Over the past six months, AIG’s stock price fell to $74.27. Shareholders have lost 5.1% of their capital, which is disappointing considering the S&P 500 has climbed by 10%. This might have investors contemplating their next move.

Is there a buying opportunity in AIG, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think AIG Will Underperform?

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons there are better opportunities than AIG and a stock we'd rather own.

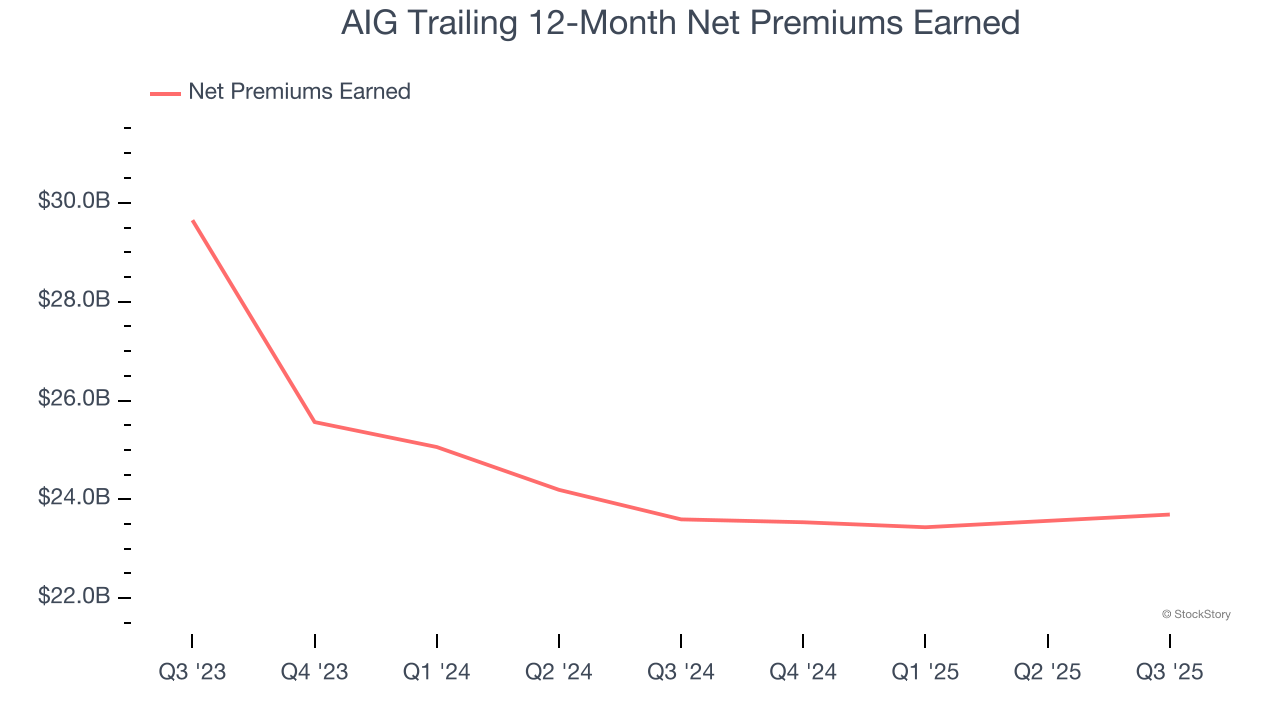

1. Declining Net Premiums Earned Reflect Weakness

Insurers sell policies then use reinsurance (insurance for insurance companies) to protect themselves from large losses. Net premiums earned are therefore what's collected from selling policies less what’s paid to reinsurers as a risk mitigation tool.

AIG’s net premiums earned has declined by 5.8% annually over the last five years, much worse than the broader insurance industry. A silver lining is that policy underwriting outperformed its other business lines.

