To hear some analysts tell it, geopolitics and the weather are exogenous events when it comes to energy prices.

That is, somehow crude oil prices would operate quite "rationally" if it weren't for either of them.

According to these guys, supply and demand is what drives the market, and from time to time these "outside elements" only muddle things up.

Well, I hate to break it to them, but there hasn't been a "normal" market for some time now.

To assume that Mother Nature dumping snow, Vladimir Putin misplacing his army somewhere in Ukraine, and/or the Middle East falling into chaos are just one-off occurrences is simply not rational.

That type of thinking can be costly. Plain and simple, when energy investors disregard the weather, the geopolitical, or both, they lose money.

So as we begin the fourth quarter, I'm going to handicap where oil prices are likely headed next...

Where Crude Oil Prices Go From Here When it comes to crude oil prices, geopolitical events will have the widest sway.

When it comes to crude oil prices, geopolitical events will have the widest sway.

Despite the fact that North America is rapidly approaching self-sufficiency, thanks to tight and shale oil reserves, oil remains in an integrated global market.

As such, events abroad will still impact U.S. prices regardless of how much more oil is added to the domestic market from local drilling. And remember, the cross-border trade in oil is also directly affected by flows from both ends (the raw crude produced and the processed volume). U.S. refineries just happen to have become the largest exporters of refined oil products in the world.

As a result, crisis situations will continue to weigh on the oil market, even here at home.

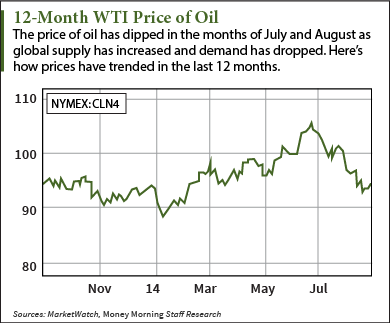

As it stands, the crises in both Ukraine and Iraq have been discounted by traders because of the time of year and the adequate supply. Traditionally, August and September are the months when oil demand lags.

Even the unraveling in Libya, and the cut-off of its supply, hasn't been enough to send oil prices higher.

This will certainly change, but absent a major geopolitical collapse, I just don't foresee a rapid jump in crude oil prices. The key here, however, is this:

It's what I see as the pricing floor.

As I write this, West Texas Intermediate (WTI) is trading in New York at about $96 a barrel; Brent in London at $103. Those levels will likely be the low price through the first quarter of 2015, while the average will likely be closer to $100 for WTI and $106 for Brent.

As I write this, West Texas Intermediate (WTI) is trading in New York at about $96 a barrel; Brent in London at $103. Those levels will likely be the low price through the first quarter of 2015, while the average will likely be closer to $100 for WTI and $106 for Brent.

As for the "standard" market pressures, global oil supply is currently adequate. Yet, should we start to see the projected demand increases expected by OPEC, the International Energy Agency, and the U.S. Energy Information Administration kick in toward the end of the year, there will be some rather noticeable international regional pricing differentials in the oil market.

This won't be because we are running out of oil. I can't emphasize that enough.

Instead, the difference will be caused by the premium certain regions - such as Asia and West Africa (for oil products) - are prepared to pay for needed volume.

Now in these situations, which occasionally do turn into actual supply constrictions, oil trading tends to push up the cost of futures contracts, reflecting the higher prices registered in selected expanding markets.

Remember, contracts in "normal" market trading reflect the expected price of the next available barrel of crude. On the other hand, contracts in "uncertain" markets tend to take their bearings from the expected price of the most expensive next available barrel. This uncertainty will manifest itself in cycles over the next several months.

So all told, on average oil prices have likely formed a base at about where we are now, but will experience periods of higher pricing due to geopolitical events.

So, the world is hardly coming to an end. But it is likely that the energy needed to run it all will continue to increase.

The good news is the cost of the raw materials will continue to be a manageable factor in the overall economic expansion, regardless of what happens in an American off-year election.

Given this scenario, the success of your energy portfolio will revolve around the careful selection of individual companies, partnerships, and exchange-traded funds (ETFs). And as we move into the end of the year, I'll be certain to keep you informed on the best way to position your portfolio - no matter what happens to crude oil prices.

More from Dr. Kent Moors: Icy methane hydrates, also known as "fire ice," are touted by some as the next major source of energy. But there's a dangerous flip side to this ice-like substance. Here's how this deadly "fuel of the future" will speed up climate change...

Tags: Crude Oil Prices, Energy Prices, oil price, Oil Prices, price of crude oil, price of oil, where oil prices are headedThe post Where Crude Oil Prices Are Headed Next appeared first on Money Morning - Only the News You Can Profit From.