Traders have short memories but – WOW!

Traders have short memories but – WOW!

China Evergrande Group, until recently the world’s largest property developer, owns dozens of stalled sites like Sunny Peninsula in Guangzhou – all across China. Buckling under more than $300 Billion in liabilities, the company is close to collapse, leaving 1.5 million buyers waiting for finished homes and leaving it's lenders on the verge of insolvency as well. Furious retail investors who helped fund Evergrande’s expansion have turned up at the company’s Shenzhen headquarters to complain about delayed repayments on wealth management products it sold.

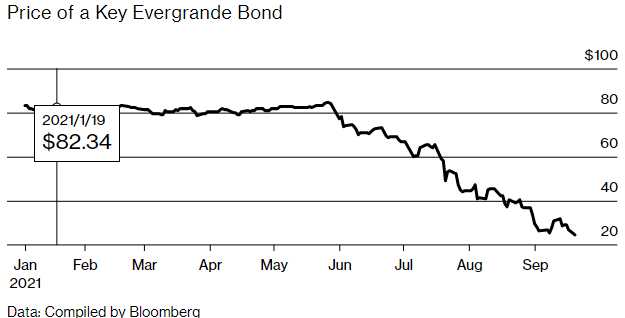

Evergrande is China’s largest issuer of high-yield dollar-denominated bonds, and bills are coming due to an array of banks and suppliers. Given its footprint in the housing market, there’s also a risk of a disorderly collapse triggering a broader decline in property prices—bad news in an economy where 27% of loans are for real estate.

China may be willing to let Evergrande fail if it thinks it can engineer a soft landing for the real estate sector. The $56 Trillion domestic financial system is dominated by state-owned lenders, which give the government extensive power both to squeeze borrowers and to manage the impact of defaults. But the stakes are enormous. When industries such as construction and property services are included, real estate accounts for at least 15% of the nation’s gross domestic product, and more than 70% of urban China’s wealth is stored in housing.

At the end of 2016, the ruling party’s Politburo unveiled a new slogan: “Houses are for living in, not for speculation.” One policymaker complained the following year that the economy was being “kidnapped” by the housing sector. Since then, China has changed the rules to discourage housing speculation and that, unfortunately, is what Evergrande built their business on. They have attempted to build more low-cost housing – but there are entire luxury projects that sit half-started and abandoned – like this soccer stadium in Guangzhou.

At the end of 2016, the ruling party’s Politburo unveiled a new slogan: “Houses are for living in, not for speculation.” One policymaker complained the following year that the economy was being “kidnapped” by the housing sector. Since then, China has changed the rules to discourage housing speculation and that, unfortunately, is what Evergrande built their business on. They have attempted to build more low-cost housing – but there are entire luxury projects that sit half-started and abandoned – like this soccer stadium in Guangzhou.

China's landscape is littered with projects like this that have ground to a halt and it's not just affecting the financial market but also the commodities market as all that copper, iron,…