Tax preparation company H&R Block (NYSE: HRB) announced better-than-expected revenue in Q4 CY2025, with sales up 11.1% year on year to $198.9 million. The company expects the full year’s revenue to be around $3.89 billion, close to analysts’ estimates. Its non-GAAP loss of $1.84 per share was 2.8% above analysts’ consensus estimates.

Is now the time to buy H&R Block? Find out by accessing our full research report, it’s free.

H&R Block (HRB) Q4 CY2025 Highlights:

- Revenue: $198.9 million vs analyst estimates of $185.2 million (11.1% year-on-year growth, 7.4% beat)

- Adjusted EPS: -$1.84 vs analyst estimates of -$1.89 (2.8% beat)

- Adjusted EBITDA: -$265.8 million (-134% margin, 1.7% year-on-year decline)

- The company reconfirmed its revenue guidance for the full year of $3.89 billion at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $4.93 at the midpoint

- EBITDA guidance for the full year is $1.03 billion at the midpoint, in line with analyst expectations

- Operating Margin: -161%, up from -164% in the same quarter last year

- Free Cash Flow was -$649.5 million compared to -$597.4 million in the same quarter last year

- Market Capitalization: $4.90 billion

"Across the business, we've made tangible improvements this season, whether receiving assistance from a tax professional or filing using our award-winning online tax product," said Curtis Campbell, president and chief executive officer.

Company Overview

Founded in 1955 by brothers Henry W. Bloch and Richard A. Bloch, H&R Block (NYSE: HRB) is a tax preparation company offering professional tax assistance and financial solutions to individuals and small businesses.

