Artificial Intelligence is all the rage. And nobody is doing better than Nvidia (NVDA). This was on FULL display in their tremendous Wednesday after market earnings beat that lit a fire under stocks on Thursday...especially any tech stocks tied to AI.

This led to an impressive breakout above 5,000 for the S&P 500 (SPY) to close the session at 5,087. But should investors be worried that not all stocks are participating in this rally. Like how the small caps in the Russell 2000 are still in the red this year???

We will discuss that and more in today’s market commentary.

Market Commentary

February has been marked by an ongoing test of the 5,000 level for the S&P 500.

Twice before stocks closed above 5,000 for a short stretch only to fall back below. But there is a sense that this 3rd time is the charm with a further breakout likely on the way.

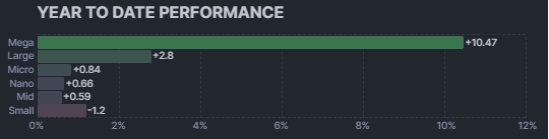

Yet just like 2023 the gains seem far too isolated in the mega cap tech stocks as can be seen by this year to date chart focused on gains my market cap:

With history as our guide, a healthy bull market has small caps leading the way. That is because these smaller companies typically have superior growth prospects which propels their shares above the pack.

That is why the returns for small caps going back 100 years are typically 20% better than large caps. For clarity this means that if large caps average a 10% return that small caps would be around 20% better at 12% return (not a 30% return).

One theory is to say “the trend is your friend”. And thus investors are best served playing the large cap tech game until the party is over.

Going back to the late 1990’s that was a great idea as long as you sold in early 2000 at the first signs the bubble was bursting. Unfortunately, investors rarely make those prudent moves. Instead, they tell themselves seemingly sound logic like selling when shares get back to previous levels. This flawed thinking leads to disastrous outcomes at the end of bubble as shares can so easily fall 50-80% in fairly short order.

To be clear, I am not saying Mega Caps or AI stocks are as much of a mania as we saw in 1999 for internet stocks. Nvidia and others are profitable companies growing at a phenomenal pace. But their PE nearing 40X earnings is a premium that history points to having very low odds of future success.

Meaning these shares are priced for perfection. Likely they will stay aloft as long as that perfection continues to unfold with each subsequent earnings report. But once there is the first blemish in that earnings outlook, then “watch out below!”.

Note that back in my days at Zacks Investment Research we ran a series of studies looking at the PE and projected growth rates of companies. Most would assume that the higher the expected growth...the higher the returns. And yet it was the exact opposite with the highest growth companies offering the lowest future returns.

That is precisely because of the higher PE and priced for perfection problem noted above. Growth never holds up over time. Whether its industry conditions or stiff competition, at some point the growth party ends. And when it does the stocks implode and PE comes down to size.

My assumption is that most everyone has an allocation to these Magnificent 7 stocks to benefit as long as this AI party lasts. That ownership is either directly in the individual companies or through ownership in SPY or QQQ which is dominated by these shares.

The question is what are you going to do with the rest of your money because it is unwise to have too many eggs in this becoming more fragile basket?

For me it is to lean into my best investing advantage. That being a focus on the proven outperformance from stocks uncovered by our POWR Ratings system.

Analyzing every stock by 118 factors that point to future outperformance is why the coveted A rated stocks have generated an average return of +28.56% per year since 1999. And that outperformance is showing up in spades once again this year.

What top POWR Ratings stocks am I recommending today?

Read on below for the answer...

What To Do Next?

Discover my current portfolio of 12 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999)

This includes 5 under the radar small caps recently added with tremendous upside potential.

Plus I have 1 special ETF that is incredibly well positioned to outpace the market in the weeks and months ahead.

This is all based on my 43 years of investing experience seeing bull markets...bear markets...and everything between.

If you are curious to learn more, and want to see these lucky 13 hand selected trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares were trading at $507.66 per share on Friday morning, up $0.16 (+0.03%). Year-to-date, SPY has gained 6.81%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post Is a Stock Bubble Forming? appeared first on StockNews.com