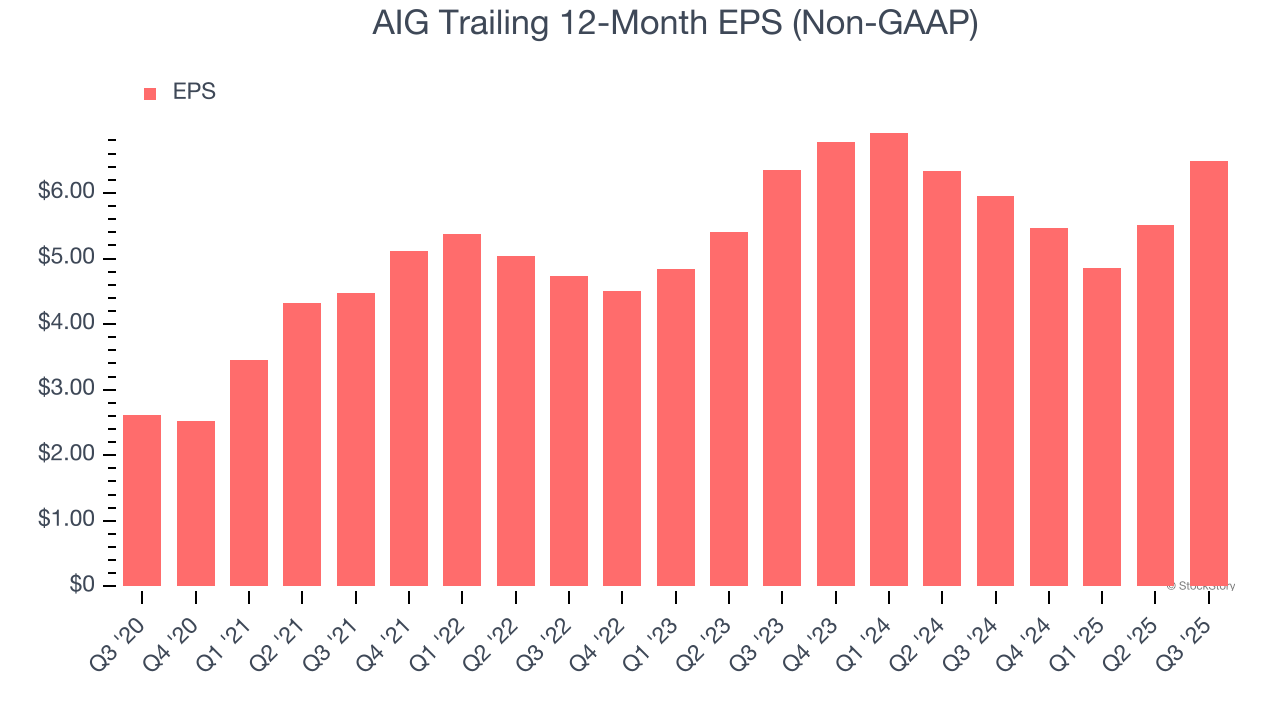

2. Recent EPS Growth Below Our Standards

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

AIG’s EPS grew at a weak 1% compounded annual growth rate over the last two years. On the bright side, this performance was higher than its 10.6% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

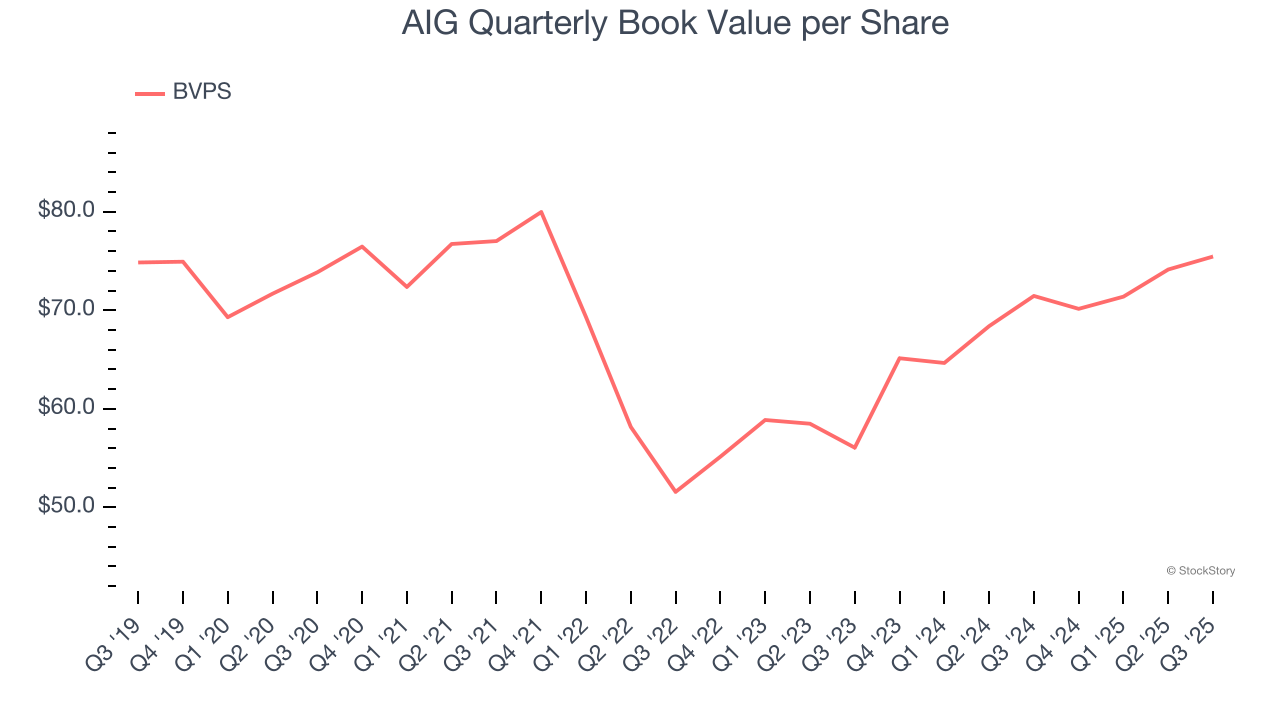

3. Steady Increase in BVPS Highlights Solid Asset Growth

For insurers, book value per share (BVPS) is a vital measure of financial health, representing the total assets available to shareholders after accounting for all liabilities, including policyholder reserves and claims obligations.

Although AIG’s BVPS was flat over the last five years. the good news is that its growth has recently accelerated as BVPS grew at a solid 16% annual clip over the past two years (from $56.06 to $75.46 per share).

Final Judgment

We see the value of companies helping consumers, but in the case of AIG, we’re out. After the recent drawdown, the stock trades at 1× forward P/B (or $74.27 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better stocks to buy right now. We’d recommend looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of AIG

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.