million. Its non-GAAP profit of $2.39 per share was 1.9% above analysts’ consensus estimates.

Is now the time to buy Charles River Laboratories? Find out by accessing our full research report, it’s free.

Charles River Laboratories (CRL) Q4 CY2025 Highlights:

- Revenue: $994.2 million vs analyst estimates of $980.9 million (flat year on year, 1.4% beat)

- Adjusted EPS: $2.39 vs analyst estimates of $2.35 (1.9% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $10.95 at the midpoint, beating analyst estimates by 0.6%

- Operating Margin: -28.5%, down from -16.7% in the same quarter last year

- Free Cash Flow Margin: 8.9%, similar to the same quarter last year

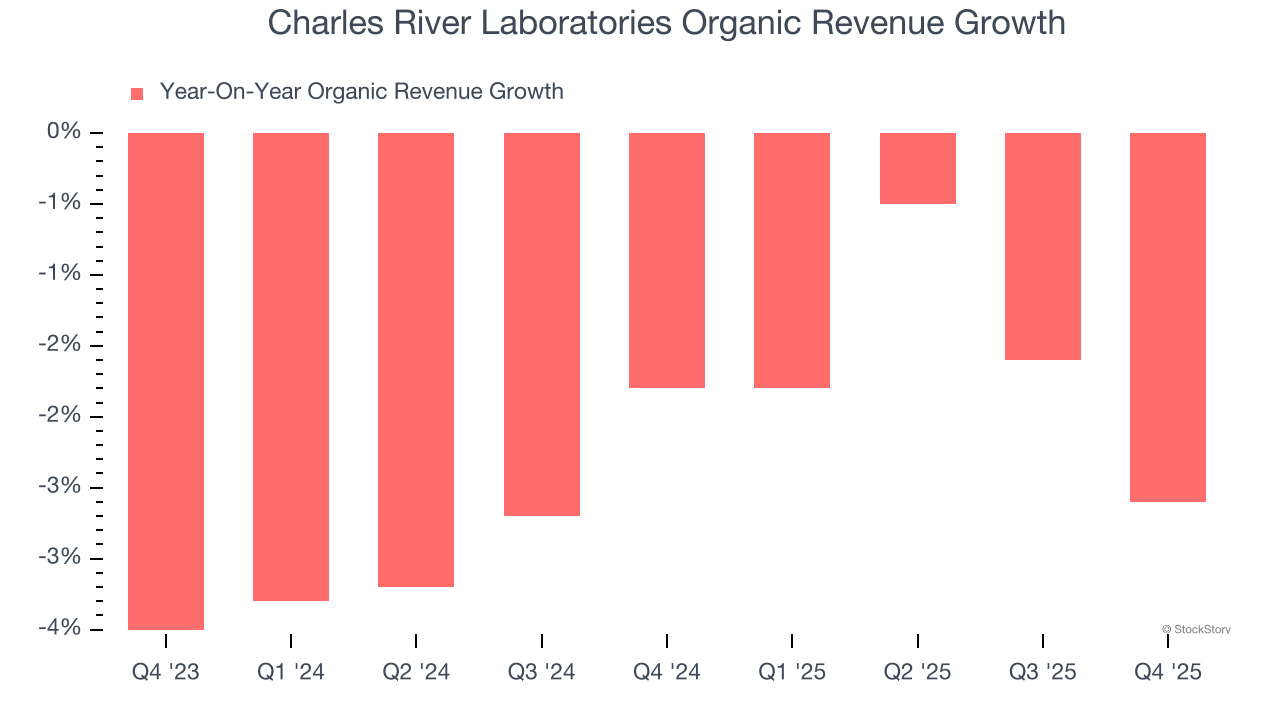

- Organic Revenue fell 2.6% year on year (beat)

- Market Capitalization: $7.80 billion

James C. Foster, Chair, President and Chief Executive Officer, said, “We were pleased with our 2025 financial results, including substantial improvement in DSA net bookings in the fourth quarter that demonstrates the stabilization of the biopharmaceutical demand environment. We are making significant progress on several strategic initiatives that will enable the Company to better capitalize on future growth opportunities, and we remain intently focused on scientific innovation that will reinforce our position as the leader in preclinical drug development."

Company Overview

Named after the Massachusetts river where it was founded in 1947, Charles River Laboratories (NYSE: CRL) provides non-clinical drug development services, research models, and manufacturing support to pharmaceutical and biotechnology companies.

