Well, you can't say I didn't tell you so.

Well, you can't say I didn't tell you so.

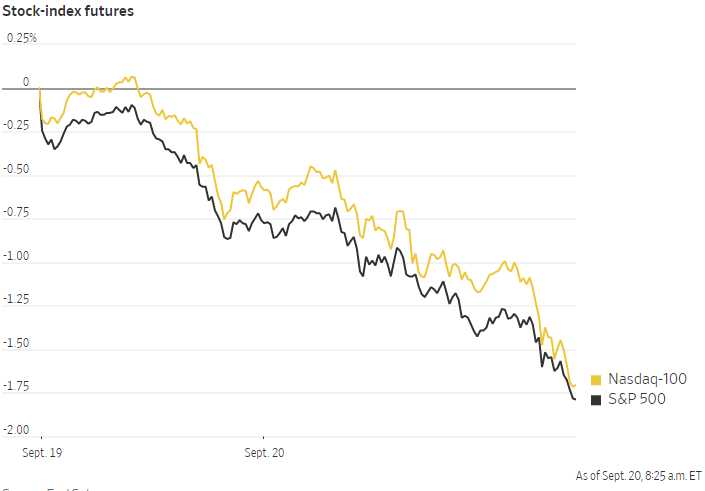

This is what we were afraid of. In a thinly-traded market, there are not enough buyers to put a floor under a sell-off and the market can drop very rapidly when there is any kind of panic selling. There were so many things that could have set this off but, this morning, it's one of the earliest ones we had bet on – China Evergrande, their largest property developer that we have warned about on many occasions, is rumored to be failing – and the State is letting it happen!

Market participants increasingly believe that Beijing will let Evergrande fail and inflict losses on its shareholders and bondholders. The company’s debt burden is the biggest for any publicly traded real estate management or development company in the world.

“Everyone is looking at Evergrande and saying ‘has the time come for a major default in that area, and then the potential for contagion into the broader property sector?’” said Edward Park, chief investment officer at Brooks Macdonald. “It’s an imminent risk now rather than being a theoretical risk as it has been for the past few years.”

Other factors weighing on markets Monday included a natural-gas shortage in Europe that has prompted the U.K. government to hold emergency talks with energy suppliers, Mr. Park said. The Federal Reserve will likely use its policy decision Wednesday to pave the way to pare back some of the stimulus it lavished on markets last year, he added.

IN PROGRESS