Revenue Growth

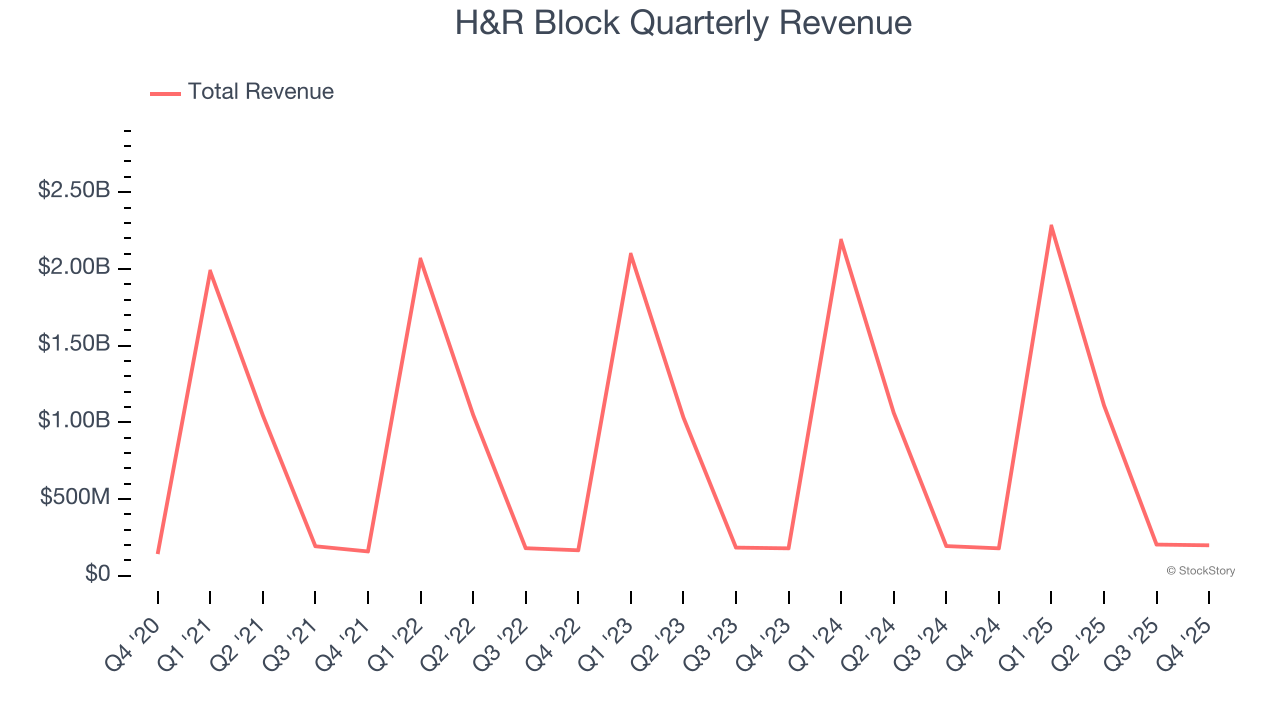

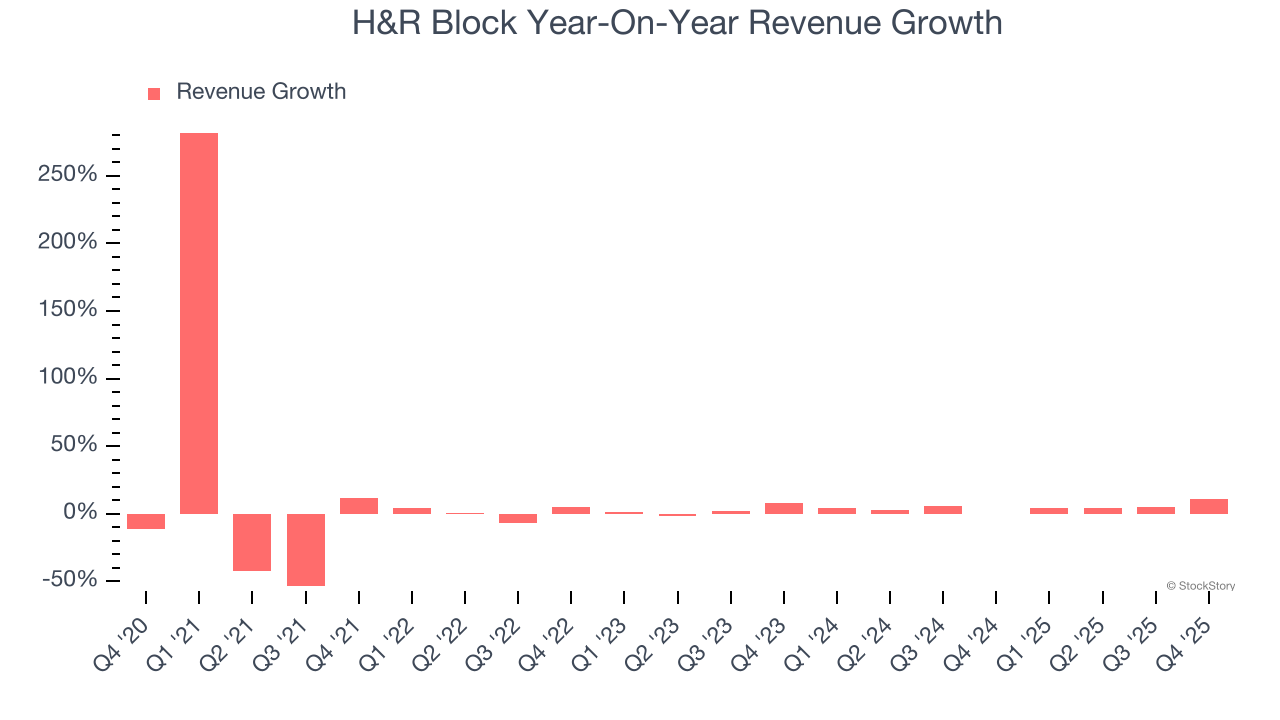

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, H&R Block grew its sales at a weak 5.6% compounded annual growth rate. This fell short of our benchmark for the consumer discretionary sector and is a poor baseline for our analysis. We note H&R Block is a seasonal business because it generates most of its revenue during tax season, so the charts in our report will look a bit lumpy.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. H&R Block’s recent performance shows its demand has slowed as its annualized revenue growth of 4.2% over the last two years was below its five-year trend.