Revenue Growth

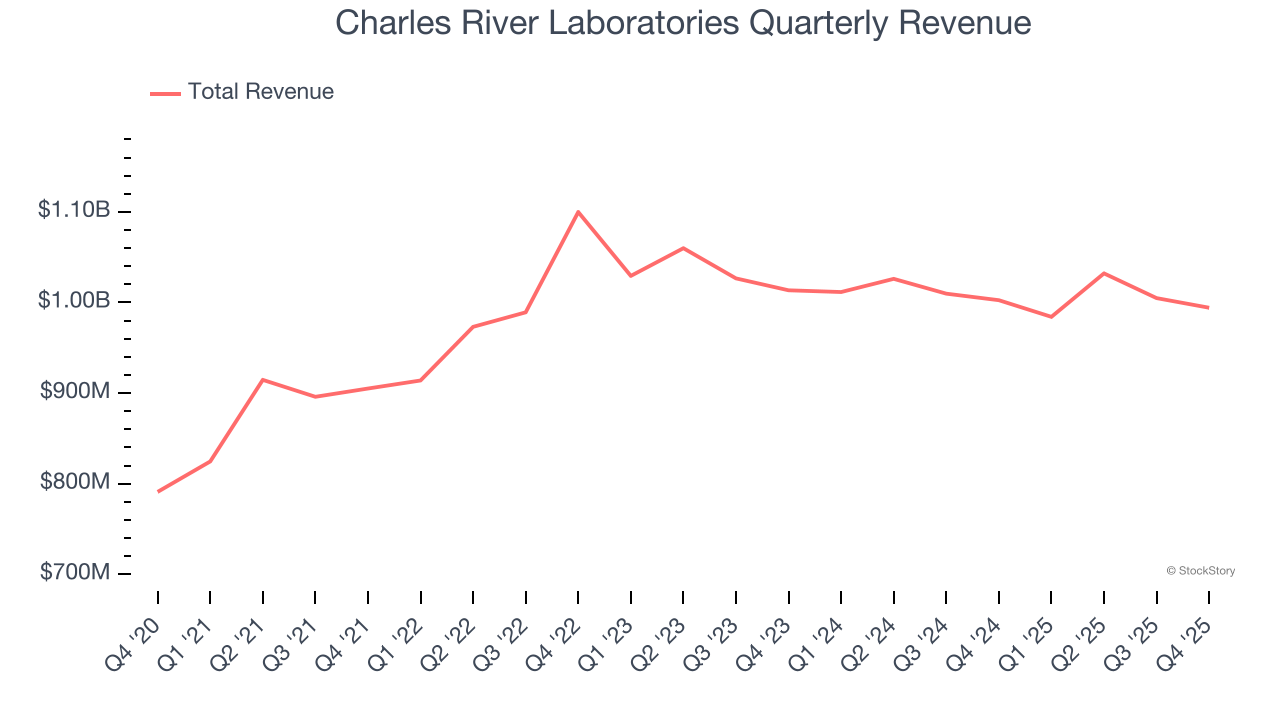

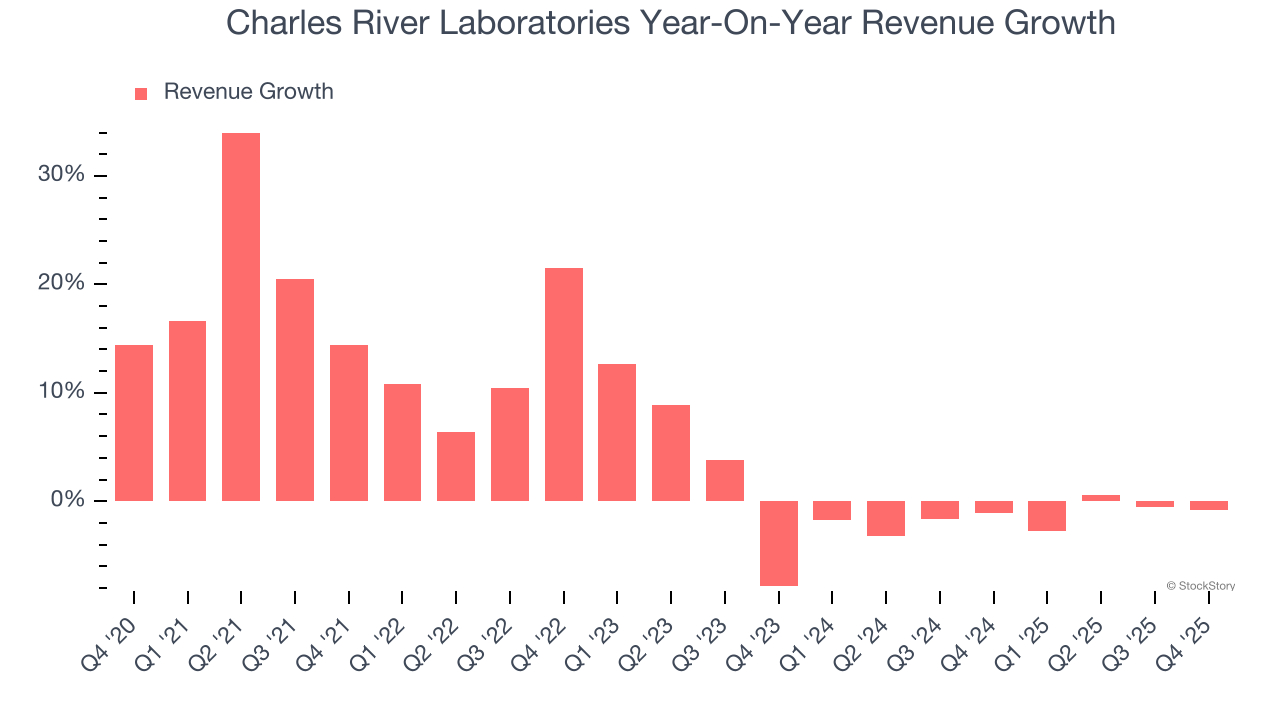

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Charles River Laboratories’s 6.5% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the healthcare sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Charles River Laboratories’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.4% annually.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Charles River Laboratories’s organic revenue averaged 2.2% year-on-year declines. