Lennar Corp (NY:LEN)

121.91

+0.47

(+0.38%)

Streaming Delayed Price

Updated: 12:03 PM EST, Feb 18, 2026

Add to My Watchlist

All News about Lennar Corp

Mortgage Markets Resurge as All-Cash Home Purchases Hit Five-Year Low

February 17, 2026

Via MarketMinute

Topics

Economy

1 S&P 500 Stock to Keep an Eye On and 2 We Avoid

February 16, 2026

Via StockStory

LEN, DHI Stocks Slip On Reports Of A Potential DOJ Probe ↗

February 06, 2026

Via Stocktwits

NVR, Inc. (NVR): Analyzing the Buyback Paradox and the 7.3% Slip

February 16, 2026

Via Finterra

Via MarketMinute

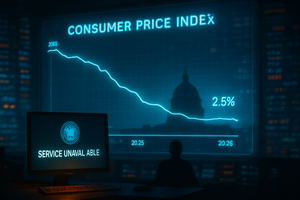

The Great Divergence: Mortgage Spreads Widen as the "Warsh Fed" Pivots

February 11, 2026

Via MarketMinute

The Data Drought Ends: January Jobs Report Arrives Amid Shutdown Shadows and Fed Pivot Hopes

February 11, 2026

Via MarketMinute

Topics

Economy

The Warsh Transition: A New Era for the Federal Reserve and Wall Street

February 06, 2026

Via MarketMinute

The Fed’s High-Wire Act: Interest Rates Held Steady as Cooling Labor Market Tests Inflation Resolve

February 02, 2026

Via MarketMinute

Topics

Economy

US Pending Home Sales Plunge 9.3% in December as Market Hits Lowest Point Since 2020

January 30, 2026

Via MarketMinute

Topics

Economy

Via MarketMinute

Topics

Economy

Via MarketMinute

Topics

Economy

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.