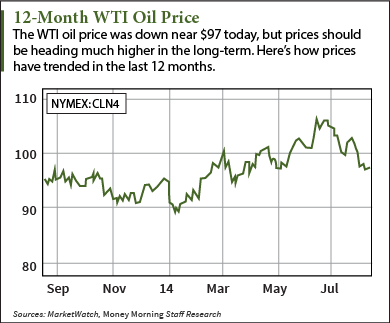

WTI oil prices were down this morning (Wednesday) to a low of $97.06 for September contracts, after the Energy Information Administration (EIA) reduced its 2014 price forecast yesterday.

Citing increased oil production in the United States, the EIA dropped its 2014 forecast for WTI oil prices to $100.45 per barrel. In July, the EIA had projected a price of $100.98 per barrel.

Citing increased oil production in the United States, the EIA dropped its 2014 forecast for WTI oil prices to $100.45 per barrel. In July, the EIA had projected a price of $100.98 per barrel.

The EIA also lowered its forecast on Brent crude from $109.55 to $108.11 for the rest of 2014.

According to the EIA, crude production in the United States is expected to reach 8.46 million barrels per day by the end of 2014 and 9.28 million per day in 2015. That's the nation's highest average in 42 years.

At the same time, global demand is expected to drop slightly. In July, worldwide demand was at 91.62 million barrels per day. The EIA expects global demand to average 91.56 million barrels a day for the rest of the year.

High U.S. production is also why oil prices have dipped this month. The WTI oil price has been steadily declining since hitting a high of $106.64. At the time, the crisis in Iraq escalated rapidly and oil traders flooded the market with buy orders. Since then, the conflict in Iraq has been contained mostly to the northern part of the country and parts of Syria.

The southern region of Iraq is responsible for the country's exports and has been unaffected so far by ISIS (Islamic State of Iraq and Syria) militants.

The fact that Iraq's export region has yet to be hit with the crisis has led to a price correction from June's inflated highs, and yesterday's report of increased U.S. production and decreased global demand further deflated the WTI oil price.

But according to Money Morning's Global Energy Strategist Dr. Kent Moors, oil prices will be heading much higher in the long term, despite the short-term outlook of the EIA...

Why the WTI Oil Price Is Headed Much HigherThe price jump over $106 a barrel in June was not surprising at all, given the geopolitical landscape of the Middle East.

"Whenever a conflict occurs in an oil-producing country, oil prices rise," said Moors. "It's one of the most predictable patterns in the markets."

That's exactly what happened in June and July when prices spiked. But just because prices have settled doesn't mean the concern is over...

Iraq has been embroiled in political and military discord for decades, but the current situation is very different from any conflict that has come before. This crisis in Iraq is a religious war, between the Sunni militants and Shiite Muslims.

It's a humanitarian crisis that spans political, religious, and territorial borders.

Even with the export region untouched so far, "the price of oil will continue to rise in the long run, simply out of fear and uncertainty," Moors said."It is merely the fear of disrupted supply that causes the risk premium on oil to rise."

Much of northern Iraq - including the country's second-largest city, Mosul - has been overrun by ISIS. It's estimated that the area captured by ISIS militants contributes 15% of Iraq's total oil production.

That 15% may not affect exports at the moment, but it does weight heavily on Iraq's total production.

"Right now, Iraq accounts for 4% of the world's global oil production," Moors continued." That may not seem like a big percentage. But a complete loss of Iraqi production would spike the world oil price up to at least $200 per barrel in a heartbeat."

"If even just a third of Iraq's oil production went offline, former military leaders and energy experts warn that crude oil prices will go up an additional $40 per barrel," Moors said.

Instead, traders and analysts keep pointing to the untouched southern region as a reason oil prices will remain low. According to Moors, they're all missing the point.

"ISIS does not have to control a single well in southern Iraq to be able to impact the price," Moors said. "All they have to do is immobilize the government in Baghdad. Without central administrative control, the western majors running those fields in the south really don't know what they're supposed to be doing next and that's really the political vice that's being created here."

"So without controlling any fields whatsoever, prices are going to begin to feel the impact merely because of the political instability that's taking place in the capital."

Editor's Note: Now, according to Dr. Moors, the chaos in the Middle East is about to "go global." As you'll see, a select group of companies is set to benefit in a very big and unique way.

To get the full report, including what it means for your money, go here.

Related Articles:

- CNN Money: Iraq Crisis: Why Aren't Gas Prices Spiking

The post WTI Oil Prices Down This Week, But Headed Much Higher Long-Term appeared first on Money Morning - Only the News You Can Profit From.