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Charles River Laboratories’s $994.2 million of revenue was flat year on year but beat Wall Street’s estimates by 1.4%.

Looking ahead, sell-side analysts expect revenue to grow 1.5% over the next 12 months. While this projection implies its newer products and services will fuel better top-line performance, it is still below average for the sector.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

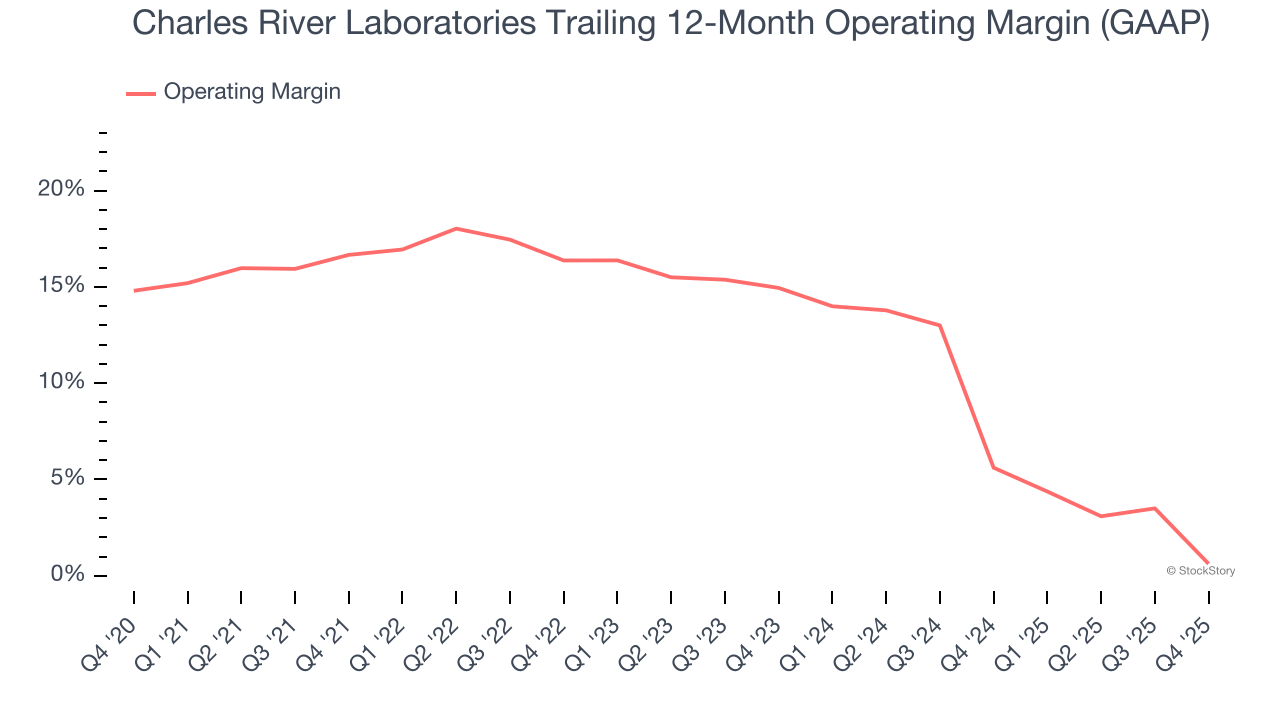

Charles River Laboratories has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 10.7%, higher than the broader healthcare sector.

