Online learning platform Coursera (NYSE: COUR) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 9.9% year on year to $196.9 million. Guidance for next quarter’s revenue was optimistic at $195 million at the midpoint, 2.5% above analysts’ estimates. Its non-GAAP profit of $0.06 per share was in line with analysts’ consensus estimates.

Is now the time to buy Coursera? Find out by accessing our full research report, it’s free.

Coursera (COUR) Q4 CY2025 Highlights:

- On December 17, 2025, Coursera and Udemy, Inc. (NASDAQ: UDMY) entered into a definitive merger agreement pursuant to which Coursera will combine with Udemy in an all-stock transaction. The transaction has been unanimously approved by the Boards of Directors of both Coursera and Udemy. The transaction is subject to the receipt of required regulatory approvals, approval by Coursera and Udemy shareholders, and the satisfaction of other customary closing conditions.

- Revenue: $196.9 million vs analyst estimates of $191.7 million (9.9% year-on-year growth, 2.7% beat)

- Adjusted EPS: $0.06 vs analyst estimates of $0.06 (in line)

- Adjusted EBITDA: $11.2 million vs analyst estimates of $9.05 million (5.7% margin, 23.7% beat)

- Revenue Guidance for Q1 CY2026 is $195 million at the midpoint, above analyst estimates of $190.2 million

- EBITDA guidance for Q1 CY2026 is $13 million at the midpoint, below analyst estimates of $19.01 million

- Operating Margin: -16.4%, in line with the same quarter last year

- Free Cash Flow was -$2 million, down from $26.6 million in the previous quarter

- Market Capitalization: $1.02 billion

“We closed 2025 with strong execution across the business, delivering $757 million in revenue and expanding operating leverage as we continue to strengthen Coursera’s foundation for long-term growth,” said Coursera CEO Greg Hart.

Company Overview

Founded by two Stanford University computer science professors, Coursera (NYSE: COUR) is an online learning platform that offers courses, specializations, and degrees from top universities and organizations around the world.

Revenue Growth

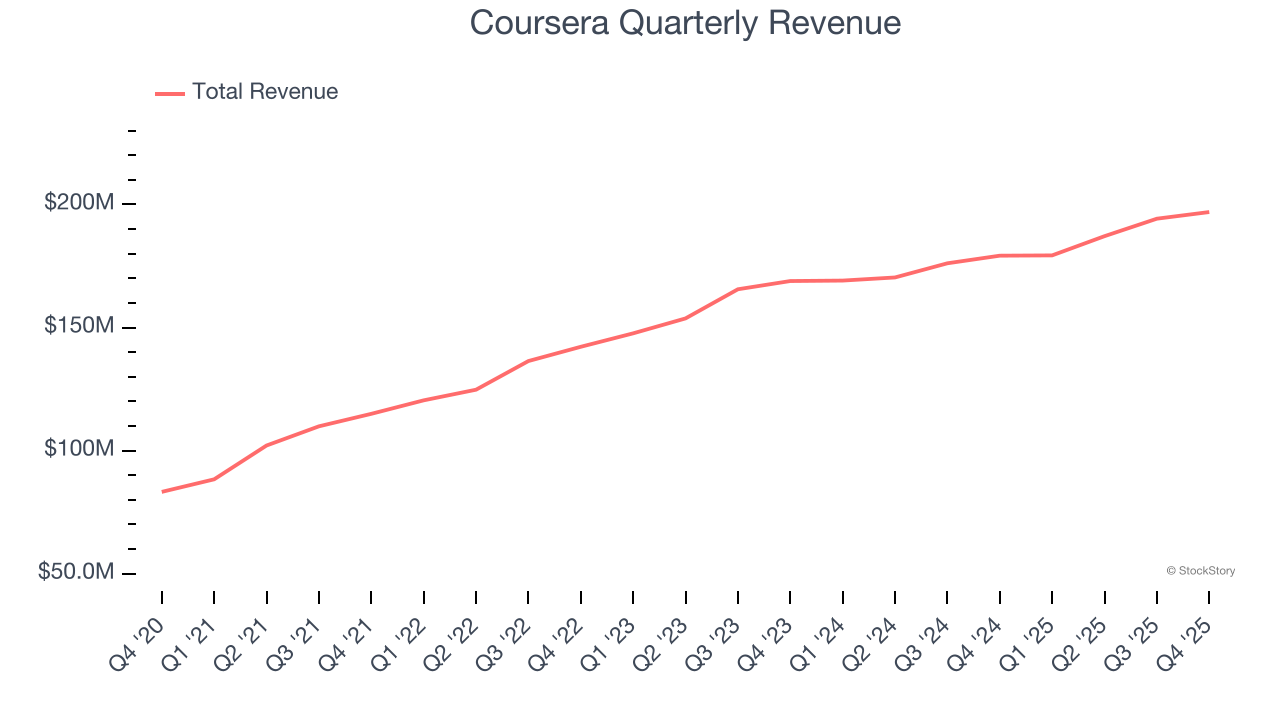

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Coursera’s 13.1% annualized revenue growth over the last three years was decent. Its growth was slightly above the average consumer internet company and shows its offerings resonate with customers.

