$2,167,659! That is up $15,088 on our paired portfolios since our last review and, I am very happy to say, $1,878,544 (86.6%) of it is now CASH!!! We cut about half of our Long-Term Portfolio (LTP) positions but then we added 5 more in past month and we are very well-hedged in the Short-Term Portfolio (STP) , with roughly $500,000 worth of downside protection against a 20% drop in the S&P 500 so, at the moment, we probably make more money on a drop than we would on a pop . The S&P 500 is hovering right about where it was on August 17th, when I wrote: " Top of the Market Tuesday – Cashing Out While We Can " so I'm not going to rehash our reasons. In fact, the Friday before that (13th), the S&P had finished the week at 4,450 and this morning we're at 4,466 and we'll see how that holds up into Quad Witching tomorrw. As I noted in yesterday morning's report, the S&P 500 has been week this month and 4,480 is the Strong Bounce line, according to our 5% Rule™, so we'll see how that goes into the weekend. It doesn't affect our well-balanced portfolios and we have no intention of getting too bullish again ahead of earnings next month but we are finding bargains and some of the biggest bargains are sitting right in our portfolios! These are the positions that have survived the gauntlet of several purges and we have 40 positions that are using $368,250 in cash and $555,000 in margin that can easily make another $500,000 (54%) over the next 12 months. At this point in the cycle (toppy and looking to correct), we shouldn't have any position that we wouldn't be THRILLED to double down on if it drops 40% – meaning we would ride out a 20% correction and see what happens. Short Puts – These are all stocks we REALLY would like to own at the net price. We just sold 10 AAPL Sept 2023 $105 puts for $7 and that puts us in 1,000 shares at net $98 – yes PLEASE!!! If that doesn't happen, we get to keep the …

$2,167,659!

$2,167,659!