Analyzing the trend in its profitability, Charles River Laboratories’s operating margin decreased by 16 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 14.3 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Charles River Laboratories generated an operating margin profit margin of negative 28.5%, down 11.8 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

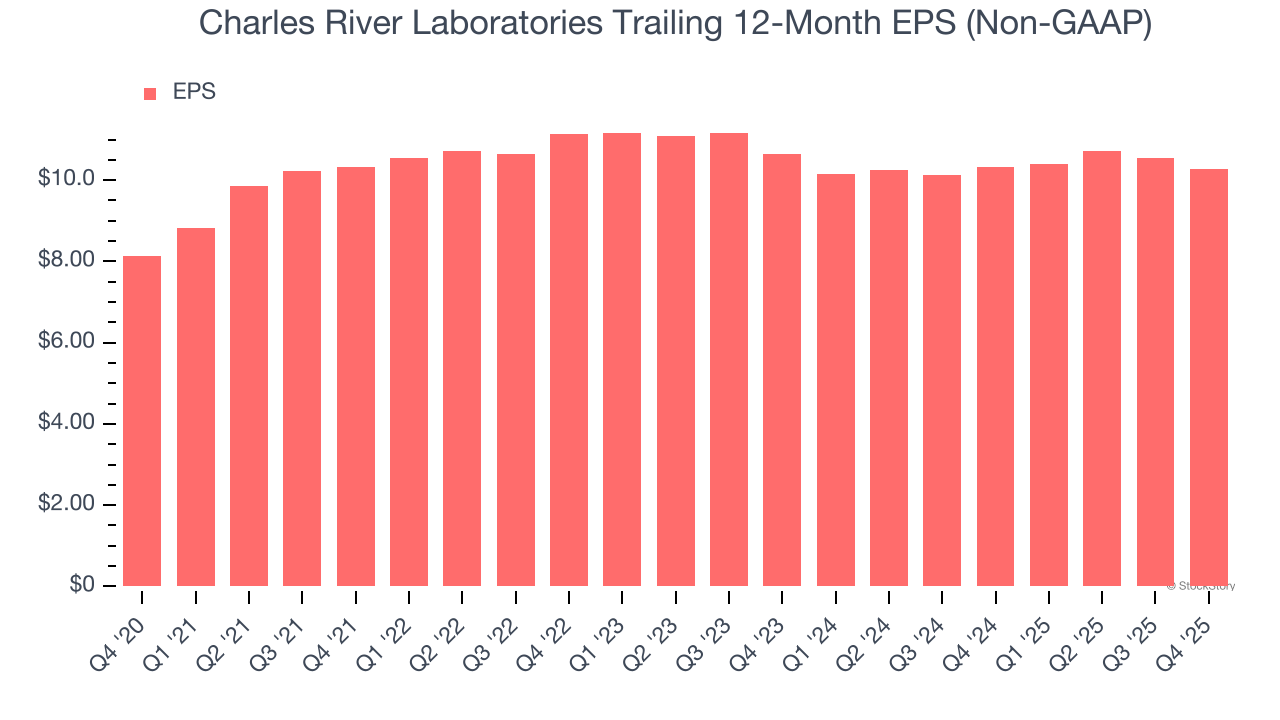

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Charles River Laboratories’s unimpressive 4.8% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q4, Charles River Laboratories reported adjusted EPS of $2.39, down from $2.66 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 1.9%. Over the next 12 months, Wall Street expects Charles River Laboratories’s full-year EPS of $10.28 to grow 6%.

Key Takeaways from Charles River Laboratories’s Q4 Results

It was good to see Charles River Laboratories narrowly top analysts’ revenue and EPS expectations this quarter. We were also happy its organic revenue narrowly outperformed Wall Street’s estimates. Looking ahead, EPS guidance was again slightly ahead of expectations. Overall, this print had some key positives. The stock remained flat at $158.00 immediately following the results.

So should you invest in Charles River Laboratories right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).