This quarter, Coursera reported year-on-year revenue growth of 9.9%, and its $196.9 million of revenue exceeded Wall Street’s estimates by 2.7%. Company management is currently guiding for a 8.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and implies its products and services will face some demand challenges.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Cash Is King

Although EBITDA is undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

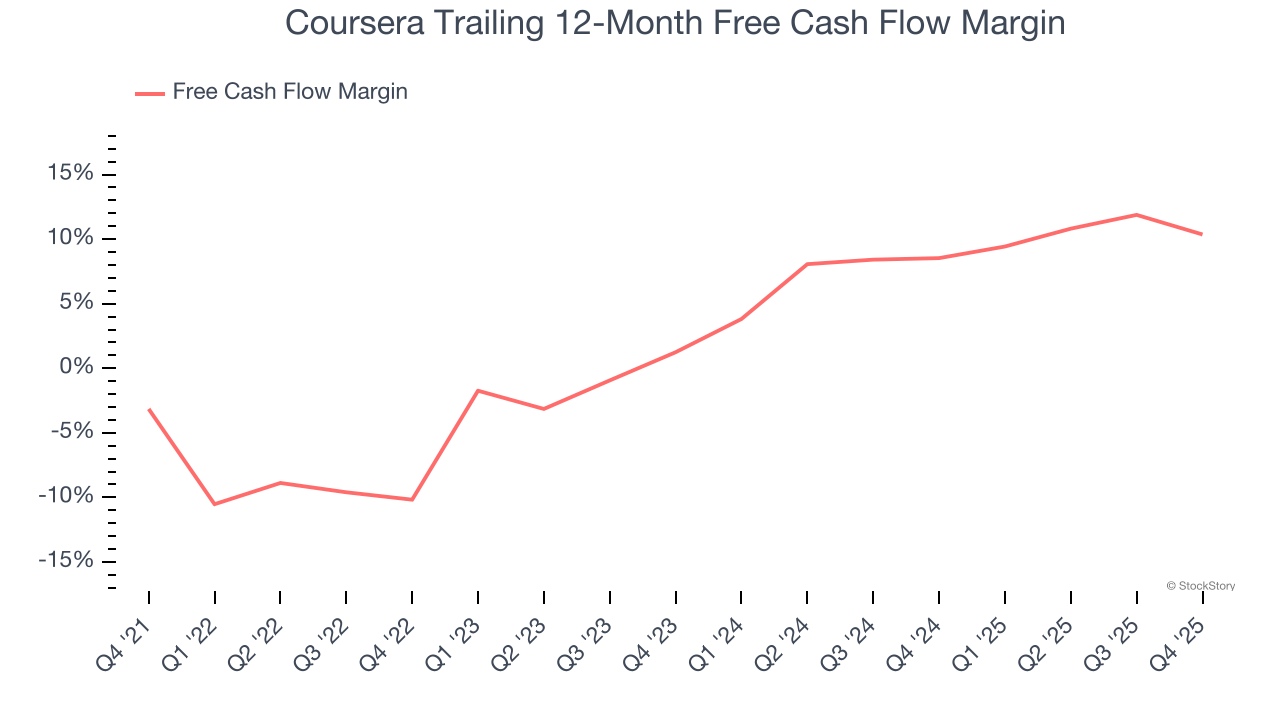

Coursera has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 9.5% over the last two years, better than the broader consumer internet sector.

Taking a step back, we can see that Coursera’s margin expanded by 20.5 percentage points over the last few years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Coursera burned through $2 million of cash in Q4, equivalent to a negative 1% margin. The company’s cash flow turned negative after being positive in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Key Takeaways from Coursera’s Q4 Results

We were impressed by how significantly Coursera blew past analysts’ EBITDA expectations this quarter. We were also glad its revenue guidance for next quarter exceeded Wall Street’s estimates. On the other hand, its EBITDA guidance for next quarter missed. Overall, this print had some key positives. The stock traded up 3.2% to $6.17 immediately after reporting.

On December 17, 2025, Coursera and Udemy, Inc. (NASDAQ: UDMY) entered into a definitive merger agreement pursuant to which Coursera will combine with Udemy in an all-stock transaction. The transaction has been unanimously approved by the Boards of Directors of both Coursera and Udemy. The transaction is subject to the receipt of required regulatory approvals, approval by Coursera and Udemy shareholders, and the satisfaction of other customary closing conditions.

Should you buy the stock or not? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).