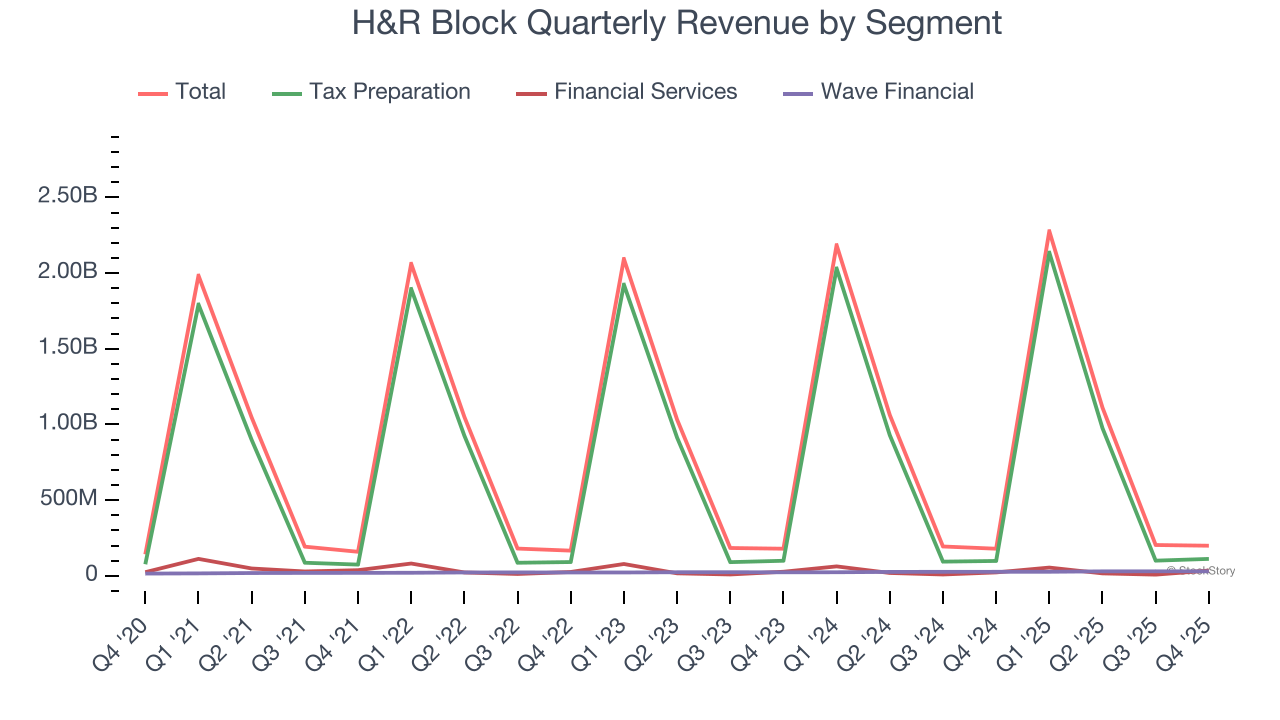

We can dig further into the company’s revenue dynamics by analyzing its three most important segments: Tax Preparation, Financial Services, and Wave Financial, which are 56.2%, 17.5%, and 15% of revenue. Over the last two years, H&R Block’s Tax Preparation (DIY, assisted, add-on services) and Wave Financial (business software) revenues averaged 5.1% and 11.7% year-on-year growth while its Financial Services revenue (Emerald Card, Spruce, interest income) was flat.

This quarter, H&R Block reported year-on-year revenue growth of 11.1%, and its $198.9 million of revenue exceeded Wall Street’s estimates by 7.4%.

Looking ahead, sell-side analysts expect revenue to grow 3% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its products and services will see some demand headwinds.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

