(Please enjoy this updated version of my weekly commentary published September 08, 2021 from the POWR Growth newsletter).

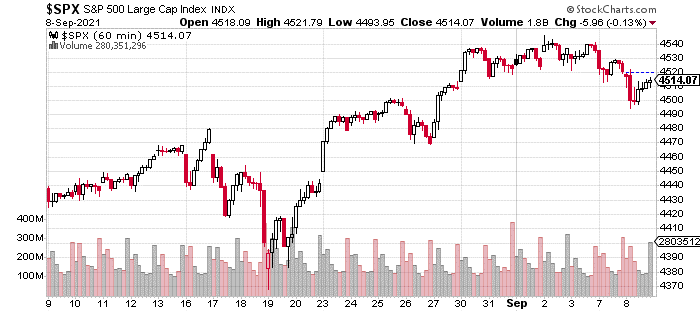

Let’s start with our usual look at the one-month, hourly chart of the S&P 500:

Since last week, we’ve seen an attempt at new highs which was quickly rejected. However, the selling has been pretty light in terms of volume, and we are less than 1% from all-time highs.

There’s been little impact in terms of external catalysts. Maybe the most germane development has been the continued rise in coronavirus Delta variant cases.

The market has essentially priced in a slowdown in the economic outlook as evidenced by the 10-year rate dropping from 1.75% in early May to as low as 1.15% in early August. This led to selling and profit-taking in all sorts of cyclical and reopening stocks.

Now, the 10-year yield has modestly bounced back to 1.35%, and we are seeing strength in many of the ‘reflation’ stocks.

In fact, one of our reflation plays is already back to new highs.

What is driving the bounce in reflation stocks and is it sustainable?

I do believe it is sustainable. And, I will point to two factors. One is that over the last couple of decades, buying Treasuries has worked following nearly any period of weakness. So, the market reflexively buys and piles in, once it starts moving higher, often with leverage.

The second is that we may be on the verge of a peak in coronavirus cases. Already, the hardest-hit states like Louisiana and Florida are showing more than 35% drops in cases. The surge in cases also resulted in a surge in vaccinations which is positive for the long-term. Based on current rates, 75% of the country will be vaccinated within 4 months. Essentially, this latest wave of coronavirus cases may be peaking.

For these reasons, I’m increasingly excited by the reflation stocks and want to increase exposure.

Now, let’s turn to growth stocks.

Since, we started the POWR Growth portfolio in mid-April, the environment for growth stocks has been… inhospitable. This is evident with the Russell 2000 being essentially flat, while the S&P 500 has continued to trend higher with a nearly 15% gain.

Rather than complain, we’ve taken advantage of opportunities and adapted our strategy to these circumstances.

However, there are some indications that market conditions are improving for growth stocks.

Usually, when making a claim like this I would insist upon some sort of hard and fast evidence. This is not the case at the moment. Instead, I have a variety of bottom-up observations like the IPO ETF making multi month highs, new highs in the IBD 50 ETF, and am seeing signs of life in the most speculative, beaten down parts of the market like SPACs, EV stocks, and frothy parts of the market.

These developments aren’t sufficient on their own to justify ramping up our exposure, but they are certainly indications that the atmosphere for growth investing may be over.

Thus, we will continue following these clues and adjust our portfolio accordingly.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

SPY shares were trading at $449.17 per share on Thursday afternoon, down $1.74 (-0.39%). Year-to-date, SPY has gained 20.93%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of POWR Growth newsletter. Learn more about Jaimini’s background, along with links to his most recent articles.

The post How Reflation Stocks Outperform the Stock Market appeared first on StockNews.com