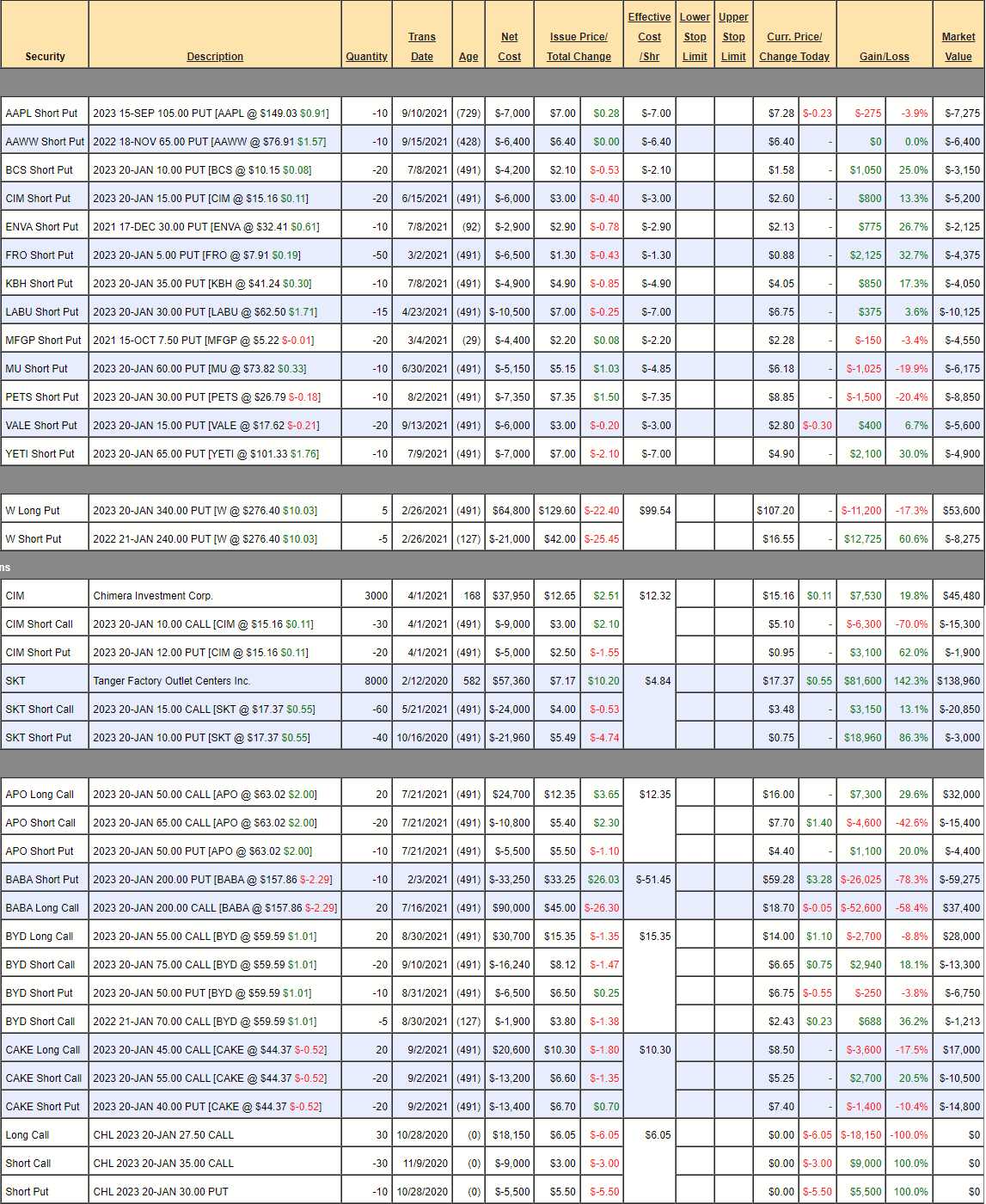

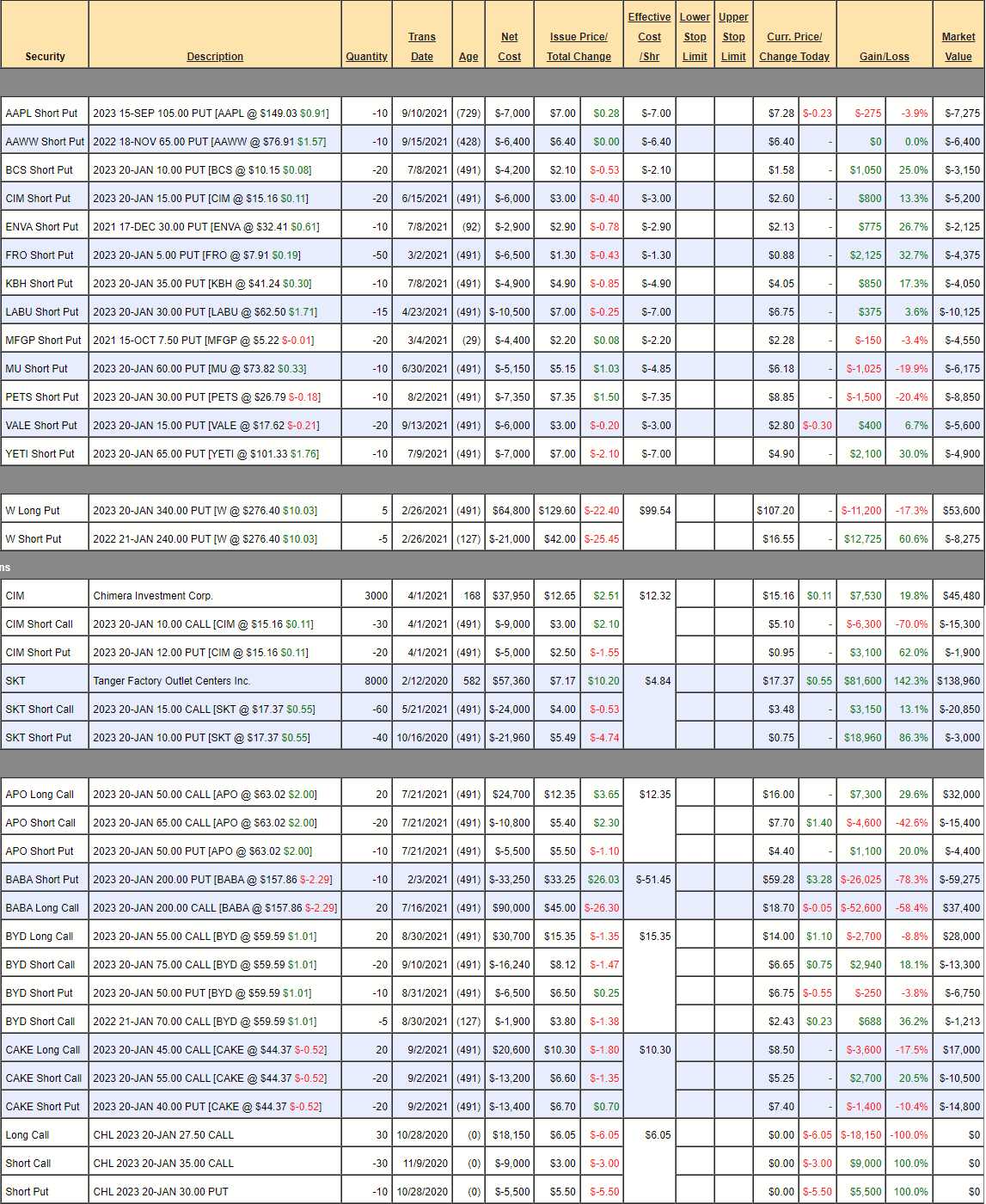

That is up $15,088 on our paired portfolios since our last review and, I am very happy to say, $1,878,544 (86.6%) of it is now CASH!!! We cut about half of our Long-Term Portfolio (LTP) positions but then we added 5 more in past month and we are very well-hedged in the Short-Term Portfolio (STP), with roughly $500,000 worth of downside protection against a 20% drop in the S&P 500 so, at the moment, we probably make more money on a drop than we would on a pop.

The S&P 500 is hovering right about where it was on August 17th, when I wrote: "Top of the Market Tuesday – Cashing Out While We Can" so I'm not going to rehash our reasons. In fact, the Friday before that (13th), the S&P had finished the week at 4,450 and this morning we're at 4,466 and we'll see how that holds up into Quad Witching tomorrw.

As I noted in yesterday morning's report, the S&P 500 has been week this month and 4,480 is the Strong Bounce line, according to our 5% Rule™, so we'll see how that goes into the weekend. It doesn't affect our well-balanced portfolios and we have no intention of getting too bullish again ahead of earnings next month but we are finding bargains and some of the biggest bargains are sitting right in our portfolios!

These are the positions that have survived the gauntlet of several purges and we have 40 positions that are using $368,250 in cash and $555,000 in margin that can easily make another $500,000 (54%) over the next 12 months. At this point in the cycle (toppy and looking to correct), we shouldn't have any position that we wouldn't be THRILLED to double down on if it drops 40% – meaning we would ride out a 20% correction and see what happens.

- Short Puts – These are all stocks we REALLY would like to own at the net price. We just sold 10 AAPL Sept 2023 $105 puts for $7 and that puts us in 1,000 shares at net $98 – yes PLEASE!!! If that doesn't happen, we get to keep the

…

$2,167,659!

$2,167,659!