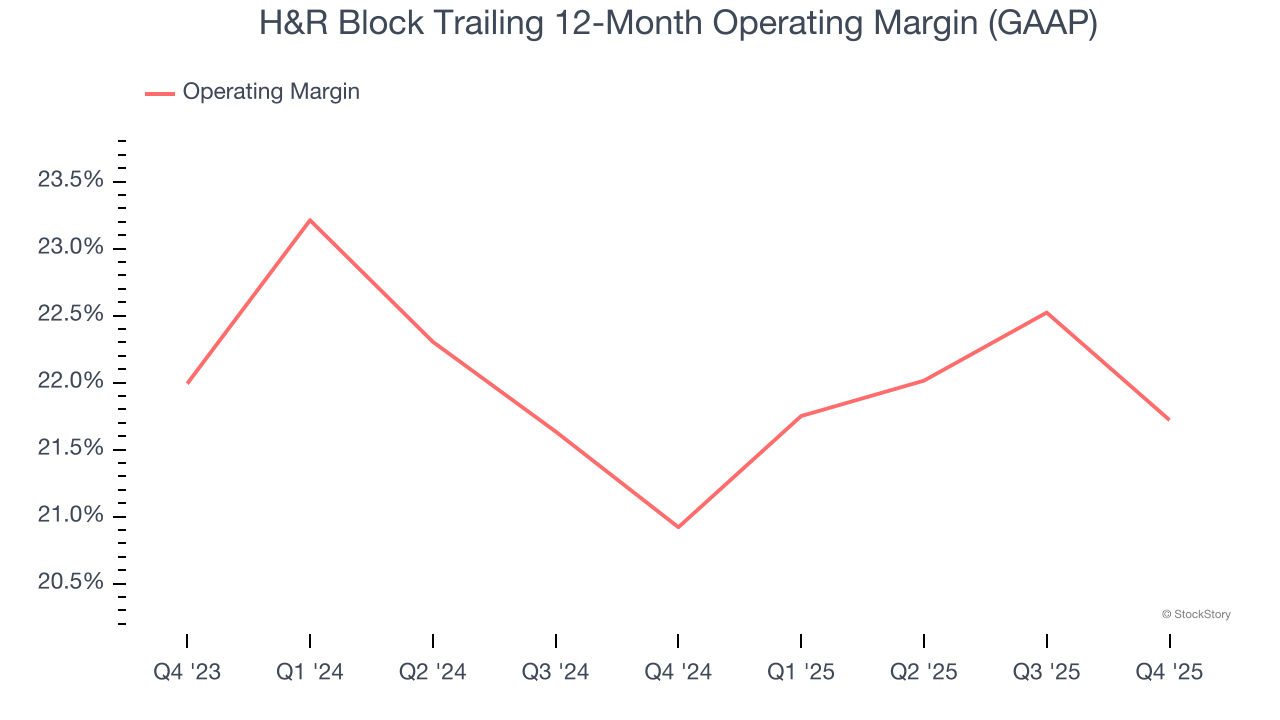

H&R Block’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 21.3% over the last two years. This profitability was lousy for a consumer discretionary business and caused by its suboptimal cost structure.

In Q4, H&R Block generated an operating margin profit margin of negative 161%, up 3.3 percentage points year on year. Because H&R Block is a seasonal business, we prefer to analyze longer-term performance rather than one quarter.

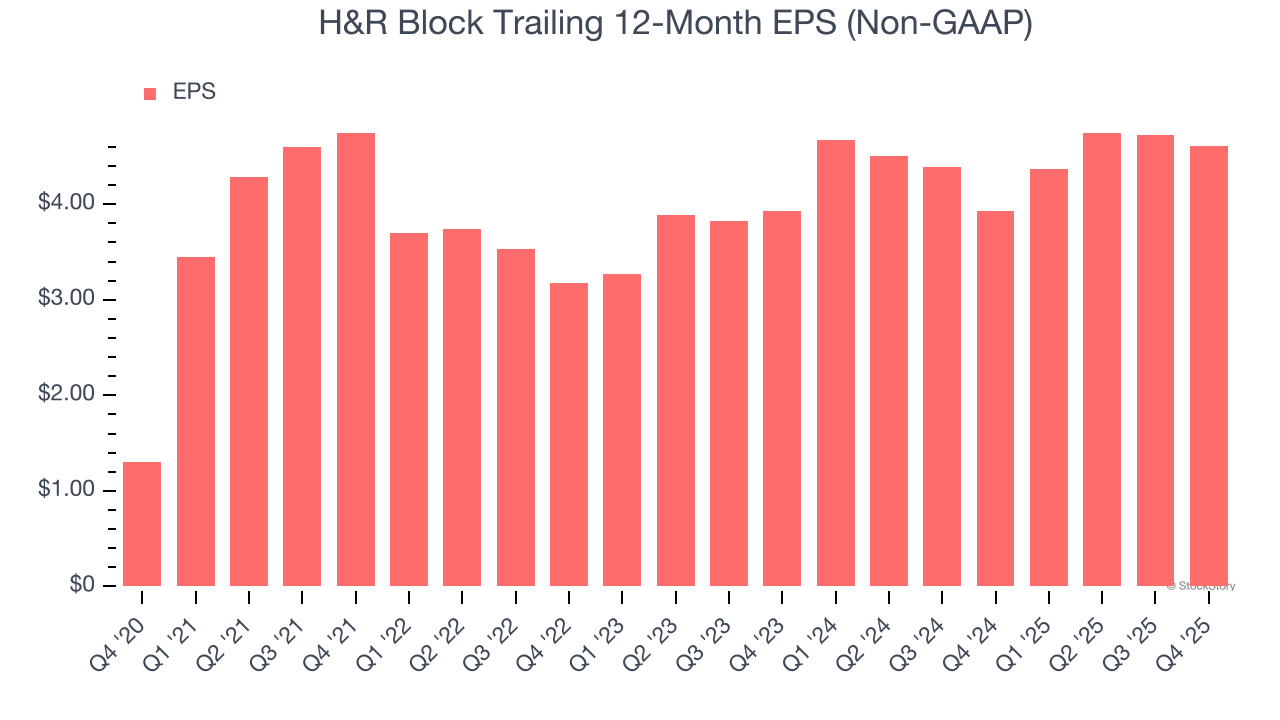

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

H&R Block’s EPS grew at an unimpressive 28.8% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 5.6% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

In Q4, H&R Block reported adjusted EPS of negative $1.84, down from negative $1.73 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 2.8%. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from H&R Block’s Q4 Results

We were impressed by how significantly H&R Block blew past analysts’ Financial Services revenue expectations this quarter. We were also glad its revenue and EPS outperformed Wall Street’s estimates. On the other hand, its Wave Financial revenue missed. Overall, this print had some key positives. The stock traded up 1.2% to $37.64 immediately after reporting.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).